Chip is an award-winning savings and investments app that makes it easy to build your wealth

Chip - Investments and savings

What is it about?

Chip is an award-winning savings and investments app that makes it easy to build your wealth.

App Details

App Screenshots

App Store Description

Chip is an award-winning savings and investments app that makes it easy to build your wealth.

DEPOSIT IN SAVINGS ACCOUNTS

We offer several savings accounts, all provided by UK-authorised banks and covered by the Financial Services Compensation Scheme (FSCS).

INSTANT ACCESS SAVINGS WITH A GREAT RATE

The Chip Instant Access Account is an easy access savings account with a highly competitive interest rate.

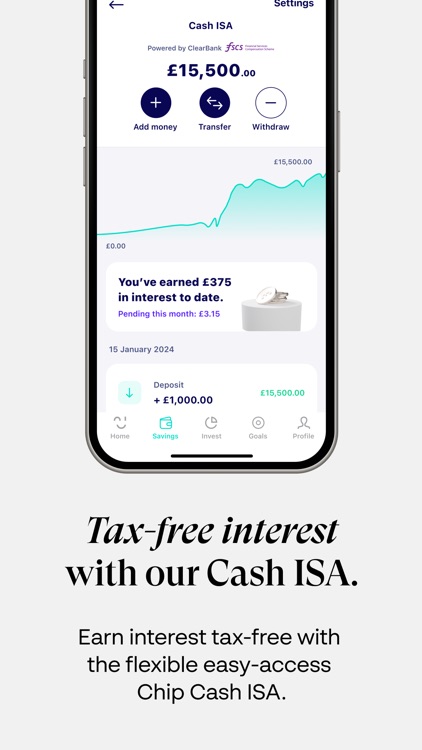

TAX-FREE INTEREST WITH OUR CASH ISA

Earn tax-free interest with our fully flexible easy-access Cash ISA. You can deposit up to £20,000 every tax year, and any withdrawals won't affect your ISA allowance.

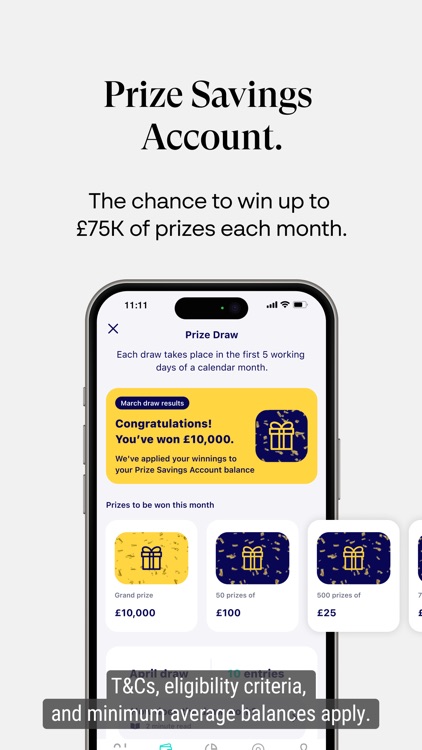

DEPOSIT TO WIN £10,000

With Chip’s Prize Savings Account, each month, we will pay up to £75k in prizes. This includes a Grand Prize of £10k, as well as thousands of smaller prizes.

It’s free to enter, you just need to hold an average balance of £100 in the account. (T&Cs and eligibility criteria apply).

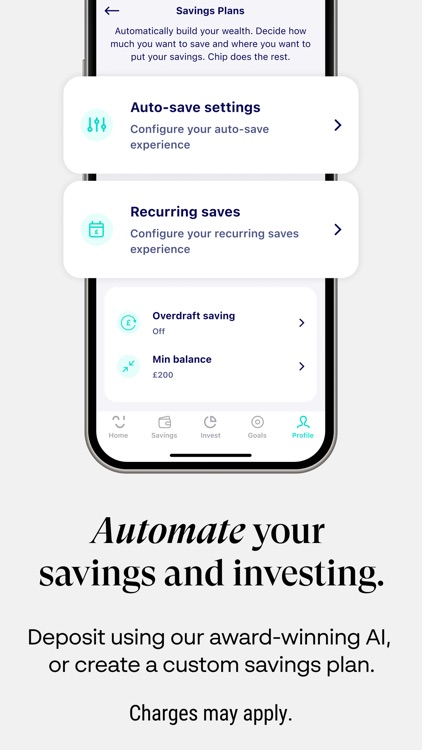

BUILD WEALTH HANDS-FREE WITH SAVINGS PLANS

Automatically save up money using AI, or create a bespoke plan to top up your savings accounts and investment funds on a custom schedule.

INVEST IN FUNDS

We make it easy to put your money to work with investment funds powered by the biggest asset managers in the world, like BlackRock, Vanguard and Invesco.

These diversified funds enable you to invest in a wide range of assets all at once. You can choose between funds that are globally diversified, specialise in ethical investments and clean energy, or get in on the next big thing and invest in emerging markets. We’re always expanding this list too.

WHAT INVESTMENT ACCOUNTS DOES CHIP OFFER?

We offer users the chance to make more of their money with a Stocks & Shares ISA. All the funds we offer are suitable for use with a Stocks and Shares ISA.

Our Stocks & Shares ISA allows you to invest up to £20,000 every tax year, and any profits you make are protected from tax.

If you have more than £20,000 to invest, or your annual ISA allowance is already full, you can use a General Investment Account (GIA) to invest as much as you like.

WHY SHOULD I INVEST WITH CHIP?

As a Chip user, you can build a portfolio across a wide range of investment funds built by the experts.

Our Savings Plans enable you to top up your investment funds or savings accounts automatically, either using our award-winning AI, or by making your own fully custom automated investment strategy.

SECURITY AS STANDARD

We provide the highest level of security as standard, offering 256-bit encryption, 3D Secure and the latest Open Banking technology. All savings accounts in Chip are eligible for FSCS protection on up to £85,000 of savings. Our award-winning UK-based customer support team is on hand.

INVEST WITH CHIP

Join 700,000 users seeking to build a better financial future with Chip, crowned Personal Finance App of the year 2022 at the British Bank Awards.

When investing, your capital is at risk. Past performance is no indication of future performance. The information communicated is generic and not specific to any particular investment. It does not constitute and should not be interpreted as either tax or financial advice. The value of investments can go down as well as up. Please also note that tax treatment depends on individual circumstances and may be subject to change in the future.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.