Finch offers the first Rewards Card that helps you invest and build credit as you spend

Finch – Invest with cash back!

What is it about?

Finch offers the first Rewards Card that helps you invest and build credit as you spend!

App Details

App Screenshots

App Store Description

Finch offers the first Rewards Card that helps you invest and build credit as you spend!

No Credit Checks | No APRs | No Hidden Fees

► HOW IT WORKS ◄

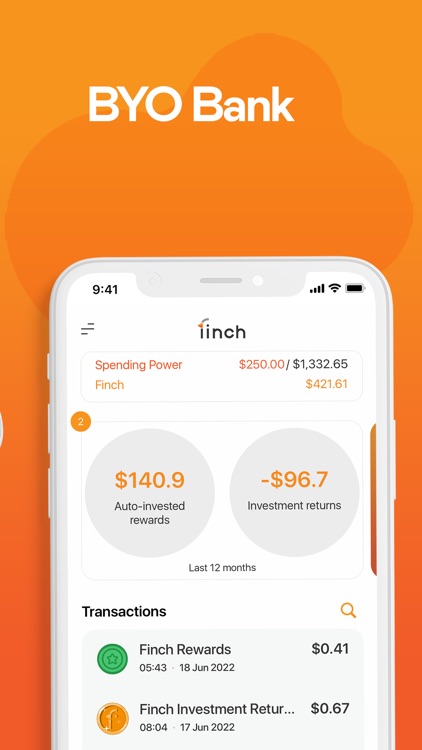

No account switching - Finch links to your existing checking account

Earn up to 5% cash back - Your Finch Rewards Card earns you up to 5% cash back on all your purchases* anywhere.

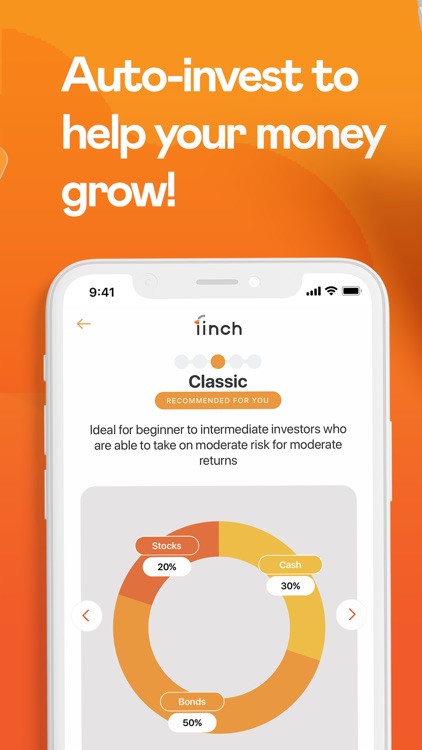

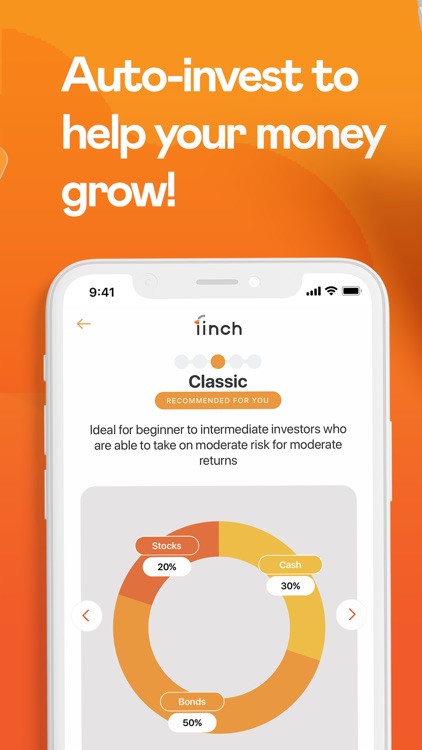

Auto-invest to boost your growth. Your cash back is auto invested into a personalized portfolio to help your money grow! To boost your growth further, simply set up an auto savings goal.

(Coming soon) Build credit without debt - When you spend we spot you and automatically pay ourselves back with the cash in your linked checking account. We report these on-time payments to all three major credit bureaus so you build credit without taking on debt.

► ADDITIONAL BENEFITS ◄

No credit checks

No hidden fees

No APRs

No Minimums

Commission free investing

Free bank transfers

No added fees for foreign transactions

Free withdrawals at over 55k ATMs

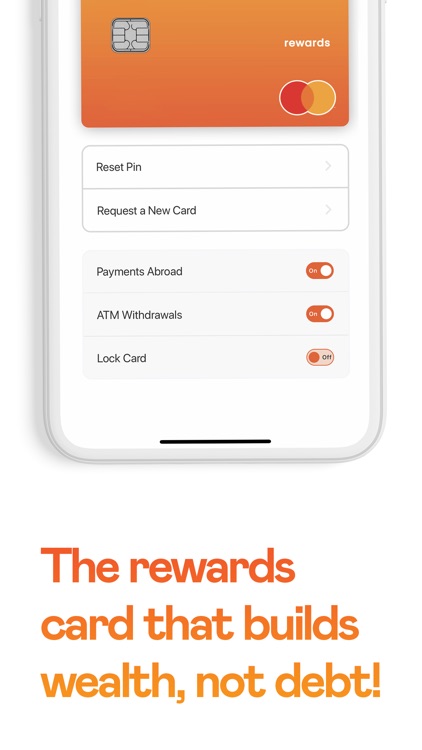

Enhanced card security

Backed by a FDIC insured bank

Backed by a SIPC insured broker dealer

► LEGAL STUFF ◄

*Purchases refer to net purchases (purchases minus any credits or returns). Purchases do not include ATM withdrawals or cash transfers.

This app is operated by Trio Financial Technologies Inc., doing business as ‘Finch’. Advisory services are provided by Trio Advisors, Inc., doing business as Trio App Advisors, Inc. an SEC-registered investment adviser.

The bank services are provided by Synapse’s bank partners, Members FDIC. The Finch Mastercard® Debit Card and Finch Mastercard® Credit Card are issued by our partner bank pursuant to a license from Mastercard International Incorporated.

Improvement in your credit score is dependent on your specific situation and financial behavior and results are not guaranteed.

Trio App Advisors, Inc. works with a partner broker, Apex Clearing Corporation, who is a member of FINRA/SIPC, which protects securities of its members up to $500,000 (including $250,000 for claims for cash). For details, please see sipc.org. Any uninvested cash or investment allocation to the Finch cash sweep is swept into an interest-bearing FDIC-insured deposit account opened by Finch's partner broker at a participating bank and is eligible for FDIC insurance up to the standard limit of $250,000 per account holder, per institution. Non-deposit investments are not FDIC insured and may lose value. Investing involves risk including loss of principal. Please consider, among other important factors, your investment objectives, risk tolerance and Finch’s pricing before investing. Past performance does not guarantee or indicate future results. Please visit finchmoney.com/legal for a complete set of disclosures.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.