Keep Track Of Your Debt With DebtMinder

DebtMinder ($1.99) by return7 is an app that will help you keep track of your current debt and set up a payoff plan.

In today’s current times, it’s hard to not be in debt. We work our butts off, and barely make ends meet. Some stuff needs to be paid by credit card, or heck, we need to take out loans and whatnot. Whatever the case may be, we certainly have accrued debt in one way or another (and if not, well, you certainly are lucky). Paying off this debt can be hard, but luckily, there’s an app for that. Say hello to DebtMinder.

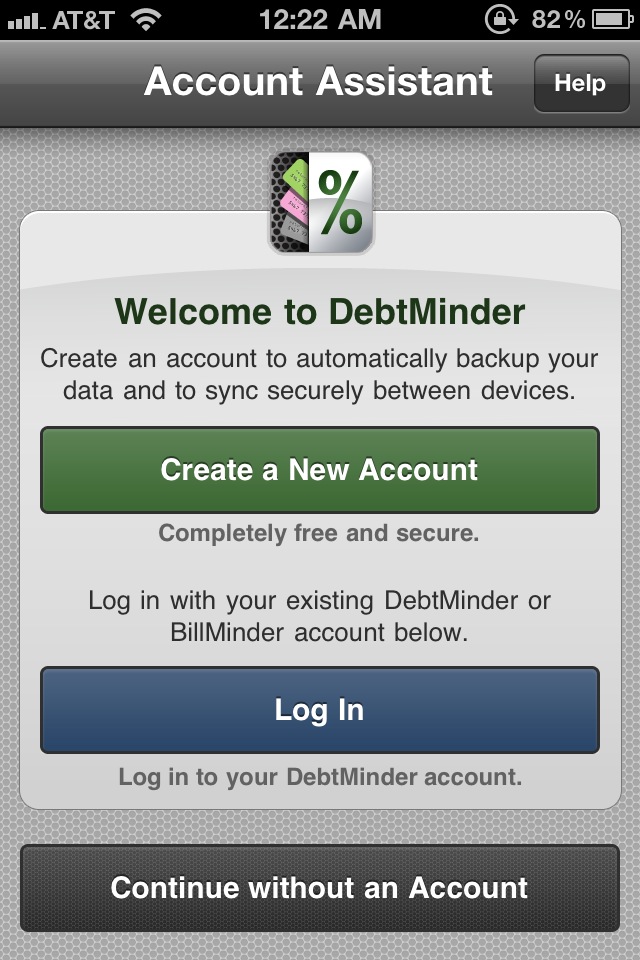

The first thing you’ll need to do is to set up a DebtMinder account. If you have been using return7’s other fine app, BillMinder, and have an account with that, then you can just use that as your log in. Creating an account on DebtMinder allows your data to be backed up and secured on their servers, and you can restore the data anytime on another device. However, DebtMinder does not require you to have an account – it is just out of convenience. The app is perfectly capable as a standalone app as well.

Once you have taken care of the account stuff, it is time to start adding in your debt. The default view is the account Overview, which gives you two viewing options: a graph and list. The graph view is a great way to view your progress, though it may take a while to see anything really significant. To add a new account, just tap on the “+” button in the top right.

When you add a new account, there are plenty of fields of information to fill out. You will be able to give the account a name, category (credit cards, loans, and other are the default), payment type (amount or percentage), and minimum payment. In addition to this information, you’ll also have to fill in the balance section.

Balance Info will ask for a name, interest rate, starting balance, and starting date. If you have another balance (sheesh, that’s a lot of money!), then include that and repeat the process until you have all of your balances in for that account. All of this is taken into consideration when DebtMinder calculates a payoff plan for you.

The last part of information to fill out is the Optional section, and includes a place for you to put contact info and any additional notes.

For those who are also users of BillMinder, you’ll be pleased to know that DebtMinder can be linked to BillMinder. Linking them will allow you to enter in a payment once and have it show up in both apps. This is a great way to integrate both apps, and definitely makes things easier.

When you’re done adding in all the various accounts you need, you can view your Payoff Plan. This part of the app takes into account the total debt you owe and calculates a debt free date based on your minimum payments and interest rates.

Categories will show you how many accounts you have in each category, and you can also add your own. Selecting an account will reveal details to you, including the option to add a payment and change to the account. Creating a category allows you to name it and assign an icon to it (out of 24 choices).

The Reports section allows you to view your payment history. By default, there are two reports already generated: All Accounts for All Time, and All Accounts for the Last Six Months. You can create your own reports as well, which give you the option for a pie chart or line graph, which account, and a date range.

In Settings, you will find three areas of options. In General, you’ll be able to set a passcode and choose the default currency. Account will allow you to manage your DebtMinder account, as well as give you links to the Terms of Use and Privacy Policy. Advanced will have export (as a CSV file) and backup options (email a backup or import from a backup). If you ever need help with the app, links to FAQ and email are provided.

I found DebtMinder highly useful and a great way to keep track of my debt and pay it off in a timely manner. The syncing is pretty fast and I love the integration with BillMinder.

However, I would like to see an option for including special promotions that you may get, like those offers of “no interest for 18 months” you get with store credit cards and whatnot. Currently, there is no option for the app to calculate a payoff plan with these kinds of promos in place.

If you have some debt that you need to pay off and want an app to help you keep track of it all, then definitely check out DebtMinder. The $1.99 price tag is a small price to pay compared to those evil high interest rates.