身處高教育費年代, 大多數父母在儲蓄子女教育基金的同時, 還需籌劃自己的退休金, 財務壓力為家長帶來沉重的負擔。子女教育經費計劃是整個家庭財務計劃中的重要一環, 如果沒有好好籌劃, 恐怕父母的退休計劃難免被迫延後。

愛.孩子未來 Love Your Kid's Future

What is it about?

身處高教育費年代, 大多數父母在儲蓄子女教育基金的同時, 還需籌劃自己的退休金, 財務壓力為家長帶來沉重的負擔。子女教育經費計劃是整個家庭財務計劃中的重要一環, 如果沒有好好籌劃, 恐怕父母的退休計劃難免被迫延後。

App Screenshots

App Store Description

身處高教育費年代, 大多數父母在儲蓄子女教育基金的同時, 還需籌劃自己的退休金, 財務壓力為家長帶來沉重的負擔。子女教育經費計劃是整個家庭財務計劃中的重要一環, 如果沒有好好籌劃, 恐怕父母的退休計劃難免被迫延後。

有見及此,富通保險研發「愛• 孩子未來」iPhone 手機應用程式,為對愛護子女的家長提供簡單易用的隨身工具。 本程式特色包括:

1) 易用的簡單介面設計,配合個性化圖像,格外親切。

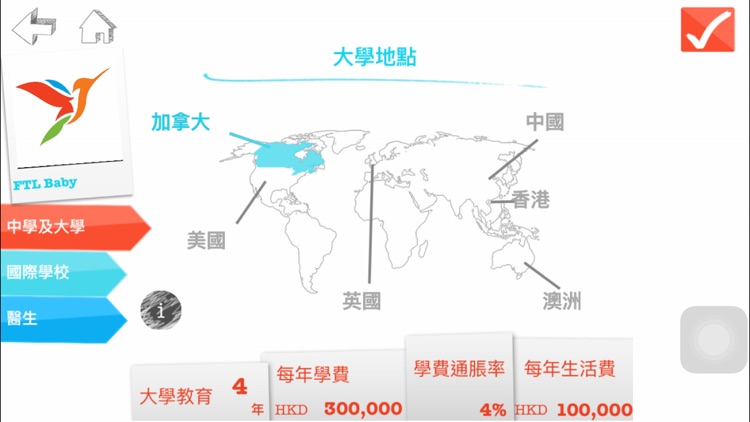

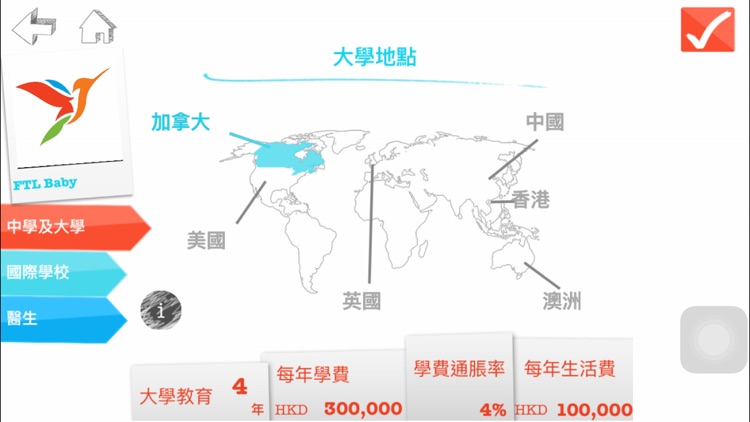

2) 計算孩子的理想教育所需金額及每月所需儲蓄,可包括中學及大學,可選未來理想專業以及可選大學地點。假若將儲蓄計劃延遲開始,每月所需儲蓄亦一目了然。

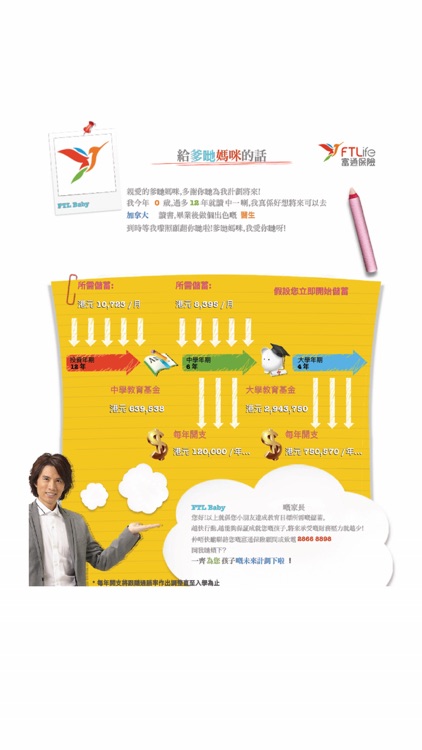

3) 人氣偶像黃子華親自圖文並茂闡釋計算結果,以PDF檔案電郵寄存,方便列印參考。

機會只會留給有充份準備的人, 愈早計劃子女教育經費, 愈能減輕將來承受的財務壓力, 愈能夠保証成就。教育經費的累積關鍵在於長線定時投資, 因此, 很多年輕夫婦在孩子未出生, 便開始為子女的教育大計未雨綢繆, 免除後顧之憂。

您孩子的理想教育需要幾多儲蓄? 馬上下載程式,一起為您孩子的理想未來開展計劃!

#所有於「愛.孩子未來」程式內提供的資料只作參考之用。

富通保險有限公司(「富通保險」)是同創九鼎投資管理集團股份有限公司 (「九鼎集團」) 的全資附屬公司,也是香港最大的壽險公司之一。

富通保險憑藉豐富經驗,為個人及機構提供多元化的保險及理財規劃服務,致力成為亞洲卓越的保險集團。我們信守承諾,竭誠與客戶建立長遠關係,提供優越理財規劃方案及專業服務,共創豐盛人生。

Education isn’t cheap nowadays. Tuition increases by leaps and bounds every year. Many of the parents need to pay for their kids’ education while simultaneously saving for their own retirement. That can place a huge financial burden on their shoulders and make their financial planning more onerous. If they have failed to plan well in advance, there’s a risk they may end up needing to defer the latter.

To help families face this dilemma, FTLife has launched an iPhone App called “Love Your Kid's Future”. This easy-to-use calculator will tell you how much it will cost for your kids to receive the education they need to achieve their dream career. Anyone can use this calculator anytime and anywhere.

Its key features include:

1) A user-friendly design interface with images you can customise to make it more personal.

2) Functions to calculate the cost of your kids’ education. You will have the option of calculating the cost for both secondary school and university; for education for a particular profession and for different university locations. They also show you the consequences of deferring your savings plan.

3) Then, Dayo Wong will explain the results with both visuals and charts in PDF. You can email or print them out for your future reference.

Good fortune favours those who are well prepared. The earlier you start planning for it, the more you can accumulate for this purpose, and the less financial pressure it will create in your life. Saving for your kids’ education requires a steady, long-term investment plan and it will make a big difference. That’s why many smart young couples have one in place even before they start their family!

If you’re wondering how much your kids’ education might cost you, download the App for FREE and start planning for it now!

#All information in "Love Your Kid's Future" App is for reference only.

FTLife Insurance Company Limited (“FTLife”) is one of Hong Kong's largest life insurance companies and a wholly-owned subsidiary of Tongchuangjiuding Investment Management Group Co., Ltd. (“JD Group”).

Capitalising on a heritage of professionalism and excellence in serving clients, FTLife seeks to become a leading insurance group in Asia. It serves individual and institutional clients from a diverse portfolio of financial protection and wealth management products. FTLife aims to excel by cultivating lasting relationships, and dedicates itself to providing clients with best-of-breed financial services to help them lead fulfilling lives.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.