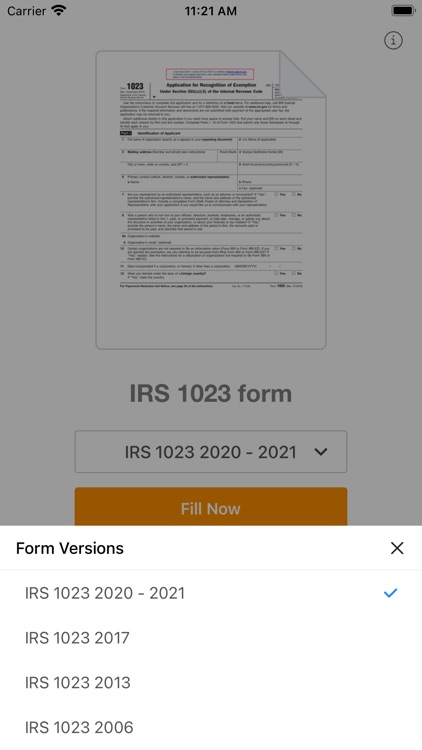

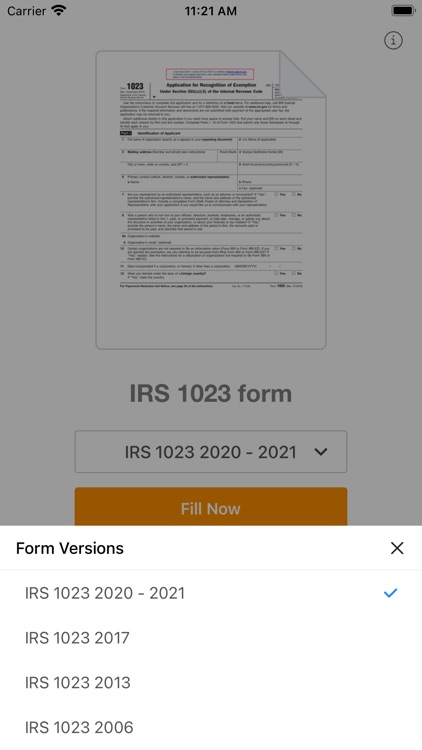

Save time and effort completing form 1023 on your iOS device

1023 Form

What is it about?

Save time and effort completing form 1023 on your iOS device

App Screenshots

App Store Description

Save time and effort completing form 1023 on your iOS device

With the new 1023 form on PDFfiller, completing the Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code is fast and easy. Forget about tiresome registration. Simply install the app on your iPhone or iPad and fill out the form straight away. Thousands of people successfully submit their tax documents using PDFfiller.

Besides its rich document database, PDFfiller has an advanced set of editing tools that you can use to choose the most suitable document format and make any necessary changes. Don't miss out on the opportunity to go paperless.

Key features:

- type text anywhere on the form and edit it whenever you need to

- navigate between fillable fields using the arrows on the top of the screen

- date the form automatically

- add custom graphics including checkmarks, images, lines, arrows, etc.

- draw a digital legally binding signature using your fingertip or stylus

- email the completed form or print it right from your iOS device

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.