Aasthy, offers data on real estate demand, appreciation and yield with a vision to encourage more budding investors to participate in real estate with a data mindset

Aasthy

What is it about?

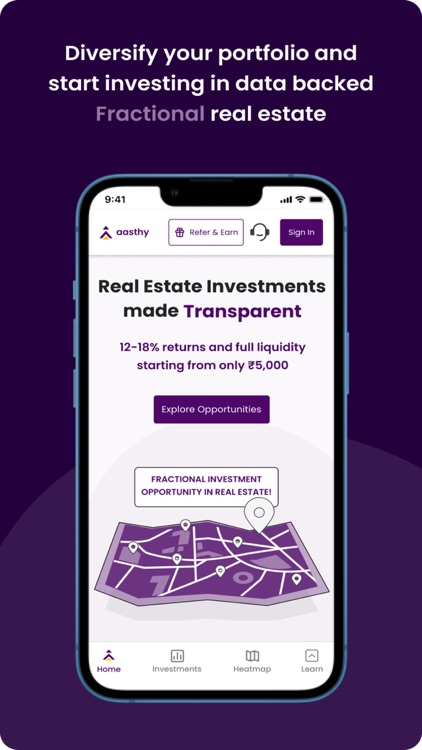

Aasthy, offers data on real estate demand, appreciation and yield with a vision to encourage more budding investors to participate in real estate with a data mindset. As part of this, Aasthy also enables fractional participation in holding of real estate assets with an approximate time frame and an estimated returns that the user can expect.

App Screenshots

App Store Description

Aasthy, offers data on real estate demand, appreciation and yield with a vision to encourage more budding investors to participate in real estate with a data mindset. As part of this, Aasthy also enables fractional participation in holding of real estate assets with an approximate time frame and an estimated returns that the user can expect.

Aasthy performs rigorous due diligence on the assets that we shortlist through our demand prediction algorithm. Some of the processes include reaching out to the existing financiers and understanding their past repayment history, checking their delivery rates, delays, complaints registered with real estate regulators, etc., as well as legal title due diligence. To ensure that the exposure to a specific builder is minimal, we keep the number of units that we list on the platform to 2-3 from the project. The deals are structured in such a manner in which the entity enters into a guaranteed builder buyback agreement at the end of the holding period. The investors will be provided with a security certificate (CCD Certificate) issued by the entity and will act as investment proof.

What is Fractional Investment?

Fractional Investment is an alternate investment strategy in which a group of unrelated third-party investors pool in funds in order to make investments in high value asset/fund/corpus. In such cases, the ownership would vest with the entity/vehicle through the investors, which will purchase the said asset.

How is this different from REIT?

REITs are highly regulated trust funds with a minimum asset requirement of INR 500 Cr, that majorly depend on commercial yielding assets (averaging at 6%), while fractional investments are self- regulated with no asset restrictions allowing it to be as small as it can be and also focus on capital appreciation. Unlike in REITs, where the manager aggregates the portfolio, in a fractional investment platform, you choose the assets you want to be invested in.

What is Aasthy's investment model?

Through Aasthy, the investors would purchase a real estate asset through a Special Purpose Vehicle (SPV) and the investors, as such, would have ownership over the asset. This approach is akin to Fractional Investment, and it reduces the financial burden on a single investor and allows the investors to purchase a high-value real estate asset by pooling in funds through the SPV.

What is an SPV?

An SPV is an entity created to isolate the underlying asset from other similar SPVs/companies, that has its own obligations, assets and liabilities outside other SPVs/companies. In case of Aasthy, an SPV is a private limited company that would then invest in particular unit/units (asset) of a project and acquire the same from the developer of the said real estate project for a consideration. Since a particular real estate asset is owned by a particular SPV, the appreciation, asset value, risks, liabilities, etc associated with it would be isolated and managed.

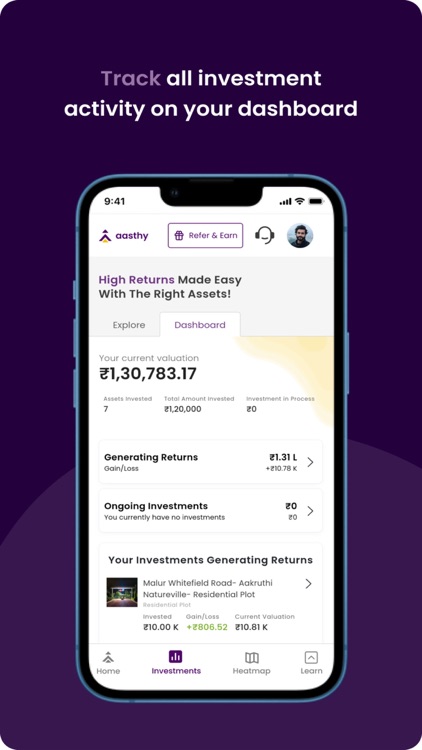

Benefits of investing through Aasthy:

- Convenience of investing

- Data driven

- Portfolio diversification

- Access to a new asset class

In case of any query, doubt, feedback or suggestion, please reach out to us via support@aasthy.com or +91 97420 12100

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.