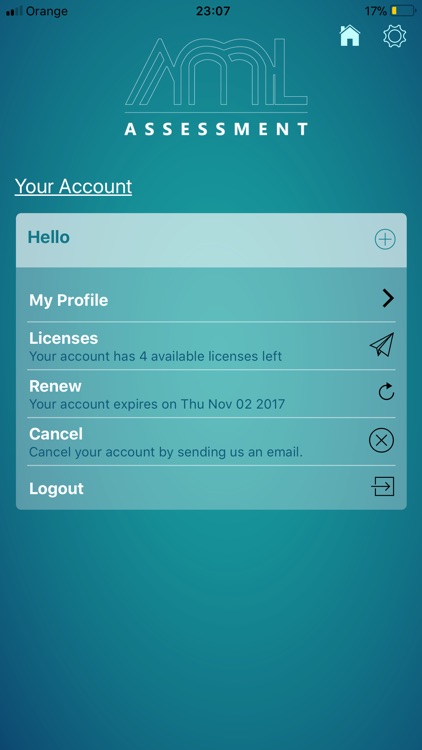

The AML Toolbox APP provides an automated solution to meet know-your-customer (KYC) regulatory obligations

AML Toolbox

What is it about?

The AML Toolbox APP provides an automated solution to meet know-your-customer (KYC) regulatory obligations. Designed by financial crime professionals to meet current legislation, the APP provides a risk-based-approach to your KYC anti-money laundering obligations.

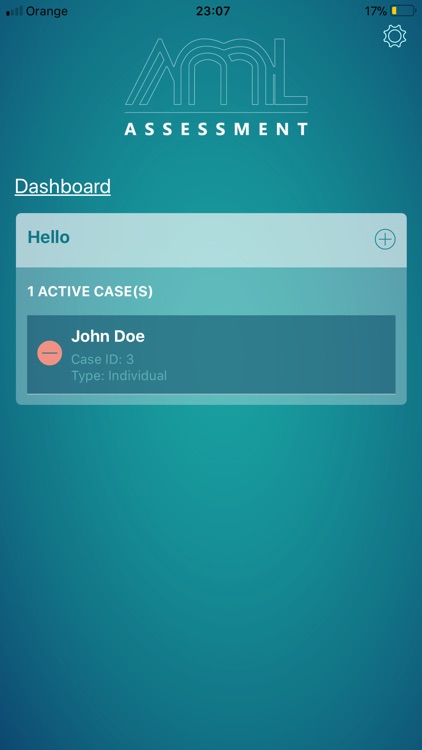

App Screenshots

App Store Description

The AML Toolbox APP provides an automated solution to meet know-your-customer (KYC) regulatory obligations. Designed by financial crime professionals to meet current legislation, the APP provides a risk-based-approach to your KYC anti-money laundering obligations.

KYC reviews can now be conducted at your client or in your office to the same high standard using the APP – greatly reducing time and cost for you both.

For those of us that have ever conducted a KYC review, we recognise that this process can be timely and costly if not performed correctly, so we have developed a practical and sensible solution. With new legislation and increased regulatory and supervisory scrutiny, it is a legal requirement to have up-to-date information for your new and existing clients. This app gives you the flexibility to collect the relevant information wherever you are with a touch of a button.

We believe that collecting KYC documentation and data is the most important piece of the build-blocks to beating financial crime; whether conducting a new customer review or for an existing client business relationship, we are required to have the relevant evidence in our customer files.

If performed correctly, the KYC process can greatly reduce on-going cost, protect your staff, protect your business reputation and reduce the risk of regulatory scrutiny.

Regulated firms are required to have robust on-going monitoring programmes in place – if your customer documentation and data is out of date – you run the risk of civil or criminal action against your firm and senior managers.

Benefits and Features:

- Available on Mobile and Tablet

- Designed by Financial Crime Professionals

- Ensure your client documentation is up-to-date and in line with current legislation

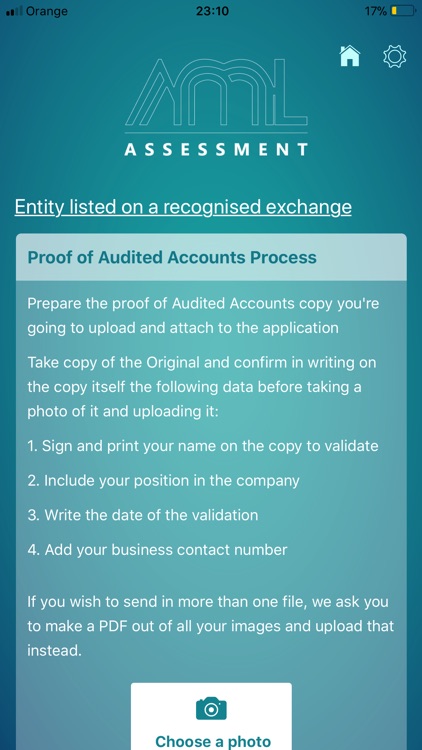

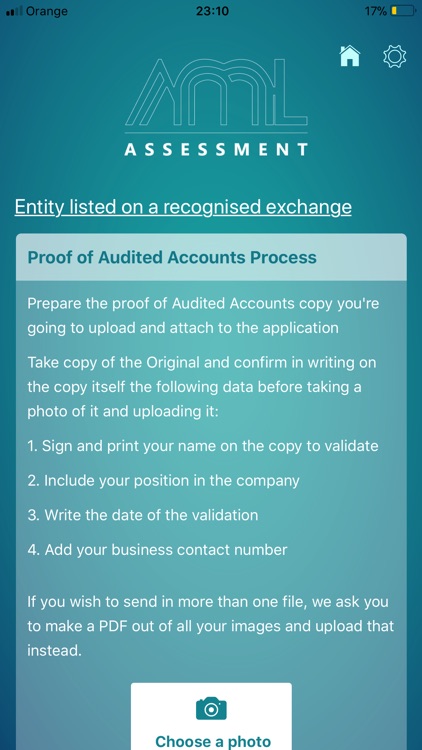

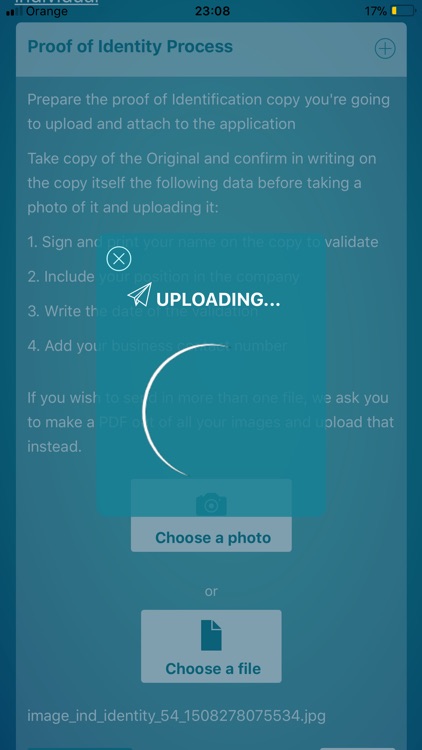

Also, upload those important documents:

- Company incorporation documents

- Audited Accounts

- Proof of identity documents

- Proof of residence

- Proof of earnings

- Source of wealth

- Source of funds and income

- Input description of service or product

- Applied risk-based-approach

The regulators and law enforcement agencies need our help to reduce financial crime – so let’s assist them in reducing financial crime. Let’s you focus on committing your resources to clients that pose a greater financial crime risk

AML ASSESSMENT Limited is committed in playing its part to reduce financial crime and we strive to assist our clients to achieve this goal too.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.