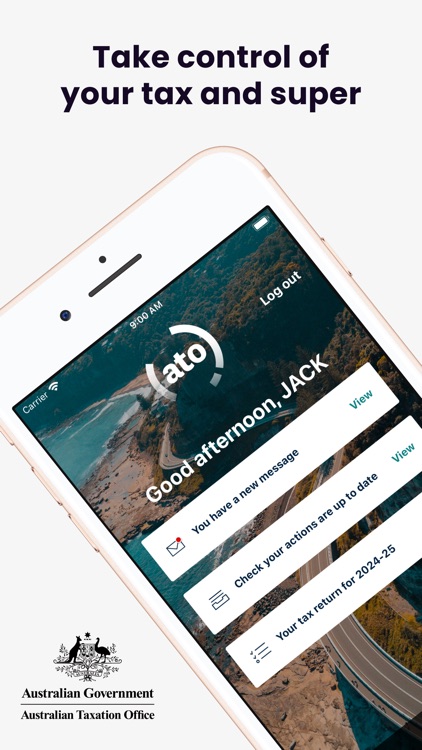

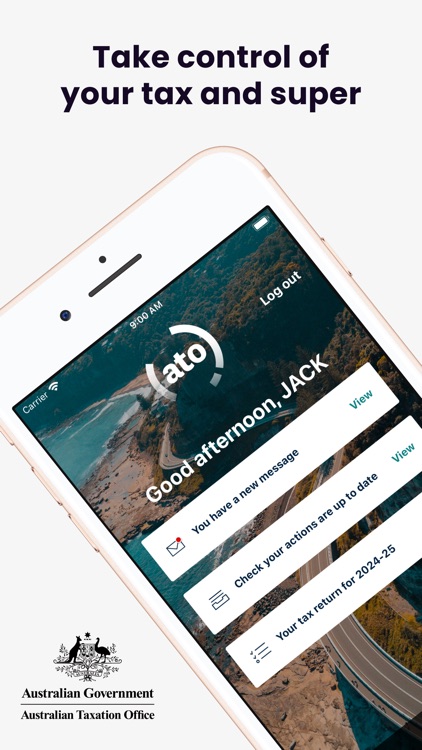

The ATO app allows you to manage your tax and super affairs on the go – making tax simple & easy

Australian Taxation Office

What is it about?

The ATO app allows you to manage your tax and super affairs on the go – making tax simple & easy.

App Screenshots

App Store Description

The ATO app allows you to manage your tax and super affairs on the go – making tax simple & easy.

A myGov account linked to the ATO is required for a personalised tax and super experience.

With the ATO app, you can:

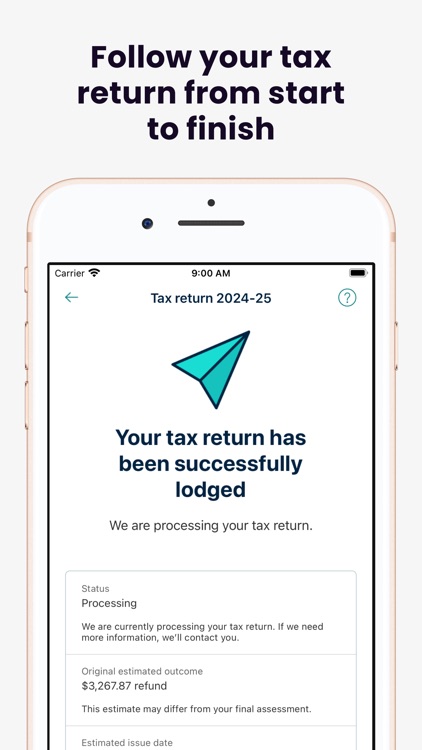

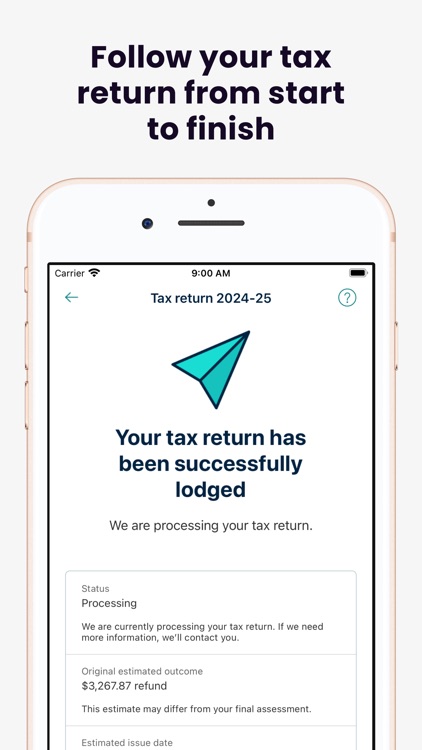

- follow your 2022-23 tax return from start to finish, including checking prefill information, tracking the progress of your return and its outcome

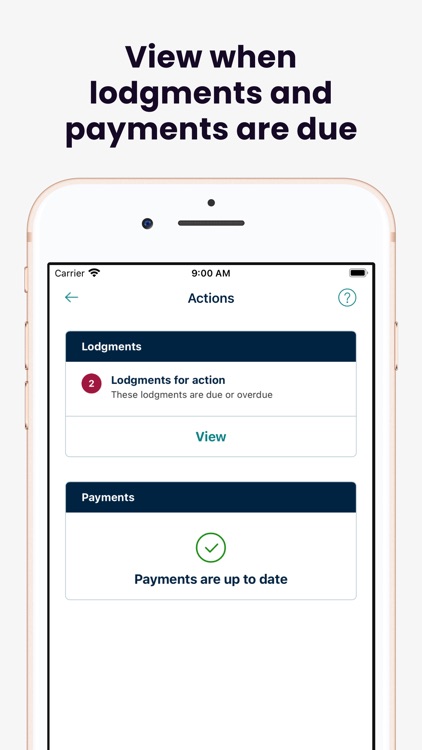

- view in real-time when lodgments and payments are due, and seamlessly action them via ATO Online

- set up streamlined and secure login using your device’s security features like face and fingerprint recognition

- view your tax accounts, with links to ATO Online to view transactions, create payment plans or pay

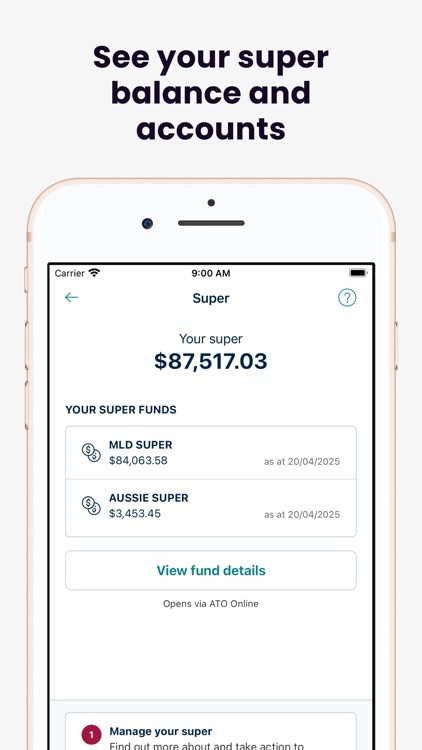

- see an overview of your super balance and accounts

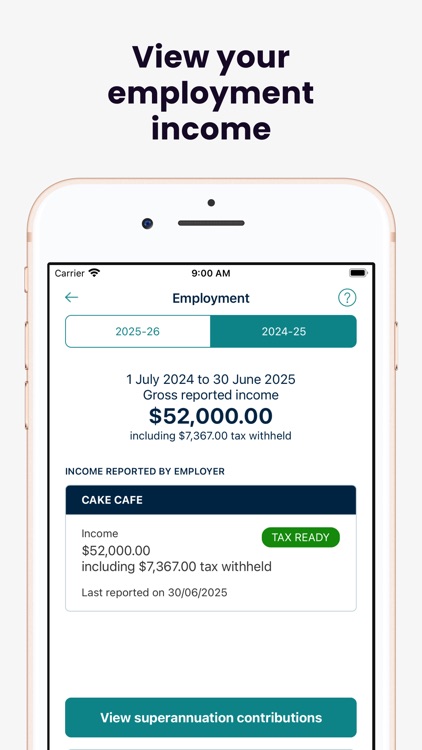

- view your employment income and superannuation contributions required from your employers

- check your personal, business (sole traders only) and registered agent’s details

- access our most popular tools.

Our most popular tools include:

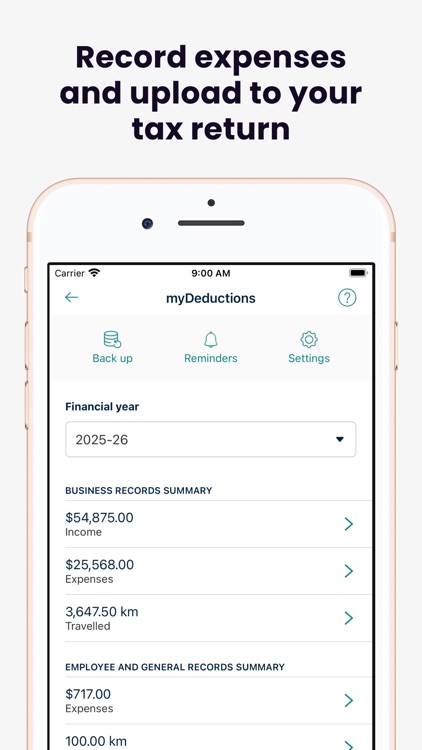

- myDeductions: record your work expenses as an employee or sole trader. Sole traders can also record income. At tax time you can easily upload your myDeductions records to your tax return or email a copy to your tax agent.

- Tax withheld calculator: calculate the amount of tax to withhold from salary and wage payments.

- ABN Lookup: search for an Australian business number (ABN).

- Business performance check: compare your business with similar businesses in your industry using the latest Small business benchmarks.

You can choose to allow the ATO app to send usage data to help improve the app. The data we collect doesn’t identify you and you can choose to turn this off at any time in your app’s setting.

GPS can be used to record trips in myDeductions. Continued use of GPS running in the background can dramatically decrease battery life.

To record a trip in myDeductions using the GPS option, the app needs access to your device location.

Find out more at www.ato.gov.au/app

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.