About AutoShares

AutoShares Automatic Investing

What is it about?

About AutoShares

App Details

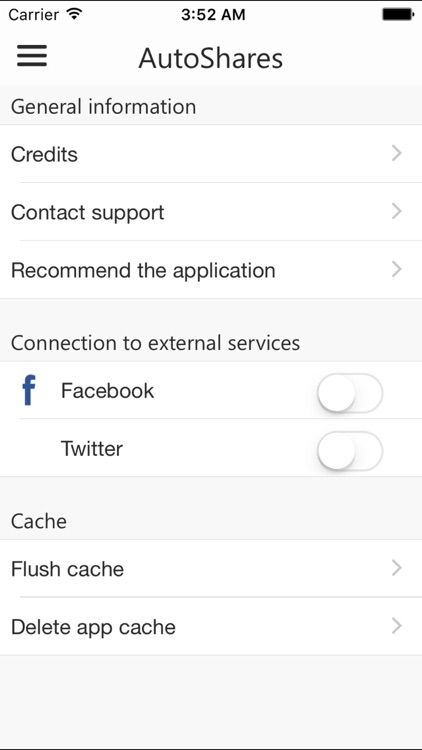

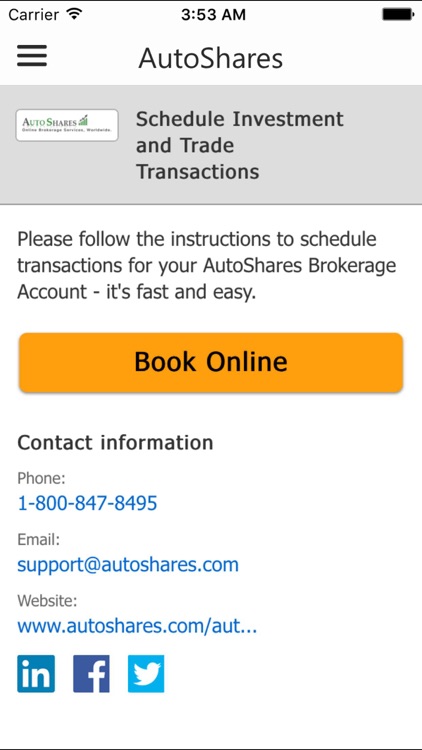

App Screenshots

App Store Description

About AutoShares

The process of managing investment related brokerage and retirement accounts requires a great deal of time and effort. Staying focused on it all can be tedious and time consuming. And, due to life circumstances, plans and opportunities may be missed or delayed. With AutoShares, investment transactions are entered into your investment account according to your instructions, freeing up your time to focus on your lifestyle.

We concentrate on providing exceptional market access, technology, trade execution, and customer support, while leveraging the operational capabilities of APEX Clearing to clear transactions and custody all client's securities and cash. We choose to operate in this way to mitigate risk and meet the needs of our clients, from high-volume institutional customers to individuals requiring traditional investing services.

Today, we are a full service firm that offers a wide array of services to meet the needs of all our clients. Our full range of benefits include: Online Investing, Automatic Investing, and AutoTrading Services in Stocks, Options, ETFs and Mutual Funds, Worldwide. Financial service vendors provide a diverse selection of financial products and services to our clients, whether investing or saving for the long or short-term, automating investing activities, or managing a self-directed account.

AutoShares is a Division of ViewTrade Securities, Inc., Members of FINRA and SIPC. Since 1998, VTS has provided market access, technology, trade execution, and investment banking services to clientele in more than 17+ countries, Worldwide. Services include discount online brokerage, investment banking, technology and informational solutions.

SIPC

As a member of the Securities Investor Protection Corporation (SIPC), funds are available to meet customer claims up to a ceiling of $500,000, including a maximum of $250,000 for cash claims. For additional information regarding SIPC coverage, including a brochure, please contact SIPC at (202) 371-8300 or visit www.sipc.org.

LLOYDS

Our clearing firm has purchased an additional insurance policy through a group of London Underwriters (with Lloyd's of London Syndicates as the Lead Underwriter) to supplement SIPC protection. This additional insurance policy becomes available to customers in the event that SIPC limits are exhausted and provides protection for securities and cash up to an aggregate of $600 million. This is provided to pay amounts in addition to those returned in a SIPC liquidation. This additional insurance policy is limited to a combined return to any customer from a Trustee, SIPC and London Underwriters of $150 million, including cash of up to $2.15 million. Similar to SIPC protection, this additional insurance does not protect against a loss in the market value of securities.

For more information, please contact us.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.