BRAC Bank (BBL) 'Shubidha' is a mobile-based app through which selective customers can avail of retail loan products digitally

BBL Shubidha

What is it about?

BRAC Bank (BBL) 'Shubidha' is a mobile-based app through which selective customers can avail of retail loan products digitally. The app performs end-to-end digital loan processing, including loan application, assessment, and disbursement. You can now enjoy a digital borrowing experience in a fast, secure, and convenient way using the BBL Shubidha app.

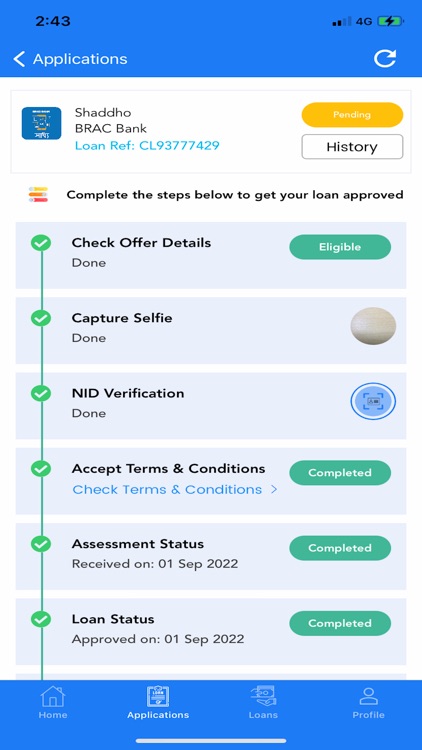

App Screenshots

App Store Description

BRAC Bank (BBL) 'Shubidha' is a mobile-based app through which selective customers can avail of retail loan products digitally. The app performs end-to-end digital loan processing, including loan application, assessment, and disbursement. You can now enjoy a digital borrowing experience in a fast, secure, and convenient way using the BBL Shubidha app.

After installing the app, you can:

1. Know about the digital loan products of BRAC Bank:

· See product features and benefits;

· View a list of merchants from where you can purchase your desired product(s) with a digital loan.

2. Check your eligibility & apply for a digital loan:

· Check the loan offer in-store for you;

· Capture your selfie;

· Accept terms & conditions of the digital loan;

· Submit loan application by 8 pm of the working day.

3. Get your loan decision:

· Wait for a few minutes for a decision on your applied loan;

· Get Loan Reference Number if the loan is approved.

4. Pay loan processing fee:

· Visit the merchant outlet & select your desired product;

· Inform the merchant to assist you to buy the product with a digital loan;

· Pay a loan processing fee from your BRAC Bank account through the app.

5. Get product delivery:

· Inform merchant about the product delivery code sent in your app;

· Get delivery of your product.

6. View anytime:

· Status of your ongoing application and loans;

· Your short profile.

7. Pre-login features:

· Registration for New User;

· Password creation.

Loan features:

· Interest rate of 9% per annum;

· Tenure of 3 to 18 months;

· Sample Loan Repayment Schedule:

If you have availed loan of BDT 100,000 @ 9% interest per annum and tenure of 12 months, your Equal Monthly Instalment (EMI) will be approximately BDT 8,745. Therefore, the total cost of the loan (principal + interest) will be BDT 104,942. In addition to interest, you have to pay loan processing fee before availing the loan as follows:

Processing fee: 0.5% of loan amount + 15% VAT

CIB & Stamp Charge: At actual.

All you need:

• An active account and a debit card with BRAC Bank;

• A smartphone with an iOS operating system;

• Internet connectivity through mobile internet or Wi-Fi.

We welcome your feedback and suggestions; please call us at 16221.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.