BHIM KBL UPI (Secure Mobile App for Rapid Transactionz)

BHIM KBL UPI

What is it about?

BHIM KBL UPI (Secure Mobile App for Rapid Transactionz)

App Screenshots

App Store Description

BHIM KBL UPI (Secure Mobile App for Rapid Transactionz)

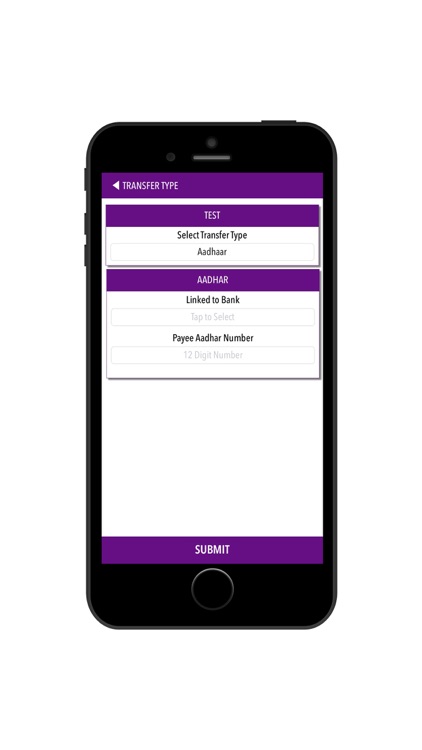

Mobile application built on UPI Platform for universal app transaction, which facilitates customers to add own and other Bank accounts linked to his/her registered mobile number. Customer can initiate payment ( push ) and collect ( pull ) fund transfer request based on virtual ID, Aadhar number , Bank account number with IFSC code, Mobile Number with MMID.

Download self help guide from https://www.karnatakabank.com/ktk/KBL-upi-manual.pdf

Scan n Pay and Generate QR code and share

A) Allowed to initiate credit collect to a card not linked account.

B) Self help mode activated

C) QR code generator option to generate QR Code to receive instant payments by sender using BHIM KBL UPI scan pay n pay option .

D) activation of user permission to access phone features .

F) Enhancements in UI/UX design

Pre-Requisites:

1. Registered Mobile number with the Bank where the account is held , sim should be in primary sim Slot

( case of dual SIM Mobile devices.)

2. Mobile Number should be registered with Bank for receiving Transaction SMS Alerts

3. Should have a Valid Debit Card

Link any of your other Bank Accounts which is mapped to your registered mobile number

with valid Debit card

You Need not to be a KBL Customer to use BHIM KBL UPI

You Can initiate Money Collection Request ( PULL )

You Can View your Other Bank Account Balance

You Can Send money to the Aadhaar Number, Virtual Address, Account Number & IFSC, Mobile Number & MMID (Mobile Money Identifier).

You can receive money from Virtual Address ( Collect / PULL )

a) U2U (PUSH): UPI to UPI transaction (Basis Virtual Address, Account Number+IFSC, Aadhaar Number, Mobile Number+MMID). In this case, both the sending and the receiving bank are live on UPI.

b) U2U (PULL): Means UPI to UPI transaction (Basis Virtual Address). In this case, both the sending and the receiving bank are live on UPI.

c) U2I (PUSH): Means UPI to IMPS transaction (and Mobile Number & MMID). In this case, the sending bank is live on UPI but the receiving bank is live only on IMPS and not on UPI.

BHIM KBL UPI will have two PINs

1. App PIN ( 4 Digits) which is created while profile creation. Used for securing the App and opening.

2. MPIN ( 4 Digits ) which is created for each account using SET UPI credentials option. MPIN is used for completing the transactions as 2 nd factor authentication.

for more details http://goo.gl/zh1RxX

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.