Manage Your Finances

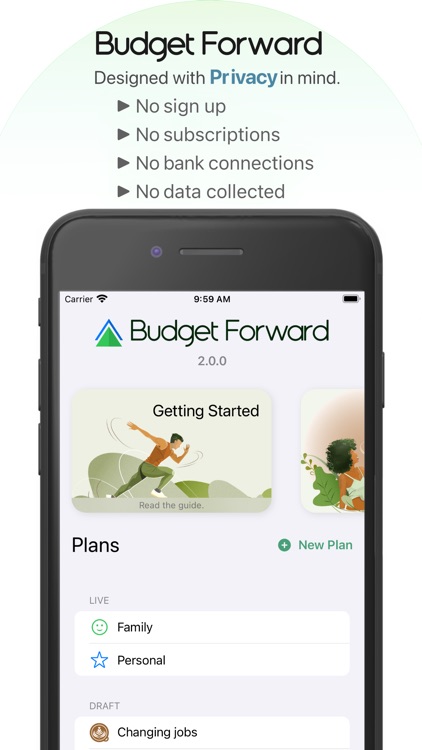

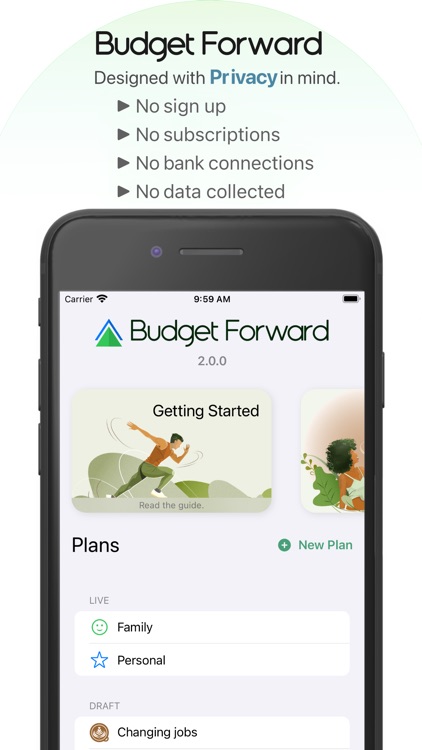

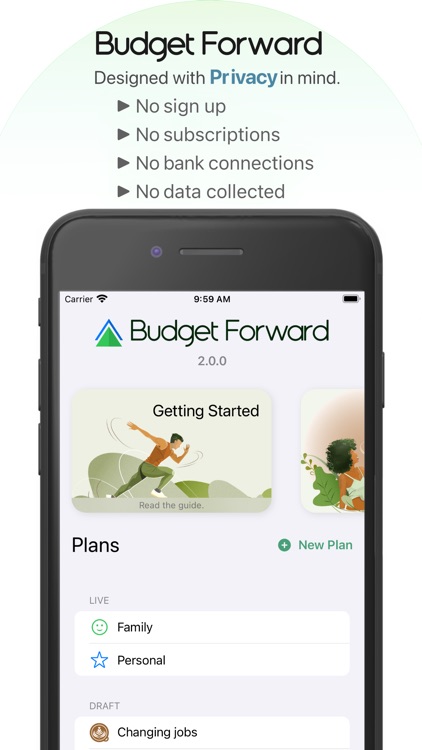

Budget Forward

The app can be used to build a budget from the ground up or used with an existing plan.

What is it about?

The app can be used to build a budget from the ground up or used with an existing plan.

App Screenshots

App Store Description

It is easier to develop good spending habits with your future mapped out in front of you. This is the premise of Budget Forward, a financial planning assistant that focus’ on the future. Create and execute a long term financial plan to take control of your finances and reduce uncertainty.

Budget Forward is not opinionated and can therefore be used alongside many popular budgeting methods. So whether you use buckets, envelopes, zero-based or have your own methodology, Budget Forward can be your ultimate timesaver due to its low maintenance design.

If you have ever tried to use a spreadsheet to budget, you will find that Budget Forward is a fast and powerful alternative with far more ability to use future recurrence to simulate your outcomes.

The declarative design allows you to build and refine a plan over time and even make large changes effortlessly. You can get started with a basic outline of your income and spending and build it up to be an all inclusive financial plan incorporating longer term goals and daily spending of allowances. The more information you add, the more accurately you can plan for the future.

Discover more at https://budgetforward.app

FEATURES

• Privacy first. No account requirement, no bank connection necessary. All of your data stays on your devices.

• With no recurring subscription or limits on plans, accounts or goals, Budget Forward gives incredible long term value for a one-off purchase.

• Designed to minimise the ongoing entry of data.

• Help is available throughout the app and online

PLANS

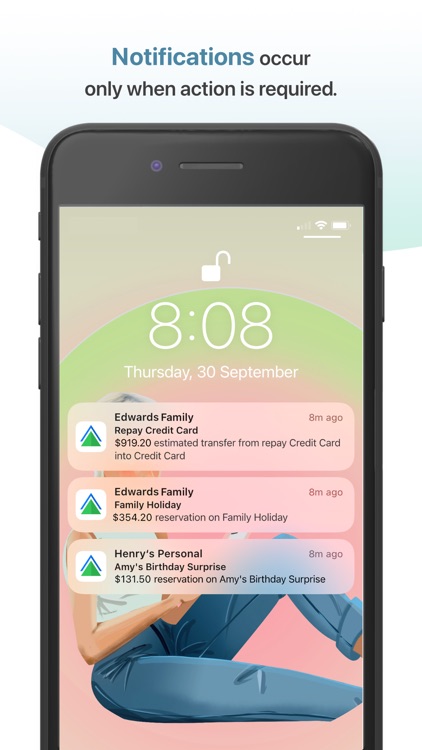

• Smart reminders only notify you when information is required.

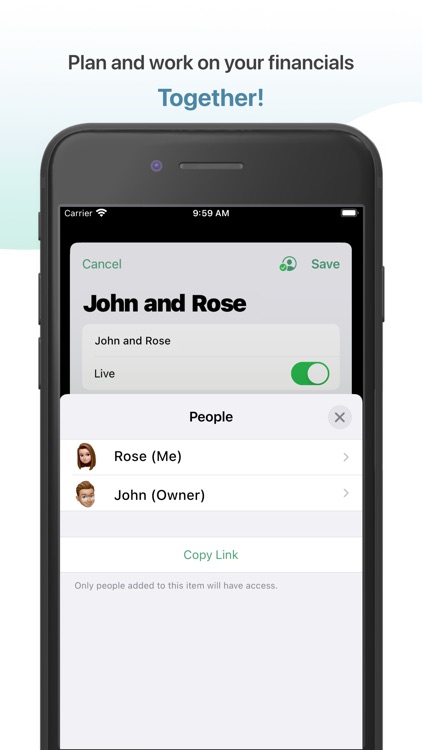

• Create as many plans as you like. You could have one for your family spending and a separate plan for your personal goals.

• Instantly duplicate a plan to compare potential changes. Great for planning job changes, having children or retirement.

• Multiple window support on iPad allows you to split screen your current plan with your alternate.

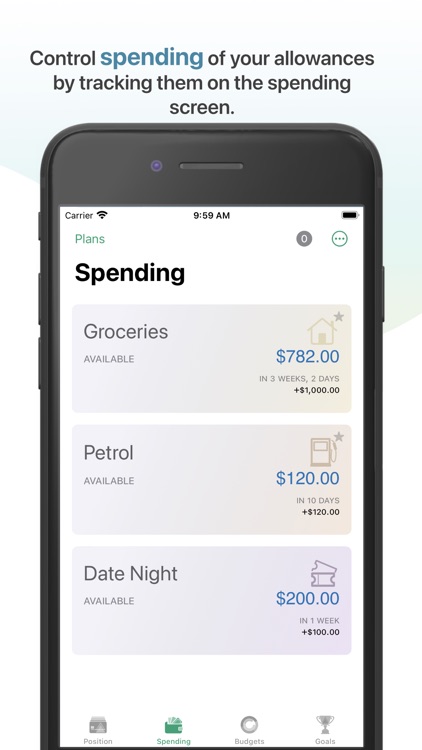

ALLOWANCES

• Allowances can be created to track regular spending.

• Ideal for grocery shopping, fuel and irregular or less predictable bills.

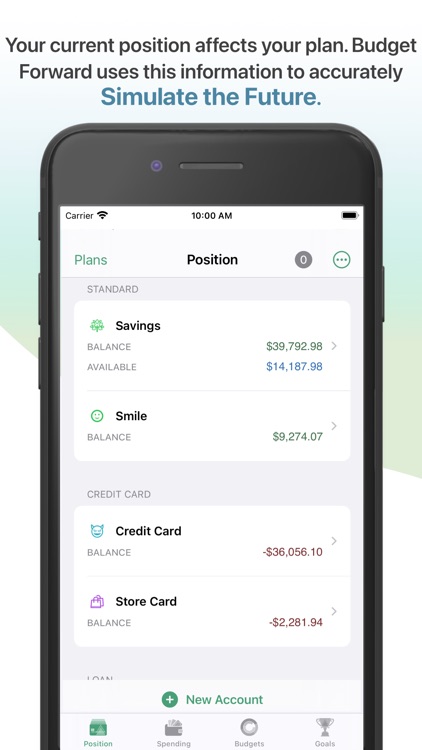

ACCOUNTS

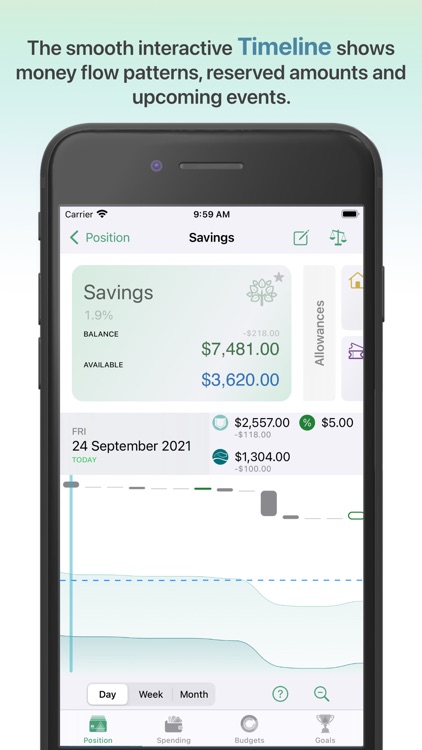

• Use the visually interactive timeline to smoothly navigate a simulation of the future.

• Available balance for each account will show you how much you can utilize without affecting future budgeted items and goals.

• Interest on accounts, both positive and negative, is simulated to get the most accurate projection of your plan.

• Offset accounts can also be simulated so that you can see the overall impact this has on your plan.

• Pocket accounts allow you to segregate funds in your accounts for specific uses such as allowances and goals.

BUDGET

• Budgets are simulated against your accounts giving you the most accurate possible timeline of your financial transactions.

• Budget rings give you a visualisation of your income compared to your expenses and highlight the potential you have to achieve

goals outside of your budget.

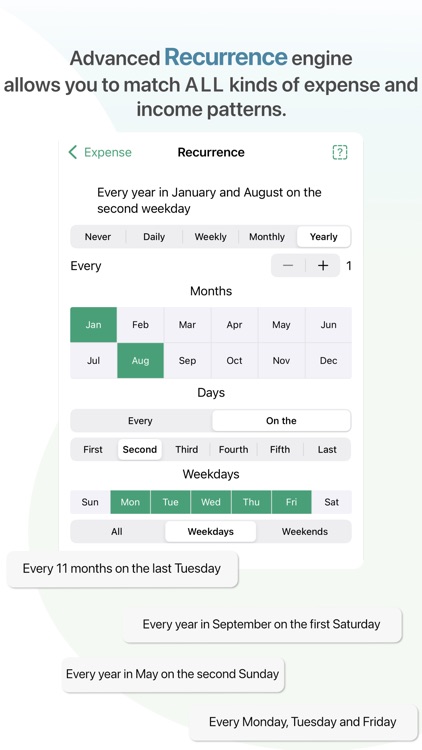

• Powerful recurrence options allow you to create many complex patterns to simulate when your transactions occur as accurately as possible.

• See every one of your budgeted expenses as a percentage of your total income.

• Sort your items by value, name, category, budget or type.

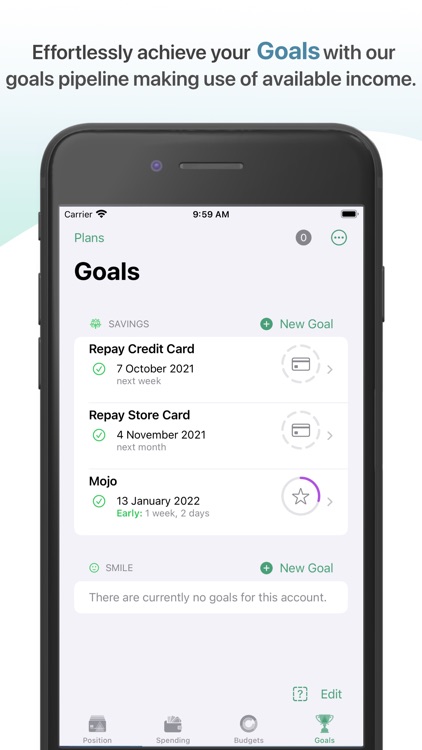

GOALS

• Choose from 4 built-in goal types: Savings, Repay Credit Card, Repay Loan and Offset Loan.

• Instantly adapt to any changes made to your spending, income or other goals.

• Our powerful simulator will project the exact date a goal will be achieved if you stick to your plan.

• Drag and drop to prioritize your goals.

• Create complex distribution of funds to your goals, even spanning multiple bank accounts.

• Fine tune the amount of income allocated towards a goal by adjusting its share.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.