NEW: Snoop will warn you if you don’t have enough cash to cover your bills

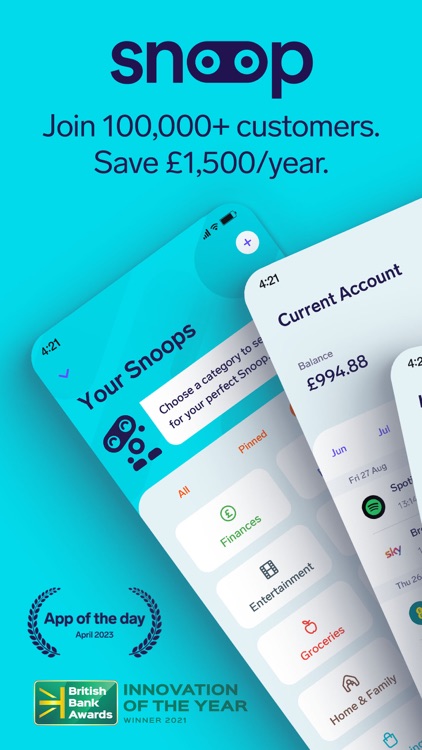

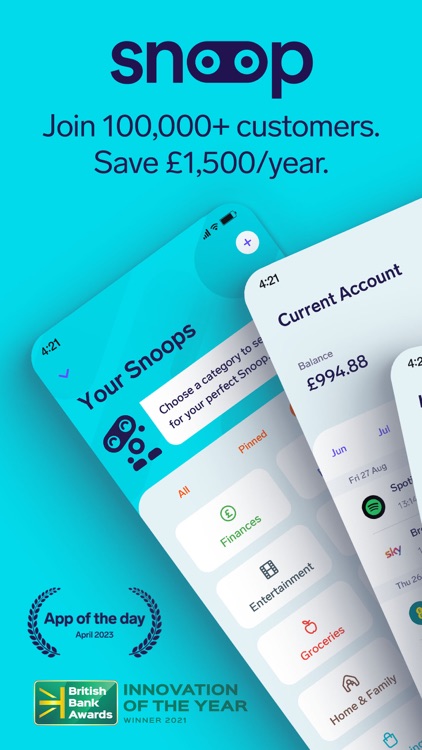

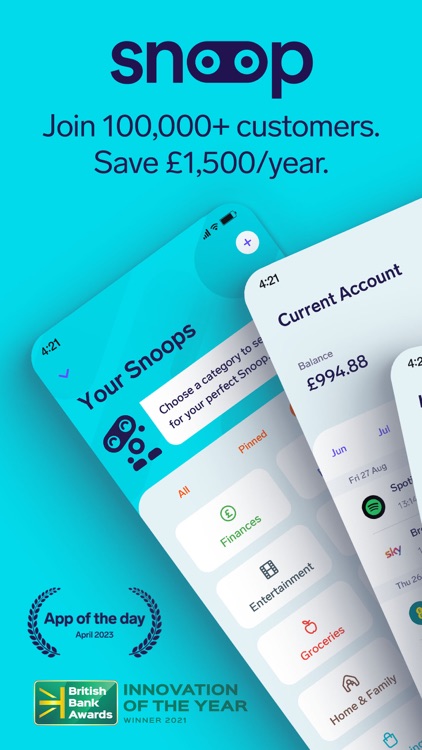

Budget Planner l Snoop Money

What is it about?

NEW: Snoop will warn you if you don’t have enough cash to cover your bills. One of our best features yet - turn it on today.

App Screenshots

App Store Description

NEW: Snoop will warn you if you don’t have enough cash to cover your bills. One of our best features yet - turn it on today.

Our latest upgrade has one of our most important bill features yet. Want to make sure you'll have enough cash in your accounts to cover your bills this month? Now Snoop can tell you! Monitor your bills vs your bank account balance and warn you if we think any bills might not be covered - so you can sort it before it's a problem.

All you need to do is:

• Confirm your bills that are paid from your connected accounts

• Confirm your income - So we don't warn about bills unnecessarily

• Snoop will create a timeline based on this, showing your bills vs your bank balance for the rest of the month

• Snoop will warn you if we think you might not have enough money

Stem the tide of the cost of living crisis and improve your personal finances with our easy-to-use money manager app, letting you save cash plus lots more. Manage bills, set budgets, get smart spending ideas & budgeting tips and avoid overdrafts by monitoring from payday to payday with our finance tracker.

FEATURES

• Connect accounts and manage all your money in one dashboard

• Track where every penny goes with money management tools

• Set an instant budget for your monthly spend with our budget planner

• Track finances and analyse your spending across different categories

• Spot where you can save money with smart spending ideas

• Uncover & cancel subscriptions with our subscription tracker

• Receive daily balance notifications

• Get weekly spending reports

• Switch and save money on insurance & broadband providers

• Spending tracker to help you see where to cut back

• Avoid overdraft charges

ALL YOUR MONEY IN ONE PLACE

• Managing money starts with transparency. Whether it’s a debit account with Starling bank or a credit account with NatWest, view all your online banking & transactions on one money dashboard.

• Keep on top of all your spending and bills in one app with smart money management tools. Smart spending means more money in your wallet at the end of the month.

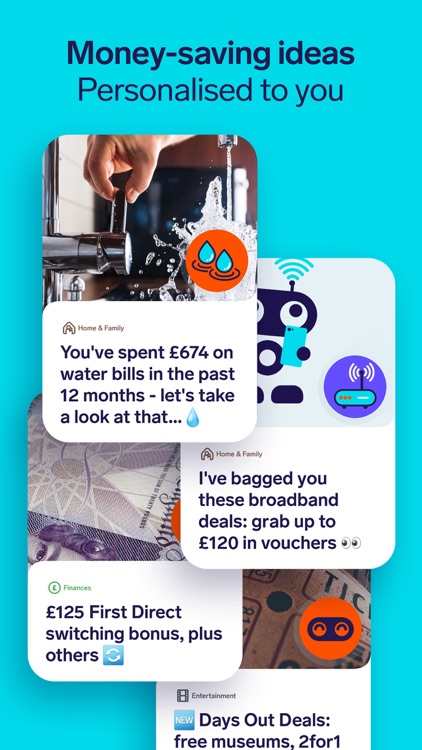

FINANCE TRACKER & SMART SPENDING TIPS

• Track finances across accounts by category on one money dashboard

• Create custom categories tailored to your spending

• Get personalised money saving ideas from our smart spending tools

• Cut wasteful subscriptions with the help of our finance tracker & save money

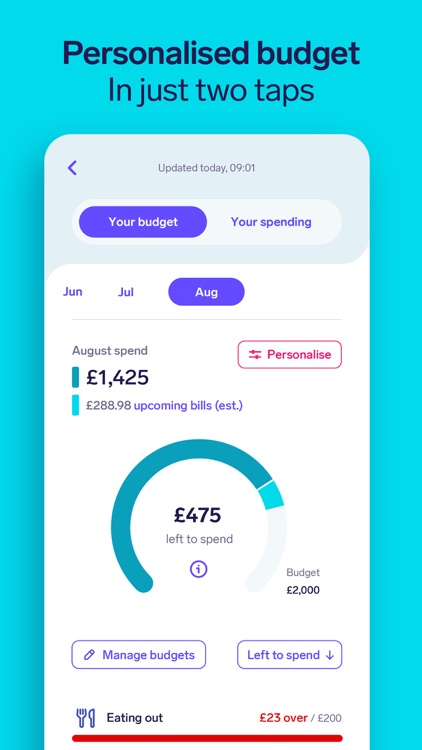

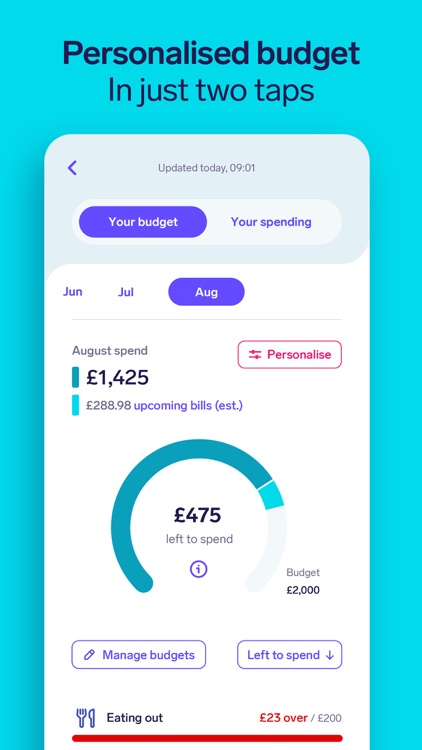

EASY BUDGETING WITH OUR BUDGET PLANNER

• Get an instant, personalised budget in two taps (or build your own easily)

• Set budgets for your total monthly spend and your category spend (e.g. groceries)

• Track how you’re doing against your budgets and get smart alerts to help

• Daily finance tracker alerts, weekly smart spending reviews, plus a preview of upcoming bills

SWITCH & SAVE MONEY

• Our finance tracker will alert you if you could save money on bills

SNOOP PLUS

Upgrade for additional money management & budgeting features.

• Personalise your money dashboard with unlimited custom categories

• Set spending targets & keep to your budget with alerts

• Monitor smart spending payday to payday

• Save money & energy tracking refunds – just get Snoop looking out for them

• Add accounts & calculate your net worth

• Generate custom spending reports

If you subscribe to Snoop Plus, payment will be charged to your iTunes account. Your next payment will be charged within 24 hours of the end of the current subscription period. Your subscription will auto-renew unless you turn off auto-renew at least 24 hours before the end of the current subscription period (you can manage auto-renew in your Account Settings after you subscribe). Currently, Snoop Plus subscription costs £4.99/month or £31.99/year. Prices are in UK sterling. You can't cancel a current subscription during that subscription period.

Terms & Conditions https://snoop.app/terms/

Privacy Policy https://snoop.app/privacy-policy/

We're registered with the Financial Conduct Authority

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.