[Summary]

![[Summary]](https://is3-ssl.mzstatic.com/image/thumb/Purple125/v4/fd/76/c0/fd76c0d2-1d14-7f02-3b1d-db8280ff17cc/source/60x60bb.jpg)

Bursar

What is it about?

[Summary]

App Screenshots

App Store Description

[Summary]

Bursar is the best and easiest way to track your expenses and plan a comprehensive budget. We take security very seriously and we do not track any of your information, it is local to you, and that’s it. We designed this app around the idea of wanting to keep our private financial information private, while still being able to have a well-designed budgeting app.

With that in mind, our app shows you all the information you need, without needing your bank information or credit card information. We have you enter all expenses to keep you mindful of your spending, but we make it incredibly easy to do.

[Privacy]

Privacy is a huge topic today, every company says they want to keep your information private and secure. Yet still there are hacks every day where your information is leaked. This app takes privacy very seriously, to the point where we don’t remotely store your bank/credit card information, we don’t even store it at all. Here, you enter all of your bills manually. There is no need to enter credit card info or anything, because we don’t use it.

The reason we don’t use credit card information to track your spending is two-fold. The most important reason is security. One less place that has that information is one less place that can get hacked and have that information stolen. The second is because it makes you think about how you are spending your money. If you have an app that pulls that data in the background, you don’t have to make an effort to log it and you can end up overspending.

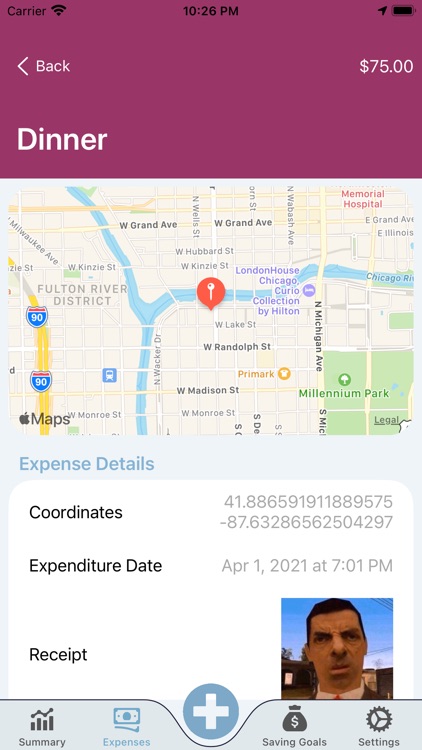

We save all data remotely on a secure server, where you are able to access it from our iOS, iPadOS, or macOS apps. We only record what you send us, no location monitoring or data harvesting.

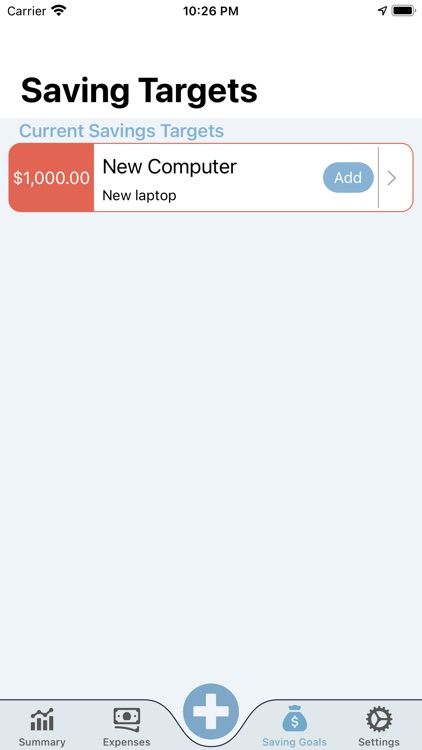

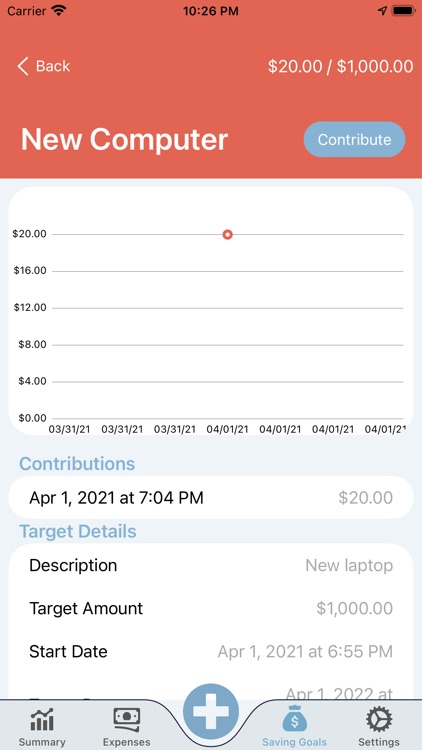

[Budget Summary]

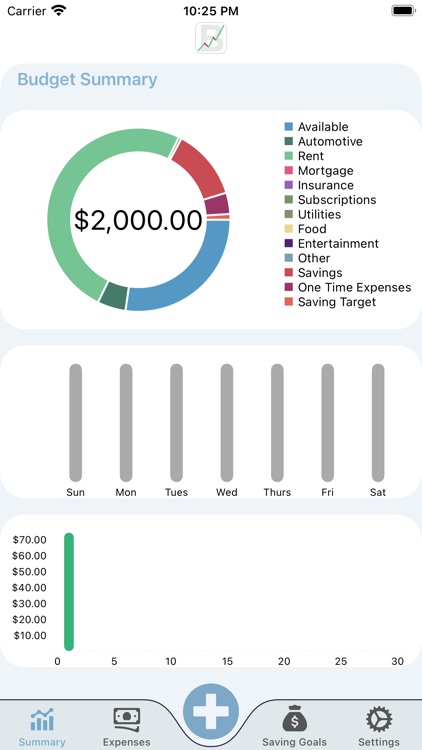

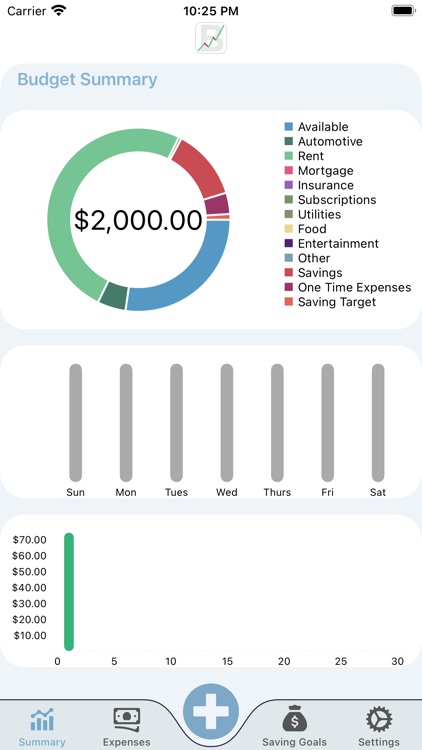

The budget summary screen is the main screen you see whenever you open the app. It is the first tab and it displays a breakdown of your monthly spending. There is a pie chart that you can tap on segments of to see exactly what you are spending your money on each month, and how much of it you are spending. When you set your after tax income you will also see the available amount after all expenses are taken out. As you add more one time expenses, the available tab shrinks, as you now have less money to spend.

[Expenses]

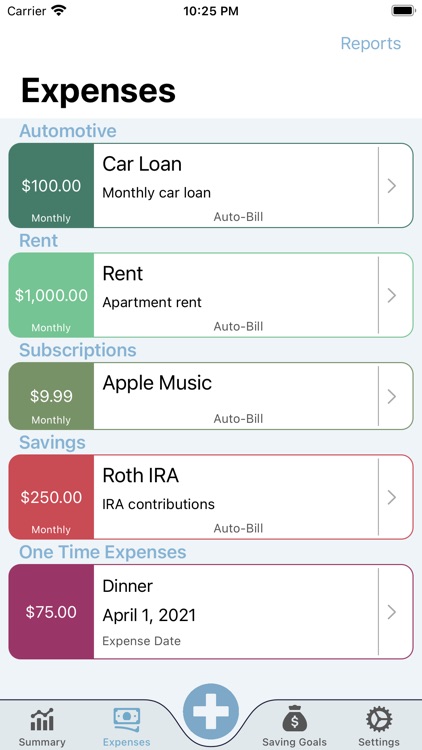

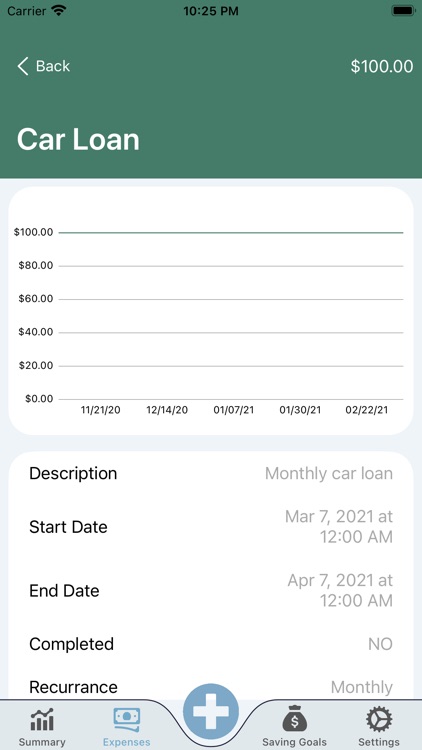

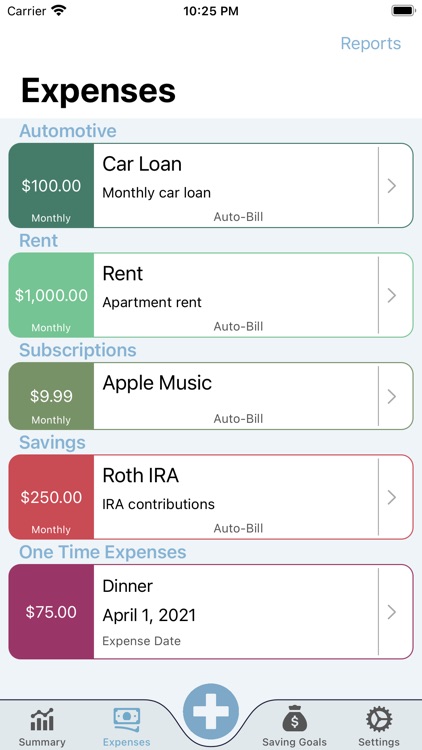

Expenses is the list of every place your money is going this month. It breaks down your spending in terms that are easy to understand, and easy to track. You are able to add new expenses here, as well as any supplemental income that you may receive (something like a tip you got at work, a bonus, or if you work on commission).

Expenses are considered recurring as long as you don’t create them as one time expenditures, so they will stay on your monthly budget until you “complete” them. Completing an expense is as simple as sliding the expense to the right to reveal the blue complete icon option. When you complete them, they will stop recurring at the end of the current month and no longer count against your overall budget. Complete an expense you didn’t mean to? Simply slide it over again and tap the incomplete icon.

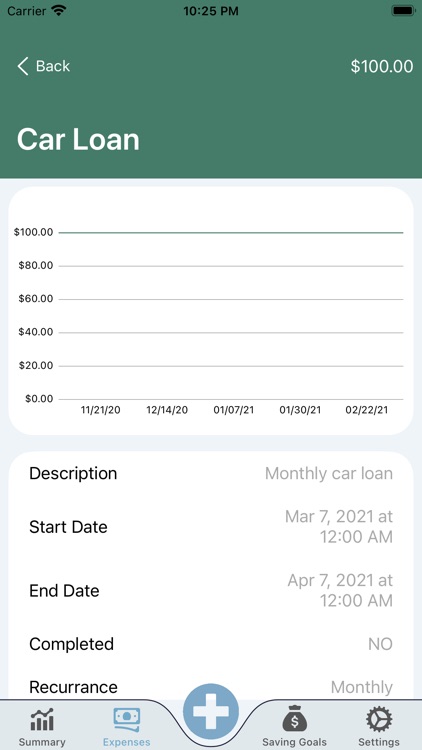

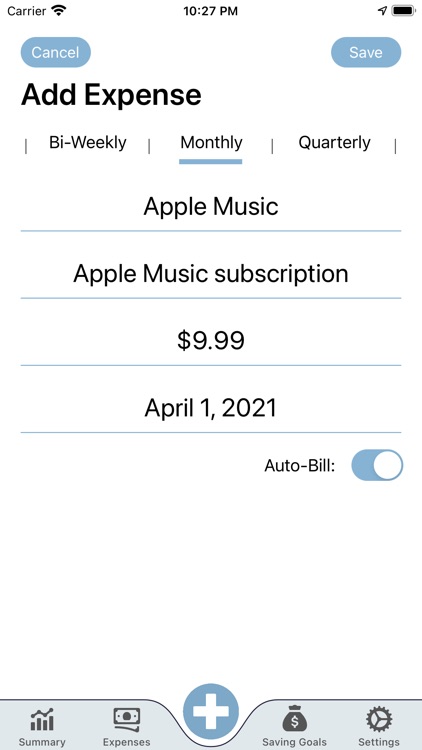

Expenses have two different categories: auto-bill, and contributed. Auto-bill expenses are created and then require no further interaction, they are automatically added at the full amount to your budget. Contributed bills will start at $0.00 at the beginning of each recurrence interval, and as you spend more money in that category, you will "contribute" to that expense and the amount you contributed will be added to your monthly budget breakdown.

Adding a new expense is simple as well, tap the add button in the category you want to add the new expense to, fill out the information, and press save. That’s it!

[Disclaimer]

A paid subscription is required in order to use this application.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.