Do you want to take a loan online or a credit card, do you need to calculate a mortgage or car loan

Calcs'n'Banks: calc your loan

What is it about?

Do you want to take a loan online or a credit card, do you need to calculate a mortgage or car loan? Before choosing a particular loan, you need to understand your future debt burden. It can differ significantly from the interest rates advertised by banks. Not in your favor, of course. To understand why this is happening, use the Calcs'n'Banks loan calculator - it will help you calculate the loan correctly and save your money. Let us analyze with examples why the real interest rates on loans may differ from the stated ones and why it is necessary to calculate the loan first, and only then borrow money.

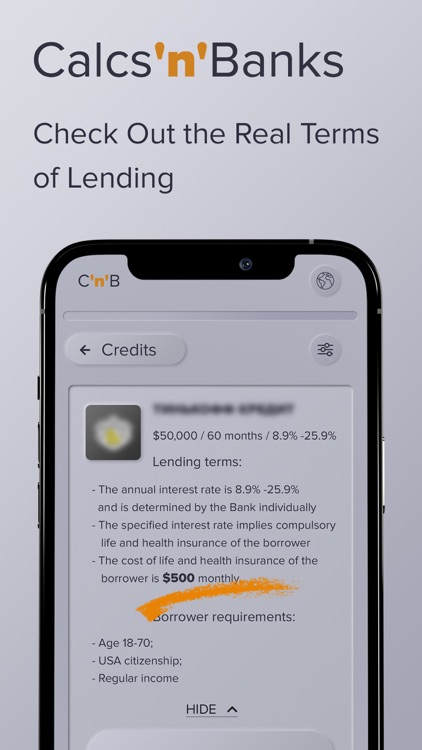

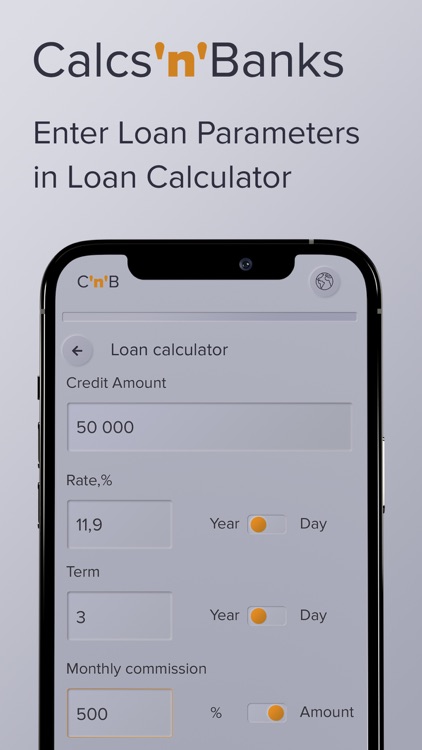

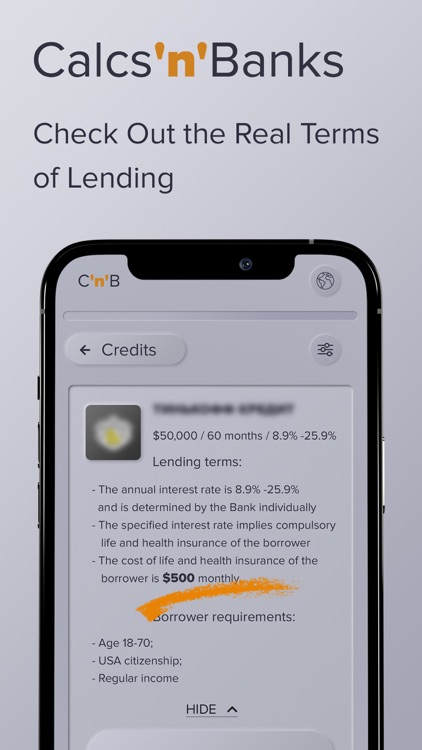

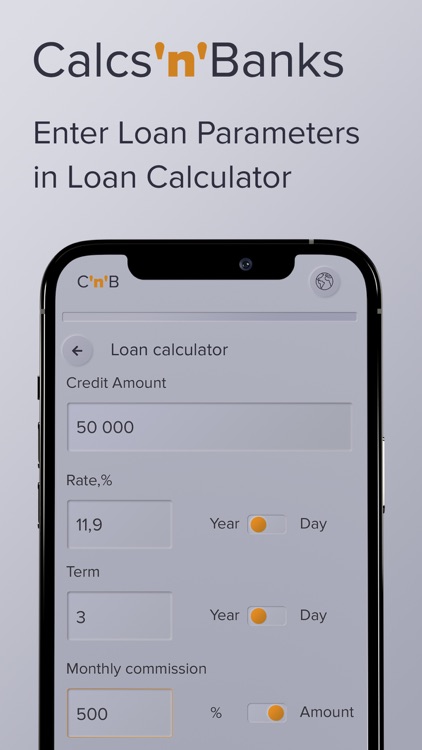

App Screenshots

App Store Description

Do you want to take a loan online or a credit card, do you need to calculate a mortgage or car loan? Before choosing a particular loan, you need to understand your future debt burden. It can differ significantly from the interest rates advertised by banks. Not in your favor, of course. To understand why this is happening, use the Calcs'n'Banks loan calculator - it will help you calculate the loan correctly and save your money. Let us analyze with examples why the real interest rates on loans may differ from the stated ones and why it is necessary to calculate the loan first, and only then borrow money.

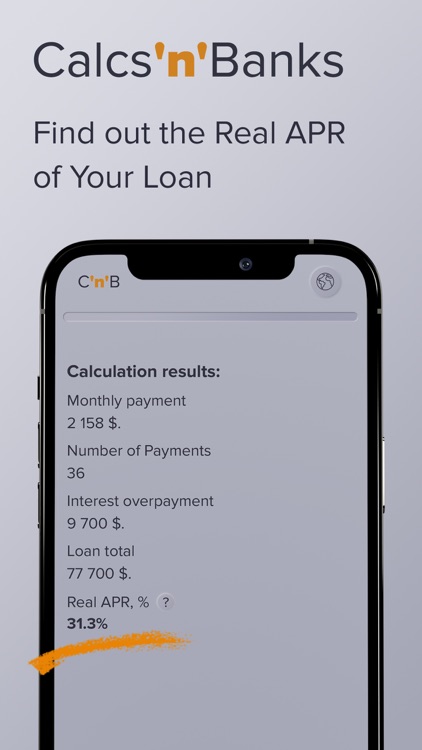

Calculation example 1. Car loan

Let's say you decide to buy a car for $25,000 and for this purpose take a car loan without a down payment. A certain bank offered you a loan for 3 years at a rate of 5% per annum. In the body of the loan, you were offered to include the amount of all related taxes and fees in the amount of $2000. If you enter the above loan parameters into the Calcs'n'Banks loan calculator, you will see that in this case the real APR will exceed the stated rate by 2 times and amount to 10.658%.

Calculation example 2. Mortgage

Suppose you decide to take out a mortgage in the amount of $1,000,000 at a rate of 3% per annum for 15 years. Your realtor's services cost $20,000. To calculate the real rate that you will pay on the mortgage, enter the specified parameters into the Calcs'n'Banks loan calculator - it will help you calculate the mortgage correctly. As a result, the real APR will be 4.338%, which is 43% higher than the stated rate.

Calculation example 3. Cash loan through an intermediary

Let's say you can't get a cash loan because of your bad credit story. A certain intermediary offers you to take out a loan online at a bank in the amount of $10,000 at 10% per annum for a period of 12 months. For his services, the intermediary asks for 10% of the loan amount. The in-app loan calculator will show you the real picture: in the end, you will pay for such a cash loan at a rate of 30% per annum.

Loan conditions

Credit institutions in usually offer money on loan on the following conditions:

- The minimum loan amount is 1000 $.

- Maximum loan amount - 30,000,000 $.

- The minimum loan repayment period is 61 days.

- The maximum loan repayment period is 30 years.

- The APR ranges from 0% to 30%.

Consequences of non-payment of a loan or credit card

When you are planning to take out a bank loan or a credit card online, remember about the fines. In case of violation of payment on the loan, a penalty is provided. Typically, the penalty is 0.1% of the total amount owed on the loan for each day of delay in payment, but the terms of the loan depend on the requirements of a particular lender.

Partner banks

Raiffeisen Zentralbank, Marcus by Goldman Sachs, Axis Bank, Home Credit Bank, Discover Bank, Wells Fargo, ICICI Bank, HSBC Bank, Citibank, SBI Bank etc.

Disclaimer

We do not advise you to take loans or credit cards, although we understand that sometimes you can't go anywhere without them. If you cannot get by with your own funds, borrow money wisely: calculate the total debt burden on your loans and borrowings using a loan calculator. Calcs'n'Banks provides information services only, does not provide loans and is not a credit institution. The list of information provided in the application, as well as the list of banks, may vary. All third-party trademarks, including logos referenced by Calcs'n'Banks, are the property of their respective owners.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.