With CarrotPay, getting a loan is almost as easy as thinking about it

CarrotPay - Instant loans

What is it about?

With CarrotPay, getting a loan is almost as easy as thinking about it. Once you pass our automated checks and your credit score is favorable, you can easily get a loan within minutes.

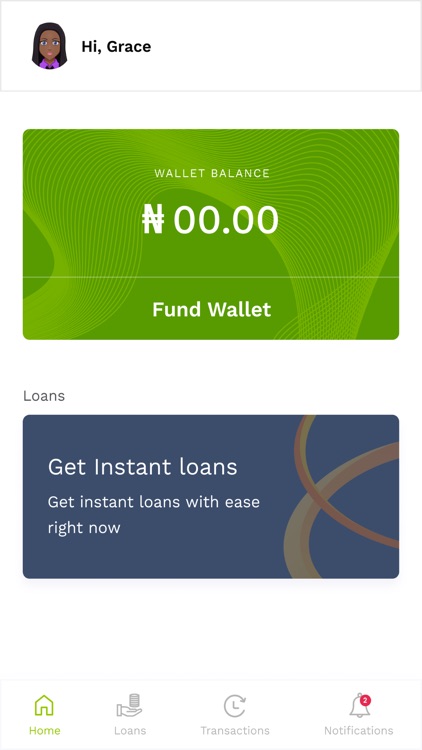

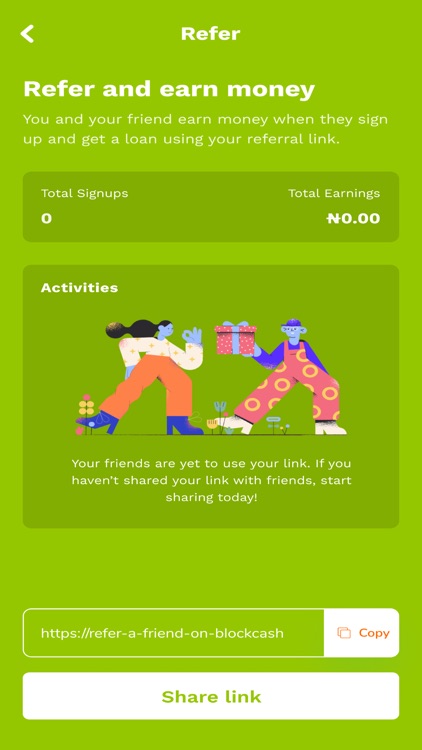

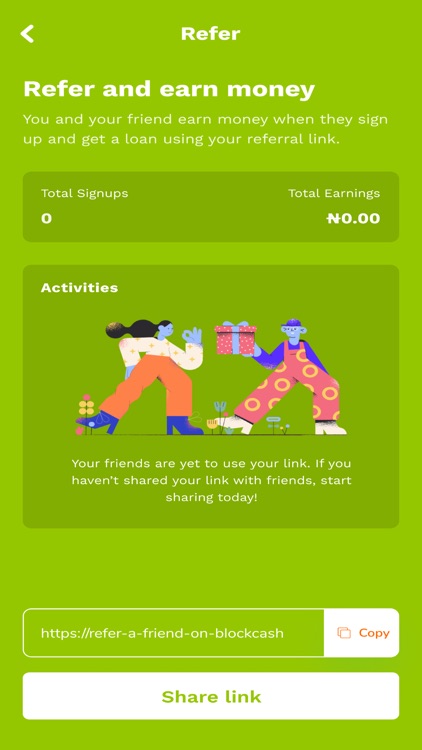

App Screenshots

App Store Description

With CarrotPay, getting a loan is almost as easy as thinking about it. Once you pass our automated checks and your credit score is favorable, you can easily get a loan within minutes.

GETTING STARTED

*Download CarrotPay

*Create your account in minutes

*Apply for a loan

*Get the cash you need

And just like that, you can solve your immediate problems.

ABOUT CARROTPAY

CarrotPay provides loans for as low as N5,000. To access our loans, you must be at least 21 years of age.

Depending on the loan product you are eligible for, a loan tenor can run up to 180 days. It’s up to you to choose the loan repayment term that works best for you. There’s also an option for partial repayment before your loan is due. By repaying diligently, you can improve your credit history, which allows you to have access to a higher amount as loans in the future.

RATES AND FEES.

To access our loans, you must be at least 21 years of age. We may require that you provide a valid Government ID. You can get as little as N5,000 and up to N50,000, and you can pay back between 60 to 180 days. Our usual repayment period is monthly. Our minimum interest rate, determined by our credit scoring algorithm, is 3% per month and a maximum of 10% per month. This comes to an Annual Percentage Rate (APR) of 36% to 120%.

REPRESENTATIVE EXAMPLE.

If you choose a loan package of N10,000 (Principal) to pay back over a 6-months tenor at an interest rate and fees of 3% per month (36% APR), you will be paying back N1,966.67 monthly for 6 months. At the end of the 6 months, you would’ve paid a total of N11,800.

Please do not take a CarrotPay loan to fund your lifestyle or service long-term debts. Short-term loans are helpful in emergencies but can quite expensive when compared to long-term loans and should be used with care.

ADDITIONAL NOTES.

When assessing your eligibility for a loan, there are several factors we consider. Some of which are past loan performance, credit score, etc.

Ensure that your loan application is correctly filled in as any falsification can lead to consequences ranging from blacklisting your profile to reporting you to the police in clear cases of fraud.

CONTACT US, WE’RE ALWAYS THERE

We appreciate your feedback and can’t wait to hear from you.

* Email us on support@carrotpay.ng

* Visit our website: www.carrotpay.ng

* Follow us on Twitter: https://twitter.com/CarrotPayng

* Like our Facebook page: https://www.facebook.com/carrotpayng/

* Follow us on Instagram: https://www.instagram.com/carrotpayng/

* Follow us on LinkedIn: https://www.linkedin.com/company/carrotpay-ng-limited

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.