F1 covers the regulation and preparation of financial statements and how the information contained in them can be used

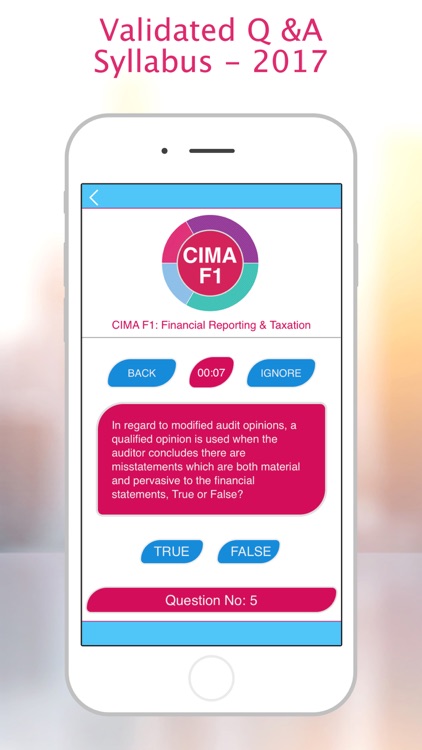

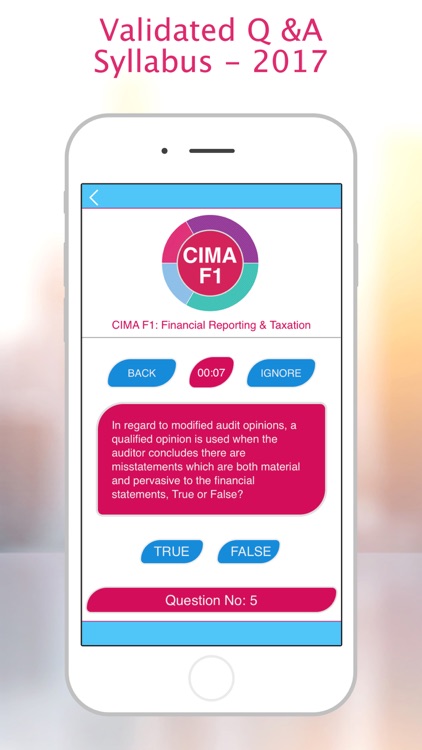

CIMA F1: Financial Reporting and Taxation.

What is it about?

F1 covers the regulation and preparation of financial statements and how the information contained in them can be used. It provides the competencies required to produce financial statements for both individual entities and groups using appropriate international financial reporting standards. It also gives insight into how to effectively source and manage cash and working capital, which are essential for both the survival and success of organisations. The final part focuses on the basic principles and application of business taxation. The competencies gained from F1 form the basis for developing further insights into producing and analysing complex group accounts (covered in F2) and formulating and implementing financial strategy (covered in F3)

App Screenshots

App Store Description

F1 covers the regulation and preparation of financial statements and how the information contained in them can be used. It provides the competencies required to produce financial statements for both individual entities and groups using appropriate international financial reporting standards. It also gives insight into how to effectively source and manage cash and working capital, which are essential for both the survival and success of organisations. The final part focuses on the basic principles and application of business taxation. The competencies gained from F1 form the basis for developing further insights into producing and analysing complex group accounts (covered in F2) and formulating and implementing financial strategy (covered in F3)

Cert Foundation App:

√ Update Contents (2017)

√ Authentic And Validated Questions

√ Full Exam Preparation in One Single Purchase, (No-InApp-Purchases) Or (Subscriptions)

√ Run Your Test on Random Base or in Full Mode

√ Progress Tracker & Time Tracker

√ Use The App For Your Training

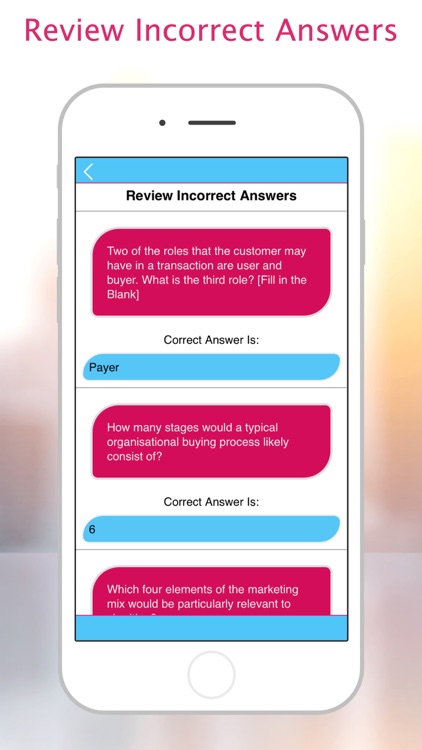

√ Progress Report & Exam Transcript *When You Finish Your Exam

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.