Clair is a banking app that gives you access to a portion of your earnings before payday

Clair

What is it about?

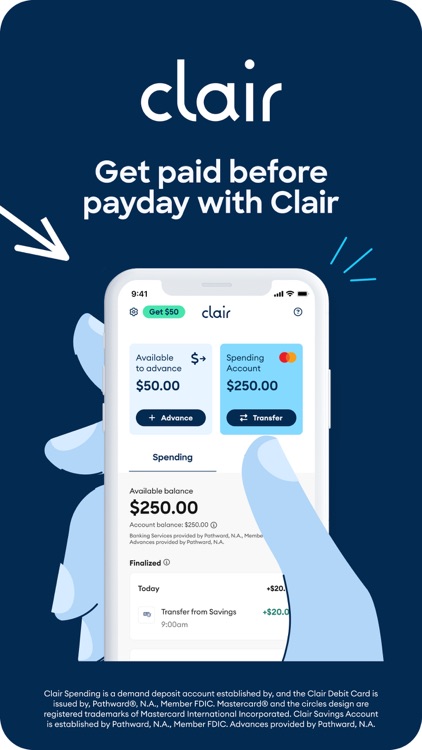

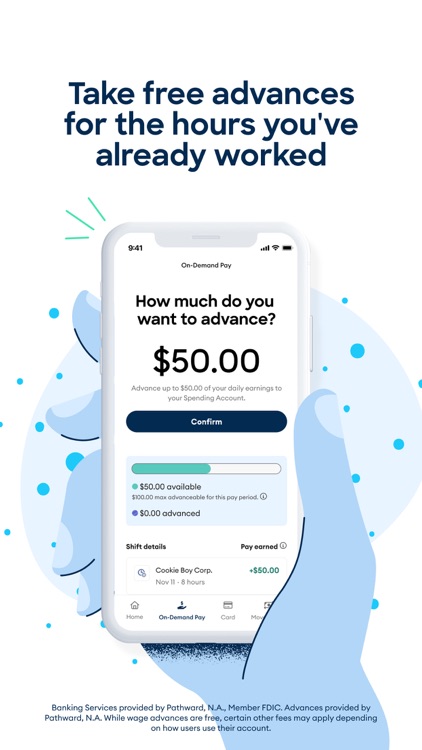

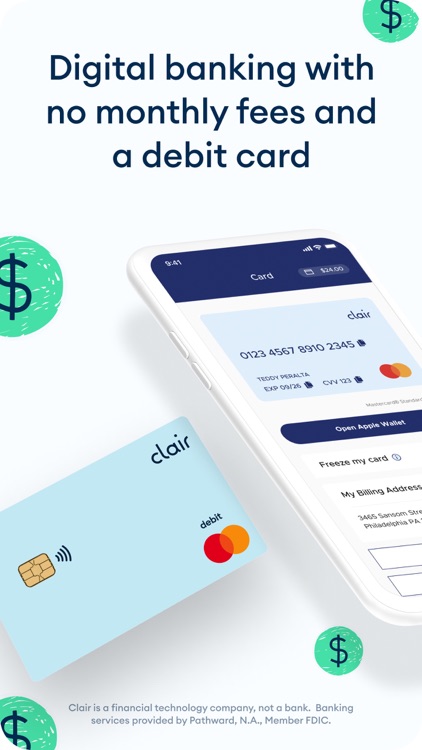

Clair is a banking app that gives you access to a portion of your earnings before payday. When you open a Clair Spending Account, held at Pathward® N.A, Member FDIC, you’ll enjoy on-demand pay with access to fee-free wage advances, an FDIC-insured* Spending and Savings account with no monthly fees, and a Clair Debit Mastercard® to spend your earnings.

App Screenshots

App Store Description

Clair is a banking app that gives you access to a portion of your earnings before payday. When you open a Clair Spending Account, held at Pathward® N.A, Member FDIC, you’ll enjoy on-demand pay with access to fee-free wage advances, an FDIC-insured* Spending and Savings account with no monthly fees, and a Clair Debit Mastercard® to spend your earnings.

Here’s what you’ll love about Clair:

- Quick and easy access: Open a Clair Spending Account and take your first wage advance in the Clair mobile app after setting up a repayment method.

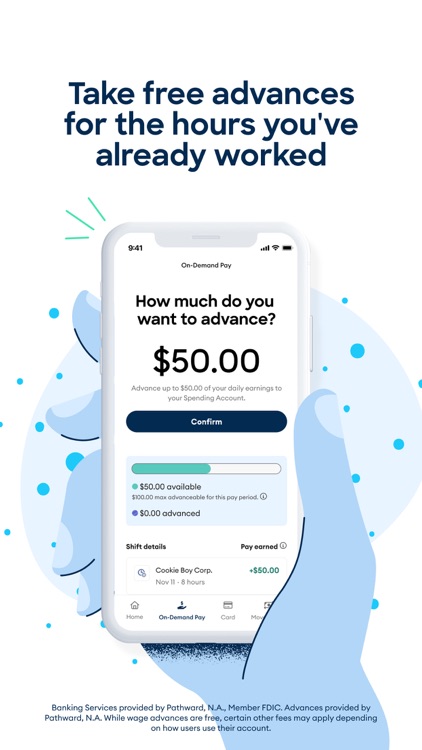

- Freedom and control: You decide how much to advance from your next paycheck, up to a pre-approved amount determined by Clair** on an individual user-basis.

- Access all the banking services you need: Get access to 40,000 fee-free AllPoint ATMs†, a virtual and physical debit card, Apple Pay™ and Google Pay, savings reminders, and much more!

Learn more about Clair at getclair.com.

Note: Clair is only available to select businesses. Check with your work app, time clock, or employer for an invite before getting started.

Clair is a financial technology company, not a bank. Clair Spending is a demand deposit account established by, and the Clair Debit Card is issued by, Pathward, N.A., Member FDIC. Mastercard® and the circles design are registered trademarks of Mastercard International Incorporated. Clair

Savings Account is established by Pathward, N.A., Member FDIC. Advances provided by Pathward, N.A.

While wage advances are free, certain other fees may apply depending on how users use their account. Standard data charges may apply when using the Clair app.

* Funds are FDIC insured, subject to applicable limitations and restrictions, when Pathward, N.A. receives the funds deposited to your account.

** Your advance rate will depend on your individual circumstances. Limits are subject to change.

† The Clair Debit Mastercard can be used for no-fee withdrawals at U.S. ATMs in the Allpoint network. Fees may apply for international ATM transactions or transactions outside of this network. Banking Services provided by Pathward, N.A., Member FDIC.

‡ The Clair Savings Account is established by Pathward, N.A., Member FDIC. Interest is calculated on the Daily Balance of the Savings Account and is paid monthly. The interest rate paid on the entire balance will be 1.98% with an annual percentage yield (APY) of 2%. The interest rate and APY may change. The APY was accurate as of 11/04/22. No minimum balance necessary to open the Savings Account or obtain the yield. You must have or obtain a Spending Account in order to obtain and open a Savings Account, and you must be the primary accountholder of your Spending Account. Savings Account funds are withdrawn through the Spending Account, and transaction fees could reduce the interest earned on the Savings Account. Funds on deposit are FDIC-insured through Pathward, N.A., Member FDIC. For purposes of FDIC coverage limit, all funds held on deposit by the accountholder at Pathward, N.A., will be aggregated up to the coverage limit, currently $250,000.00.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.