CMA Part 2: Financial Decision Making

CMA Part II - Exam Prep 2018

What is it about?

CMA Part 2: Financial Decision Making

App Screenshots

App Store Description

CMA Part 2: Financial Decision Making

The percentages show the relative weight range given to each section in the exam.

A. Financial Statement Analysis – 25%

Principal financial statements and their purposes; limitations of financial statement information; interpretation and analysis of financial statements including ratio analysis and comparative analysis; market value vs. book value; fair value accounting; international issues; major differences between IFRS and U.S. GAAP; off-balance sheet financing; Cash Flow Statement preparation, analysis, and reconciliation; and earnings quality.

Topics Tested:

– Basic Financial Statement Analysis

– Financial Ratios & Performance Metrics

– Profitability Analysis

– Special Issues

B. Corporate Finance – 20%

Types of risk; measures of risk; portfolio management; options and futures; capital instruments for long-term financing; dividend policy; factors influencing the optimum capital structure; cost of capital; raising capital; managing and financing working capital; mergers and acquisitions; and international finance.

Topics Tested:

– Risk & Return

– Long Term Financial Management

– Raising Capital

– Working Capital Management

– Corporate Restructuring

– International Finance

C. Decision Analysis – 20%

Relevant data concepts; cost-volume-profit analysis; marginal analysis; make vs. buy decisions; income tax implications for operational decision analysis; pricing methodologies including market comparables, cost-based and value-based approaches.

Topics Tested:

– Cost/Volume/Profit Analysis (CVP Analysis)

– Marginal Analysis

– Pricing

D. Risk Management – 10%

Types of risk including business, hazard, financial, operational, strategic, legal compliance and political risk; risk mitigation; risk management; risk analysis; and ERM.

Topics Tested:

– Enterprise Risk

E. Investment Decision – 15%

Cash flow estimates; discounted cash flow concepts; net present value; internal rate of return; non-discounting analysis techniques; income tax implications for investment decisions; ranking investment projects; risk analysis; real options; and valuation models.

Topics Tested:

– Capital Budgeting Process

– Discounted Cash Flow Analysis

– Payback & Discounted Payback

– Risk Analysis in Capital Investment

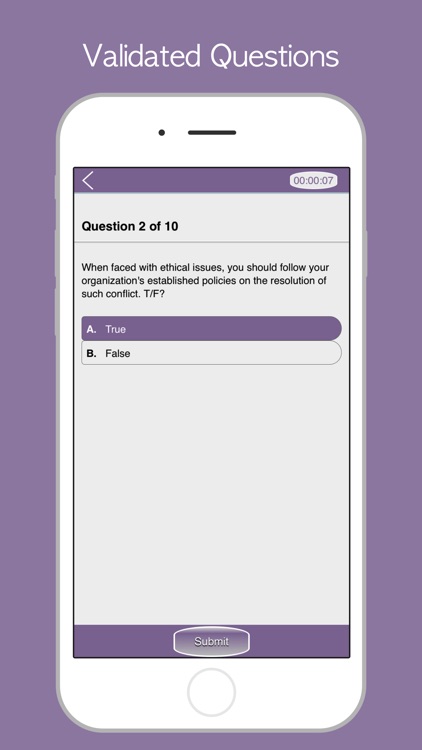

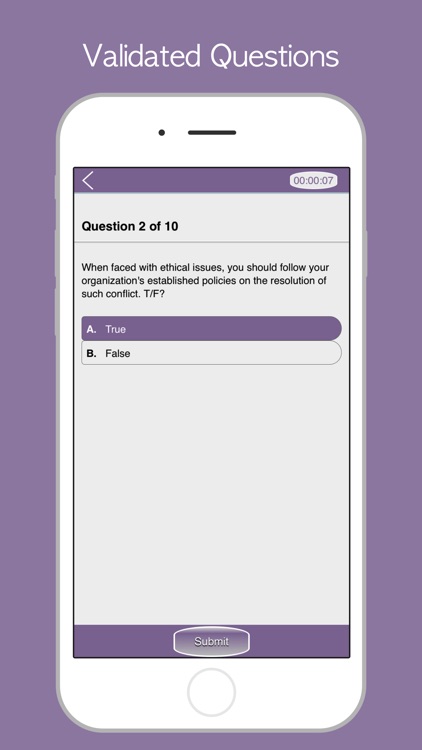

F. Professional Ethics – 10%

Ethical considerations for the organization

Topic Tested:

– Ethical considerations for management accounting and financial management professionals.

– Ethical considerations for the organization.

****

Wisdom Prep App Features:

- No Internet Required

- No In-App-Purchase or Subscriptions

- Latest Update 2018

- Based on Latest Official Curriculum 2018

- Detailed Answers and Explanations

- Study Mode Option

- App Can Be Used for Training & Certification

- Virtual Exam Mode

- Test Taking Strategy

- Tracking and Progress Report.

DISCLAIMER:

Wisdom Prep & Vision Architecture is not affiliated with or endorsed by any respected testing organization, certificate, test name or any trademark.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.