Personal wealth management based on consolidated information on wealth of individuals or families, in particular the clients of private banking, wealth management or family office services

Comarch Wealth Manager

What is it about?

Personal wealth management based on consolidated information on wealth of individuals or families, in particular the clients of private banking, wealth management or family office services. The most important areas of the wealth management process supported by the solution include:

App Screenshots

App Store Description

Personal wealth management based on consolidated information on wealth of individuals or families, in particular the clients of private banking, wealth management or family office services. The most important areas of the wealth management process supported by the solution include:

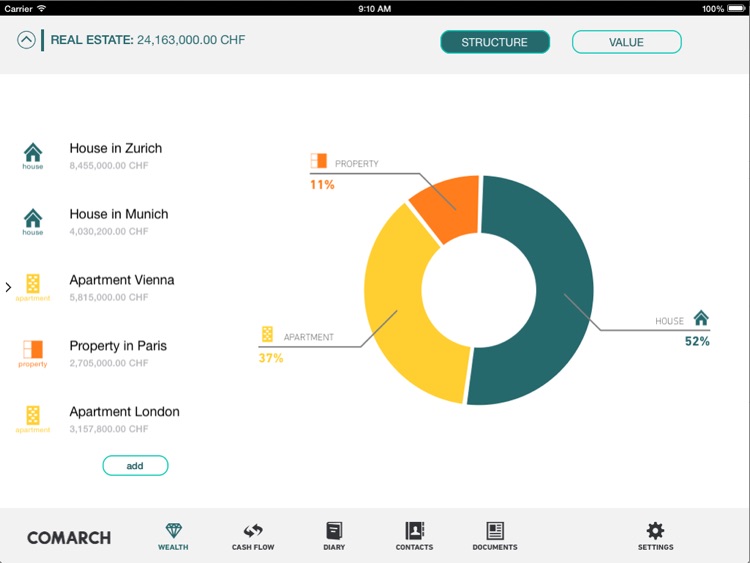

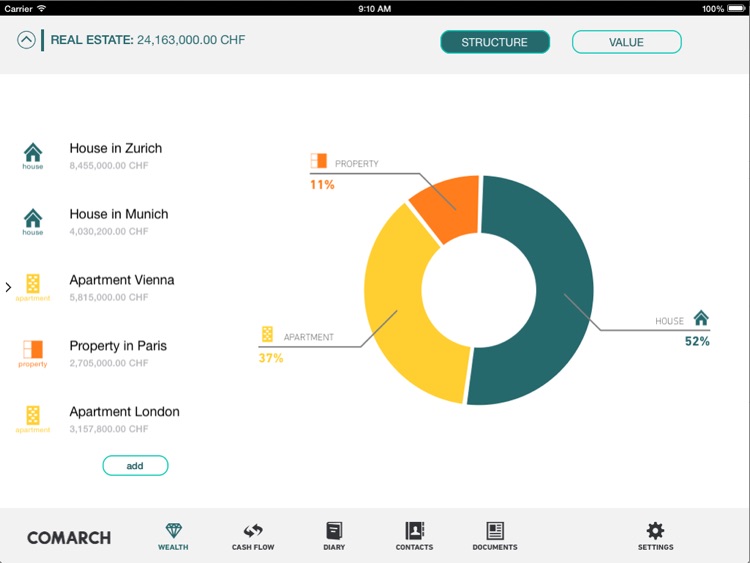

- Personal wealth inventory from the perspective of key asset classes (e.g., cash, investments, valuables, real estate, insurance) as well as individual positions, all accounts, custodians or localizations

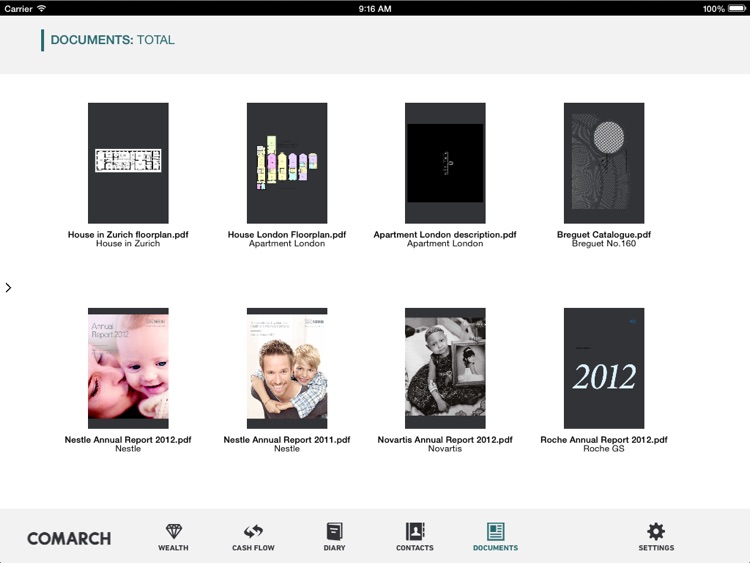

- Storing all relevant contacts, documents and information important for operational management of assets positions

- Analyses of historical, current and forecast values and returns associated with assets positions

- Handling of current and projected incomes and costs concerning all components of wealth integrated with appropriate calendars

- Analyses of personal cash flow based on projected payments and current cash positions and liabilities

- Communication between the family office/ bank and the end-user.

The solution used by end-clients is available both as the iPad app and via web channel. A dedicated web app for family offices and private bankers allows for administration of client data, and uses Comarch Smart Finance Multichannel Service Platform, which works as a multiproduct and multichannel integration layer.

Target audience: end-clients of wealth managers, private banking, family offices.

The end-clients can use this app after they are granted access by their bank or wealth manager. The client app account must be linked with a banking account to provide information about investments presented in the app. The integration is done during the implementation project for a bank/wealth management company.

When the application is integrated with the banking system, the data from the bank/wealth manager are send to the cloud (web interface of the app or the external system aggregating banking data) and distributed to end-clients. The client can add data (i.e. documents) directly from the app to be stored in the cloud.

Private clients must receive a temporary login to use the app. To get the login, please contact finance@comarch.com

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.