ARE YOU PREPARING FOR ONE OF THE MOST IMPORTANT EXAMS IN YOUR CAREER

CPP Certified Payroll Professional Exam prep 2017

What is it about?

ARE YOU PREPARING FOR ONE OF THE MOST IMPORTANT EXAMS IN YOUR CAREER?

CPP Certified Payroll Professional Exam prep 2017 is FREE but there are more add-ons

-

$6.99

Buy Full Version

App Screenshots

App Store Description

ARE YOU PREPARING FOR ONE OF THE MOST IMPORTANT EXAMS IN YOUR CAREER?

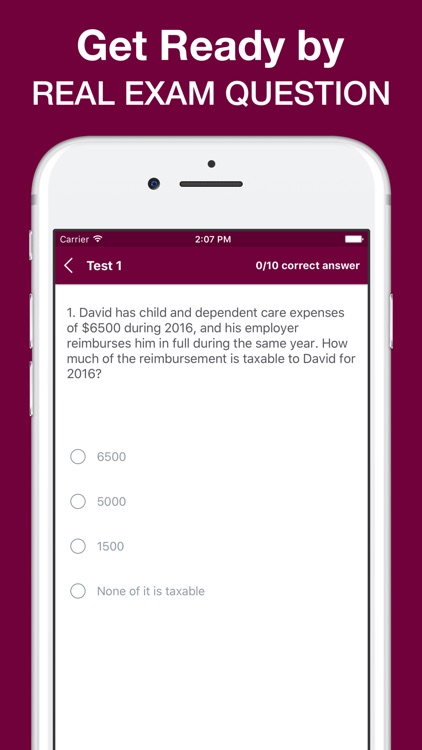

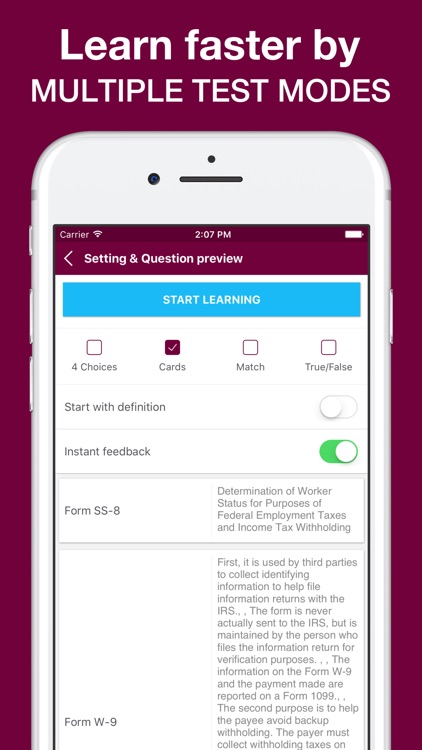

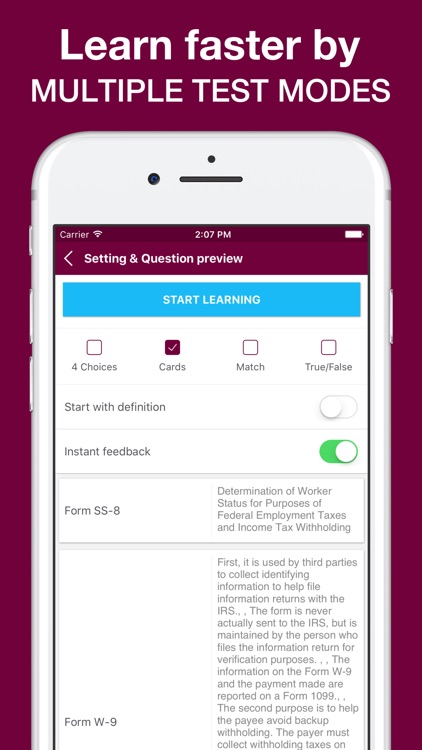

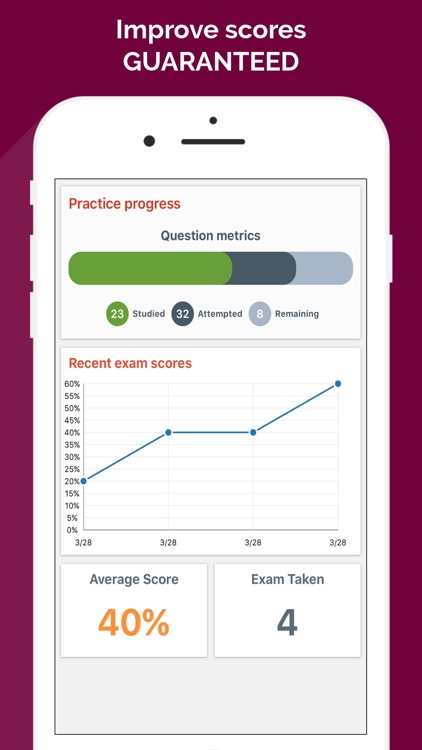

This Premium Exam Prep App will help you master the learning materials QUICKLY by many scientifically proven methods: Multiple Choice, True/False questions, Matching Game and Flash Cards ANY TIME, ANYWHERE without the Internet connection. The app content is contributed by experts, teachers, and other candidates who share the same concerns as you.

Get the FREE app now to start your preparation immediately with hundred of FREE Practice Questions and Flash Cards. In addition, five free EXAM BUILDER give you the REAL exam environment by allowing you to configure exam time, the number of questions and customized content.

When you upgrade to the full version, just ONE-TIME payment to unlock everything and forever: PRACTICE TEST, FLASH CARDS and EXAM BUILDER & SIMULATOR. Besides, you will get our LIFE-TIME support and future updates. If you don't like the app, you will have 30 days money back guaranteed. It means NO RISK!

The app content is refined and updated constantly by our experts, based on the customers' feedback. As a result, you always get the latest exam content that helps you feel confident when the exam comes.

The Certification Board of the APA requires that payroll professionals fulfill ONE of the following criterias before they take the Certified Payroll Professional Examination.Only the courses listed below, delivered exclusively by APA, are eligible to fulfill the education options listed in Criteria 2 and Criteria 3. Courses outside of this list will not fulfill the requirements of Criteria 2 and Criteria 3.

CRITERIA 1: The payroll professional has been practicing a total of three (3) years out of the five (5) years preceding the date of the examination. The practice of payroll is defined as direct or related involvement in at least one of the following:

Payroll Production, Payroll Reporting, Payroll Accounting, Payroll Systems and Payroll Taxation

Payroll Administration

Payroll Education/Consulting

CRITERIA 2: Before a candidate takes the examination, the payroll professional has been employed in the practice of payroll as defined in Criteria 1 for at least the last 24 months, and has completed within the last 24 months, ALL of the following courses within ONE of the following three options offered by the APA:

Option 1

Payroll Practice Essentials and

Intermediate Payroll Concepts and

Advanced Payroll Concepts and

Strategic Payroll Practices

Option 2

Payroll 101: Foundations of Payroll Certificate Program and

Payroll 201: The Payroll Administration Certificate Program

Option 3

Certified Payroll Professional Boot Camp

*Note: This comprehensive 20-session virtual course is delivered exclusively by APA

CRITERIA 3: Before a candidate takes the examination, the payroll professional has been employed in the practice of payroll as defined in Criteria 1, for at least the last 18 months, has obtained the FPC and has completed within the last 18 months, ALL of the following courses within ONE of the following three options offered by the APA:

Option 1

Intermediate Payroll Concepts and

Advanced Payroll Concepts and

Strategic Payroll Practices

Option 2

Payroll 201: The Payroll Administration Certificate Program

Option 3

Certified Payroll Professional Boot Camp

*Note: This comprehensive 20-session virtual course is delivered exclusively by APA

Enjoy the app and pass your Certified Payroll Professional, Payroll Systems, Payroll Taxation, Payroll Administration exam effortlessly!

Disclaimer:

All organizational and test names are trademarks of their respective owners. This application is an educational tool for self-study and exam preparation. It's not affiliated with or endorsed by any testing organization, certificate, test name or trademark.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.