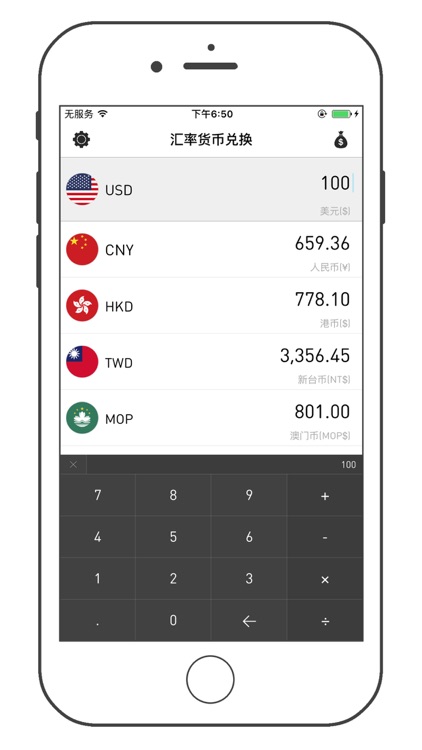

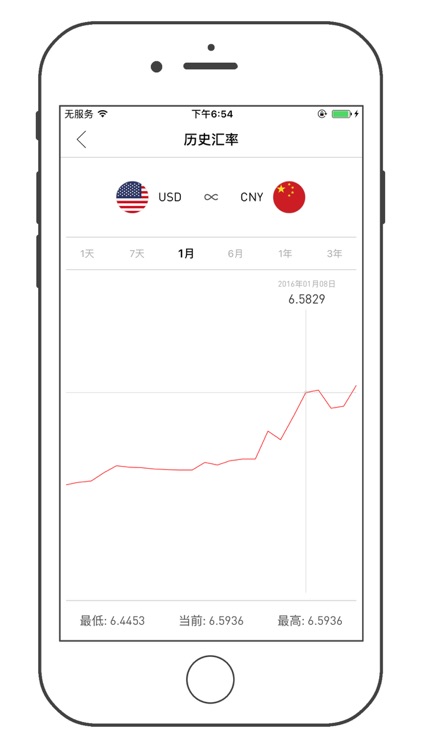

Exchange Rate Currency, Travel Essentials APP

Currency Calculator - Exchange Rate

What is it about?

Exchange Rate Currency, Travel Essentials APP.

App Details

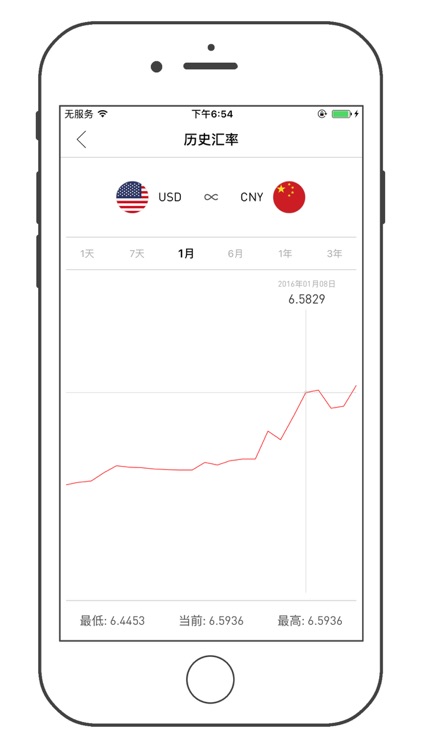

App Screenshots

App Store Description

Exchange Rate Currency, Travel Essentials APP.

Currency

English:

1. Exchange rate.

2. Rate of exchange

Exchange rate (also known as foreign exchange rates, foreign exchange rates or foreign exchange market price) between the two currencies on the exchange ratio, can be regarded as the value of a country's currency against another currency. Exchange rate is the respective countries in order to achieve their political aims financial instruments. Exchange rate because of interest rates, inflation, political and economic state of each country changes and other reasons. The exchange rate is determined by the foreign exchange market. Forex market is open to different types of buyers and sellers to conduct extensive and continuous currency trading (forex trading 24 hours a day except on weekends, namely Sundays from 8:15 GMT to 22:00 GMT time Friday. Spot exchange rate refers to the current exchange rates, and forward exchange rate refers to the date of offer and transactions, but paid on a specified future date exchange rate

For example, a value of 100 yuan of goods, if the RMB against the US dollar exchange rate of 0.1502 (indirect quotation), then this product in the United States, the price is $ 15.02. If the RMB against the US dollar dropped to 0.1429, that is the dollar, devaluation, with fewer dollars to buy this product, this product in the United States, the price is $ 14.29. So this product in the US market price becomes lower. Lower commodity prices, competitiveness becomes high, sell low. Conversely, if the RMB against the US dollar rose to 0.1667, that is the dollar, the RMB appreciation, then this product in the US market price is $ 16.67, the price of this product become more expensive dollar, buy less.

Briefly, is a unit of one currency to another currency equivalent convertible

The reason why the national currencies can be compared, parity relationship can be formed between them, the original

exchange rate

Because that they all represent a certain amount of value, which is the basis for determining the exchange rate. Under the gold standard, gold-based currency. The two countries to implement the gold standard monetary unit can be determined parity between them according to their respective gold number, namely the exchange rate. As in applying gold standard system, the United Kingdom require one pound of weight is 123.27447 grains, fineness of 22K gold, that gold 113.0016 grains of pure gold; US $ 1 a predetermined weight of 25.8 grains, fineness of nine hundred thousandths that gold 23.22 grains of gold. According to the comparison of the two currencies gold, £ 1 = $ 4.8665, the exchange rate fluctuated basis. Under the bill system, countries issue banknotes as representatives of metal currency, and with reference to past practice, in order to decree gold bill, known as the Golden parity, compared to gold parity is to determine the basis of bilateral exchange rates. But the bill is not convertible into gold, so gold legal bills often useless. Therefore, in countries with the official exchange rate by the national monetary authorities (Ministry of Finance, the central bank or foreign exchange authorities) provides exchange rate, all foreign exchange transactions must be carried out in accordance with the exchange rate. In countries with market rates, exchange rates with changes in supply and demand on the foreign exchange market, the currency change. Exchange rate has an impact on the balance of payments, income and so on.

import and export

Generally, the currency exchange rate lower, ie the ratio of foreign currency depreciate, can help promote exports and discourage imports of effect; if the currency exchange rate, ie the ratio of foreign currency to rise, it will help import, it is not conducive to exports.

Commodity price

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.