iParaV Depreciation Calculator provides various depreciation methods to calculate your asset's depreciation schedule:

Depreciation_Calculator

What is it about?

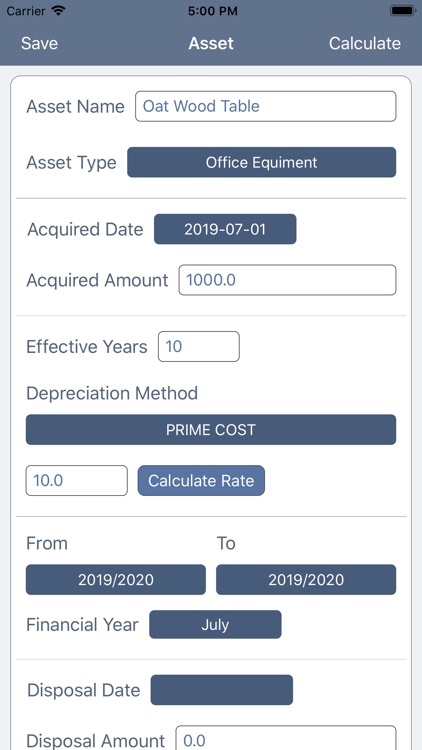

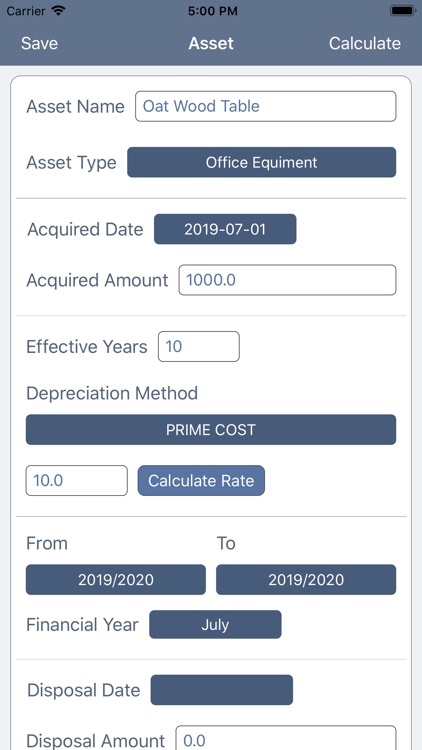

iParaV Depreciation Calculator provides various depreciation methods to calculate your asset's depreciation schedule:

App Screenshots

App Store Description

iParaV Depreciation Calculator provides various depreciation methods to calculate your asset's depreciation schedule:

- Prime Cost

- Diminishing Value

(using Declining Balance and Double Declining Balance based on asset acquired date)

- Declining Balance

- Double Declining Balance

- AU Simplified Rule (used in Australia - 15% for 1st yr, 30% for the rest)

We also generate the result for a range of years and based on a changeable starting month of your financial year.

You can store and organize your assets with categories.

In-app purchase features:

- Allow storing more assets.

- Option to remove the advertisement.

Generating and emailing the annual depreciation report.

Also, export as a CSV file.

We don't collect any data of your input.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.