U

Express4868

What is it about?

U.S. individuals must file their income tax return 1040 with the IRS this year by May 17.

App Screenshots

App Store Description

U.S. individuals must file their income tax return 1040 with the IRS this year by May 17.

Individuals that need more time to file their income tax returns can apply for an extension using Form 4868. Form 4868 provides an automatic 6-month extension of time to file the 1040 income tax return with the IRS.

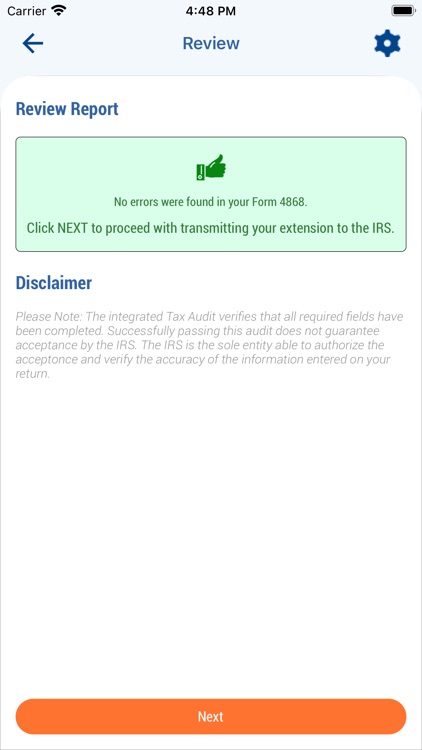

The IRS suggests individuals e-file their extension Form 4868 for both faster processing and instant approval. In addition, ExpressExtension offers an Express Guarantee this tax season, meaning any user who files a Form 4868 and receives an IRS rejection stating duplicate filing will get a full refund. However, if form 4868 gets rejected for any other reason, users have the option to correct and resubmit at no additional cost.

Get started with ExpressExtension, an IRS-authorized e-file provider for IRS tax extension forms, and e-file your Form 4868 for an automatic extension of time to file your personal income tax return.

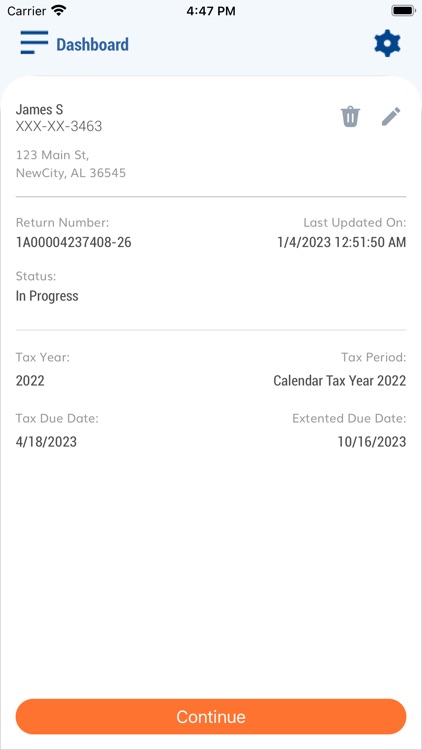

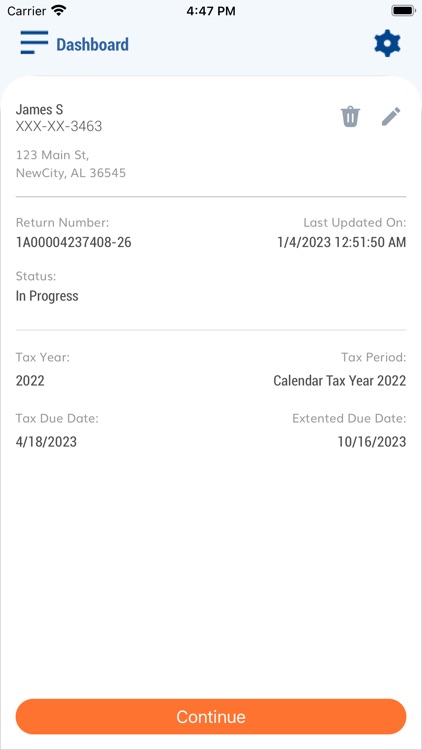

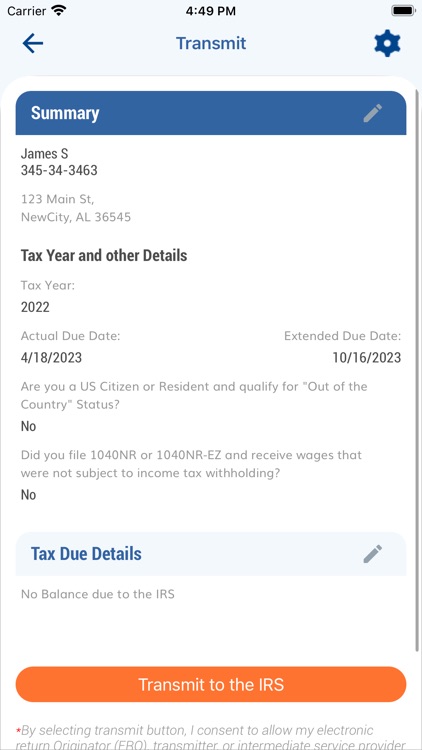

ExpressExtension provides a user-friendly, step-by-step filing process that helps you to file tax extension Form 4868 in minutes with the convenience of our mobile app.

> Simply download our app and log in to your ExpressExtension account.

> Select the extension type you would like to file. (Either individual or joint filing)

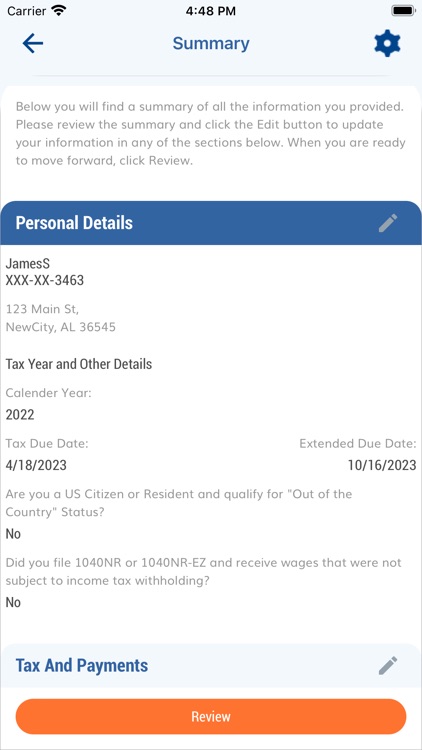

> Enter your Personal Details such as Name, SSN, and Address.

> Enter the estimate of total income tax payment and balance due, if any.

> You can choose to pay the balance due to the IRS using EFW, Check or Money Order.

> You can then review the Form summary and E-file it with the IRS.

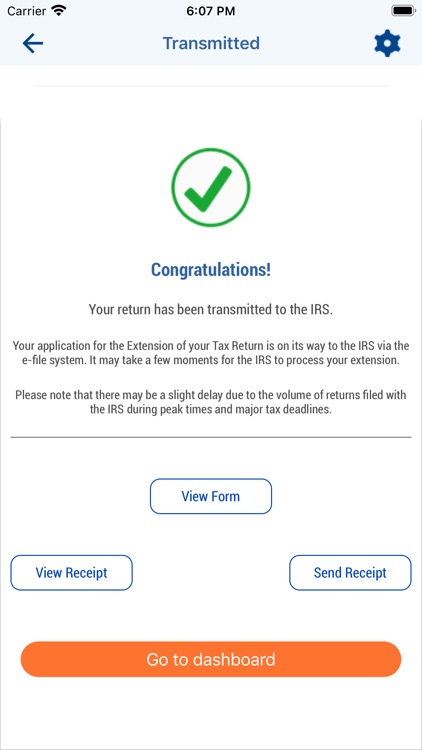

Once the IRS processes your extension, we will notify you of the filing status through email.

If the IRS rejects your extension, we will also provide you with both a reason for the rejection and the option to correct and retransmit the extension to the IRS at no additional cost.

If you have any questions about filing Tax Extensions with the IRS, you can contact the Express Tax Support Center in Rock Hill, SC at (803) 514-5155 or email support@expressextension.com.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.