Imagine an app that consolidates all your financial assets, organizes them, and helps you make smart financial decisions

FamilyBiz - כסף ביטוח פנסיה

What is it about?

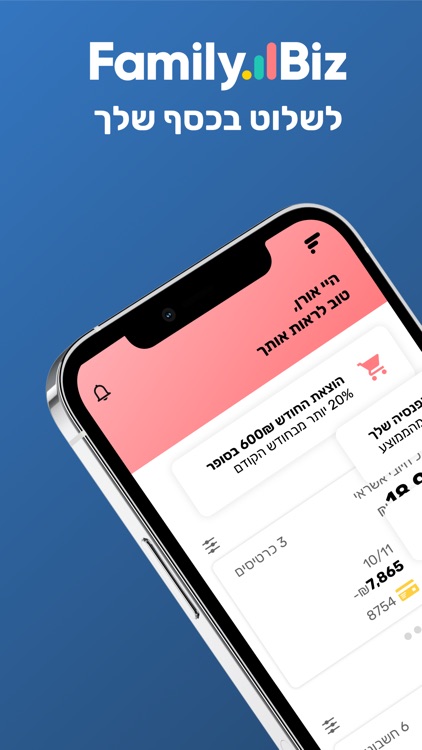

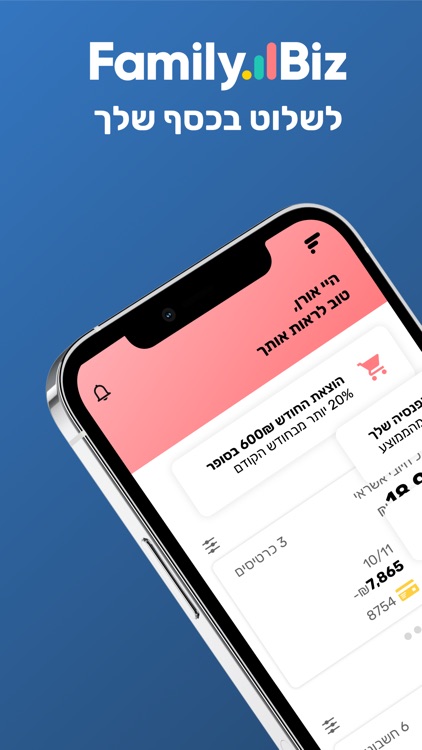

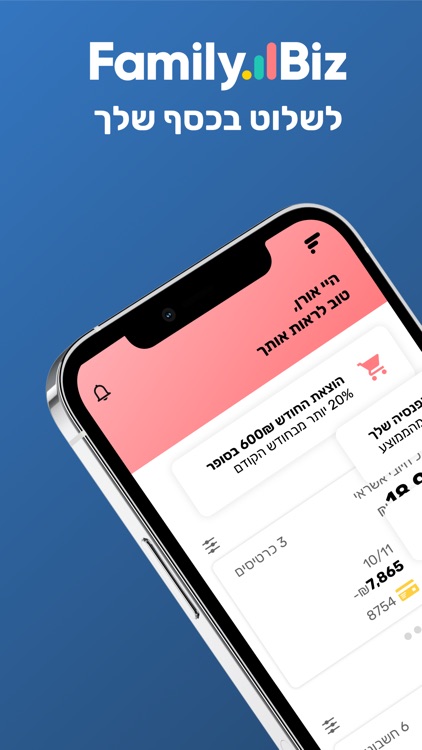

Imagine an app that consolidates all your financial assets, organizes them, and helps you make smart financial decisions. FamilyBiz, a company supervised by the Israeli Securities Authority, offers a comprehensive solution to track your expenses, insurances, funds, and pensions, managing everything in one convenient place.

App Screenshots

App Store Description

Imagine an app that consolidates all your financial assets, organizes them, and helps you make smart financial decisions. FamilyBiz, a company supervised by the Israeli Securities Authority, offers a comprehensive solution to track your expenses, insurances, funds, and pensions, managing everything in one convenient place.

FamilyBiz analyzes your financial data to build a personalized notification system that sets monthly goals to save you money. It also presents opportunities and recommendations for optimal financial management, eliminating the need for in-depth knowledge, comparisons, or time-wasting efforts.

Key features:

• Banks: Collect, view, and monitor all bank accounts from different banks, including charge and transaction details.

• Credit Cards: Collect, view, and monitor all credit cards, including charge and transaction details.

• Insurances: Collect, view, and compare conditions and prices of different insurance products.

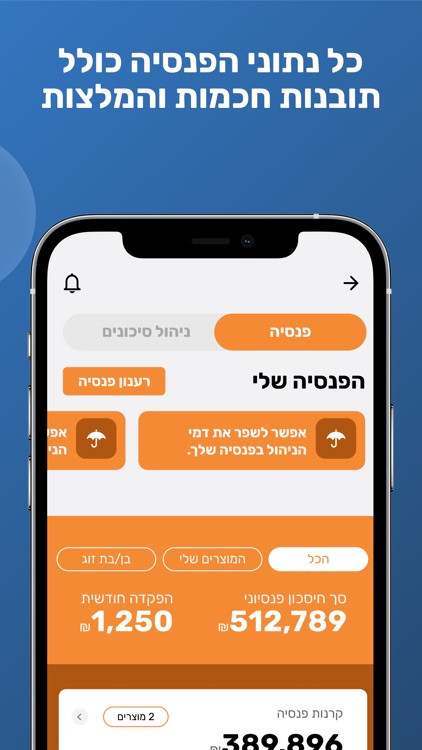

• Pension Products: Collect, view, and compare terms and fees of pension funds and related products (under the Premium Plan).

• Budgeting: Manage expenditure and income targets and monitor current financial conduct.

• Family Management: Invite a spouse for joint management in the application.

• Net Worth Calculation: Understand your current worth based on all assets and liabilities.

• Future Prediction: The application predicts future financial movements based on your usage habits.

• Educational Content: Access tutorials and information for ongoing financial management.

Cash-Flow Management:

• Information Collection: Automatically gather expenses and income data from various sources multiple times a day.

• Goal Setting: Build a financial flow based on historical data, with the ability to update goals at any time.

• Categorization: Customize and categorize financial movements, with the option to save classifications for future transactions.

• Custom Categories: Add personal categories to the application's basic list (under the Premium Plan)

• Flexible Budget Start Date: Change the start date of financial flow from the 1st of the month to any other day (under the Premium Plan)

Information Security and Privacy:

• SSL Encryption

• Security Standards: Compliance with ISO27001 and ISO27018 information security standards

• Protected by a personal password, two-step verification, and biometric options if available

• Regulatory Supervision: Supervised by the Israeli Securities Authority under the Financial Information Service Law

• Public Trust: Collaboration with the 'Emun- Civic Trust' organization to ensure fairness and privacy protection

• Penetration Tests: Periodic tests to simulate and defend against hackers

• Insurance Coverage: by an Israeli company and an English reinsurer

Subscription Options:

FamilyBiz operates on a Freemium model. Most features are available at a free basic subscription, and advanced features are accessible via a premium subscription. It's recommended to try the basic subscription first, which might suffice for your needs.

Basic Subscription Includes:

• Bank accounts and data

• Credit cards data

• Insurance data

• Basic cash-flow management

• Net worth

• Basic insights

• Family management

Premium Subscription Includes:

• All features of the basic subscription

• Pension information

• Advanced cash-flow management

• Custom categories

• Future transactions prediction

• Flexible start date for budgeting

• More frequent data refresh

• Advanced insights

• Customizable screen view

FamilyBiz supports Bank Leumi, Bank Hapoalim, Discount Bank, Mizrahi Tefahot Bank, FIBI Bank, Massad Bank, Otsar Ha'il Bank, Pagi Bank, Bank of Jerusalem, Isracard, Cal, Max, American Express.

In addition, the application gathers your insurance, and pension funds from various financial institutions.

Have additional assets or liabilities? Add them manually.

Our terms of use: https://www.familybiz.co.il/legal/terms

The support center is always at your service: https://help.familybiz.co.il/he

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.