Do you want to do an analysis of excellent businesses to see their growth potential

GIM Calculator

What is it about?

Do you want to do an analysis of excellent businesses to see their growth potential? After you decided that they are excellent businesses, do you want to do a valuation to estimate the share price at which you should buy the business in the stock market? Then you should download the Growth Investing Mastery Calculator!

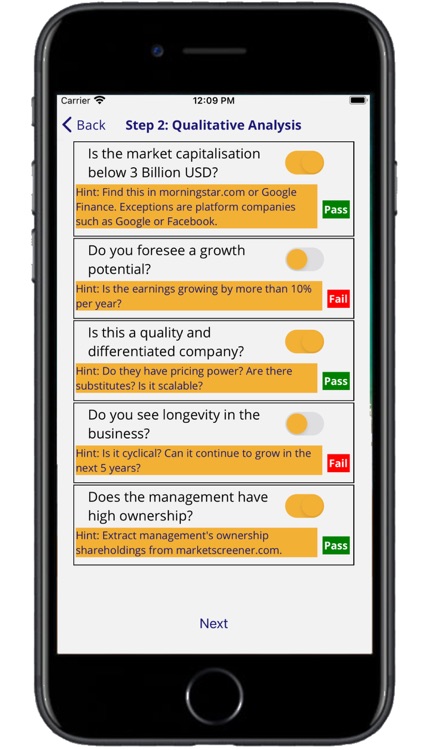

App Screenshots

App Store Description

Do you want to do an analysis of excellent businesses to see their growth potential? After you decided that they are excellent businesses, do you want to do a valuation to estimate the share price at which you should buy the business in the stock market? Then you should download the Growth Investing Mastery Calculator!

Using the calculator, you can invest with confidence. The calculator will take you through the steps required to choose excellent businesses and perform a valuation on them, one at a time.

First, you have to provide the name of the company you are analysing.

Next, you have to state what does the business do. Quoting Peter Lynch, if you can't describe the business, then you probably shouldn't invest in it.

Thirdly, you need to check the fundamentals of the company. Meaning, you need to check it's operating income, otherwise known as earnings before interest and taxes, for the past 3 years. Using these values, the calculator will automatically show the company's EBIT compounded annual growth rate and it's other ratios. These will ensure that you have picked a growth company.

Fourth, you need to assess its qualitative aspects, such as its potential to scale based on the Total Addressable Market, whether the company has differentiated products and is the market cap already large.

Fifth, you then proceed to the next step only if this company passes the criteria with at least a score of 7.5, else do not proceed!

Sixth, you can then do a valuation on the company based on its net operating income growth rate, and its Enterprise Value to its Earnings before Interest and Taxes (same as operating income).

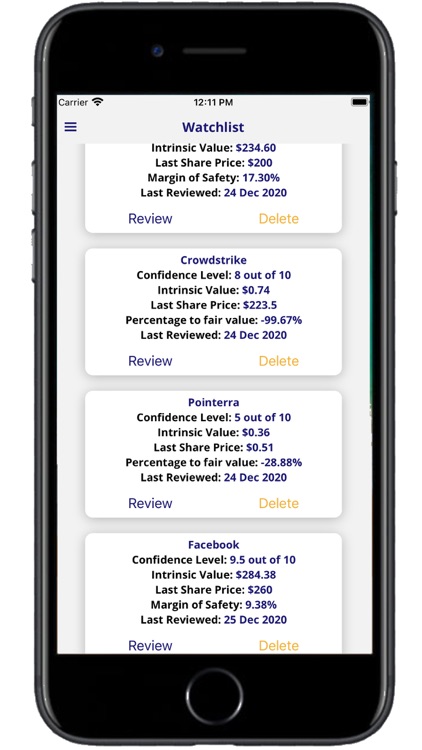

Seven, if it is undervalued, buy the company immediately! If not, save the company in a watchlist!

After these seven steps, you will be able to see and review the companies in the watchlist!

Your watchlist will also remind you to review the company every quarter, especially when there are quarterly earnings announcements. At a quick glance, you can also see which companies are undervalued!

If you want to find out more about the GIM course, click on this link now! http://bit.ly/growmyportfolio

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.