Gross-Net will calculate for you other components of remuneration for workers in Poland, based on the given gross or net amount

Gross-Net

What is it about?

Gross-Net will calculate for you other components of remuneration for workers in Poland, based on the given gross or net amount. The amount may be given in the form of a mathematical formula (e.g. 3000+(2*250)+150).

App Screenshots

App Store Description

Gross-Net will calculate for you other components of remuneration for workers in Poland, based on the given gross or net amount. The amount may be given in the form of a mathematical formula (e.g. 3000+(2*250)+150).

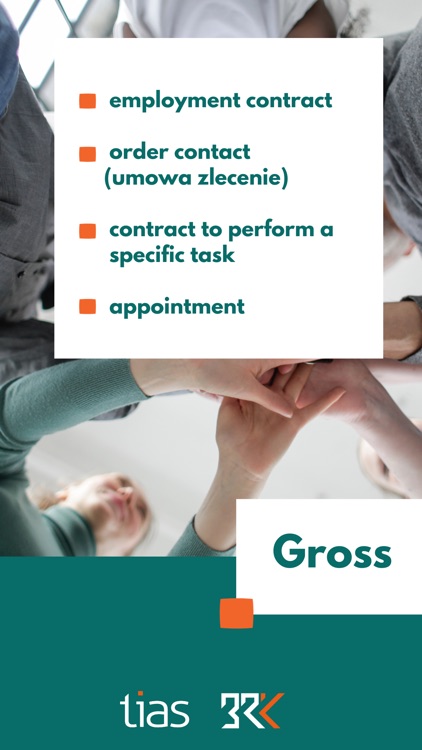

The following bases for work performance are available:

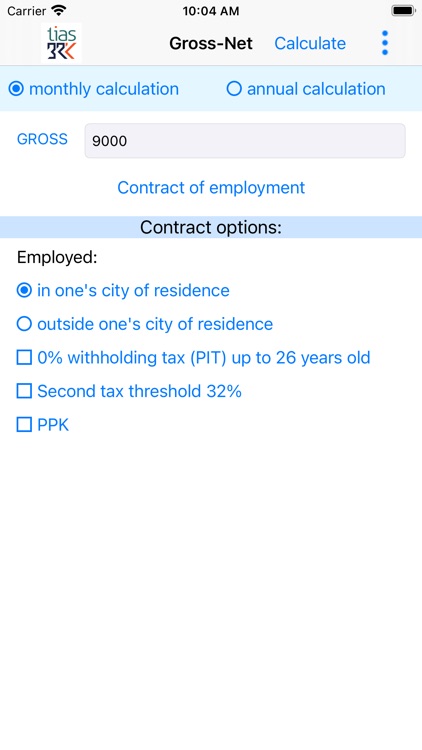

* contract of employment

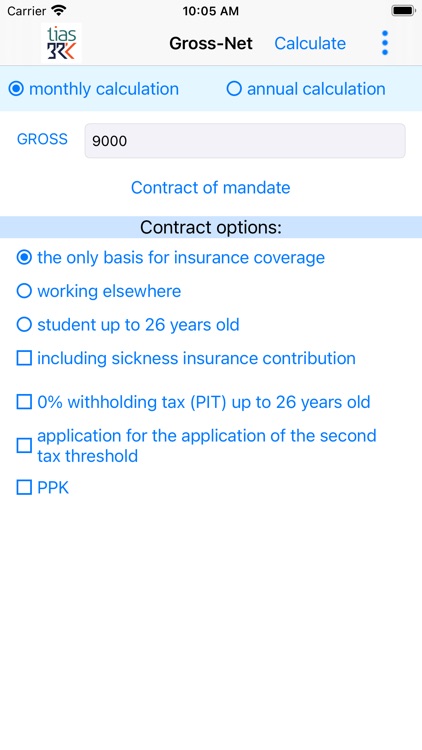

* contract of mandate

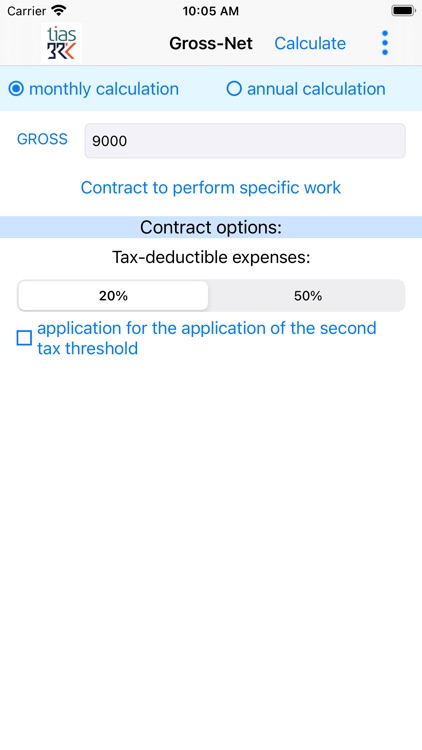

* contract to perform specific work

* appointment

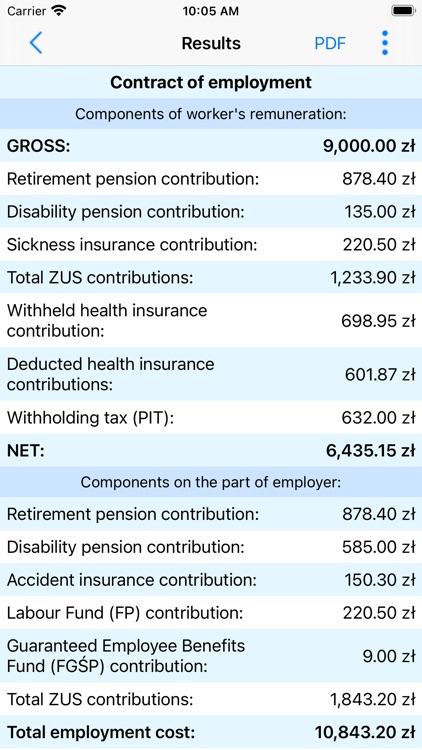

The following components of worker's remuneration are calculated:

* gross remuneration

* net remuneration,

* total ZUS (social security) contributions,

* retirement pension contribution,

* disability pension contribution,

* sickness insurance contribution,

* withheld health insurance contribution,

* deducted health insurance contribution,

* withholding tax (PIT).

The following remuneration components on employer's side are also calculated:

* total ZUS contributions,

* retirement pension contribution,

* disability pension contribution,

* accident insurance contribution,

* Labour Fund (FP) contribution,

* Guaranteed Employee Benefits Fund (FGŚP) contribution,

* total cost of employment.

The amount of accident insurance contribution, on employer's side, is set at a default value of 1,67%. This value can be modified.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.