Halkbank mBanking aplikacija Vam omogućava da preko mobilnog telefona upravljajte svojim finansijama, u svakom trenutku i na svakom mestu

Halkbank mBanking

What is it about?

Halkbank mBanking aplikacija Vam omogućava da preko mobilnog telefona upravljajte svojim finansijama, u svakom trenutku i na svakom mestu.

App Screenshots

App Store Description

Halkbank mBanking aplikacija Vam omogućava da preko mobilnog telefona upravljajte svojim finansijama, u svakom trenutku i na svakom mestu.

MOGUĆNOSTI

Na brz, jednostavan i potpuno siguran način, možete da:

- Dobijete uvid u stanje i promet po tekućim dinarskim i deviznim računima

- Izvršite plaćanje svih vrsta računa i platnih naloga

- Izvršite interni prenos sredstava

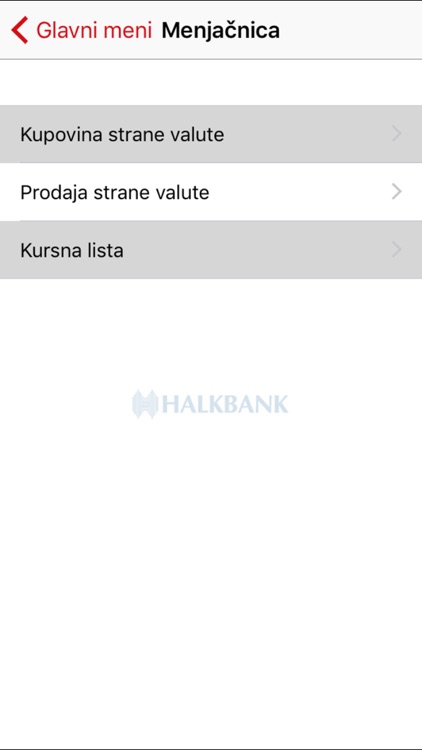

- Dobijete uvid u kursnu listu

- Obavite menjačke poslove

- Dobijete uvid u stanje i promet po platnim karticama

AKTIVIRANJE USLUGE

Da biste aktivirali Halkbank mBanking, potrebno je da dođete u najbližu filijalu Halkbank i da podnesete Zahtev za korišćenje aplikacije. Link za preuzimanje Halkbank aplikacije biće Vam poslat u SMS poruci na mobilni telefon, a aktivacioni kod na Vašu e-mail adresu. Nakon aktivacije kreirate PIN kod za pristup aplikaciji, čime je aplikacija spremna za korišćenje. Naplata naknada i provizija za održavanje i korišćenje mBanking usluge se vrši u skladu sa dokumentom Tarifa naknada, koji je dostupan na zvaničnoj internet prezentaciji Halkbank.

SIGURNOST

Nakon instalacije aplikacije, neophodno je izvršiti aktivaciju naloga unosom aktivacionog koda koji je poslat na Vašu eMail adresu. Tokom aktivacije Vaš uređaj se registruje u Banci, čime je omogućeno da se Vašem nalogu pristupa isključivo sa tog uređaja.

Nakon unosa aktivacionog koda, potrebno je da odaberete i unesete PIN kod koji ćete koristiti za buduća prijavljivanja na aplikaciju.

Ovim se uvodi dvostruka potvrda identifikacije klijenta, jer je pristup omogućen samo sa Vašeg uređaja i neophodan je unos PIN koda pri otvaranju aplikacije.

Vaši lični podaci, podaci o računima kao i PIN kod se ne čuvaju na uređaju, a sav saobraćaj između uređaja i banke je kriptovan, čime se garantuje tajnost podataka.

Ukoliko je tri puta unet pogrešan PIN kod, Halkbank mBanking aplikacija se automatski blokira i za nastavak korišćenja je potrebno da se obratite Banci.

Halkbank mBanking is a service of Halkbank that enables you to manage your finances via your mobile device, any time and anywhere.

CAPABILITIES

In a fast, simple and fully safe manner, you can:

- Have an insight into balance and turnover of your current accounts in domestic and foreign currencies

- Make all types of payments and payment orders

- Make internal fund transfers

- Have an insight into exchange rate list

- Conduct currency exchange operations

- Have and insight into payment cards balance and turnover

SERVICE ACTIVATION

To activate Halkbank mBanking, please visit the nearest branch of Halkbank and submit a request for this application. You will receive an SMS with the link for downloading the Halkbank application, while the activation code will be sent to your e-mail address. After you activate the application, you will create a PIN code to access the application, which will then be ready for use. Collection of fees and commissions for maintenance and use of mBanking is carried out in accordance with the document Tariff of Fees, which is available on the official website of Halkbank.

SAFETY

Upon the application installation, you should activate the account by entering an activation code which is sent to your e-mail address. During the activation your device will be registered in the Bank, which will enable the access to your account only with that device.

After the activation code is entered, you should select and enter the PIN code that you will use for logging in the application.

In this way, a two stage client identification is enforced, because the access is enabled only from your mobile device and you must enter the PIN code to start the application.

Your personal data, account information and the PIN code are not stored on the device, and all communication between your device and the bank is encrypted, thus guaranteeing secrecy of data.

If you enter a wrong PIN code three times, Halkbank mBanking application will automatically block and you will have to contact the Bank for further usage.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.