Hundred Times Company is an online investment platform allowing you to invest in Mutual Fund with ease

HundredTimes

What is it about?

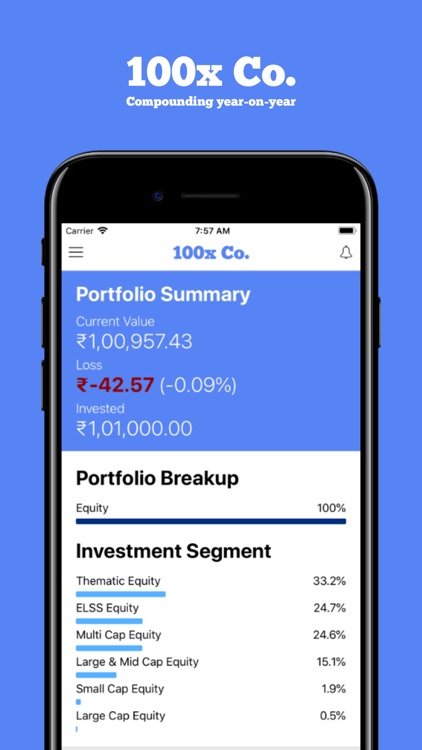

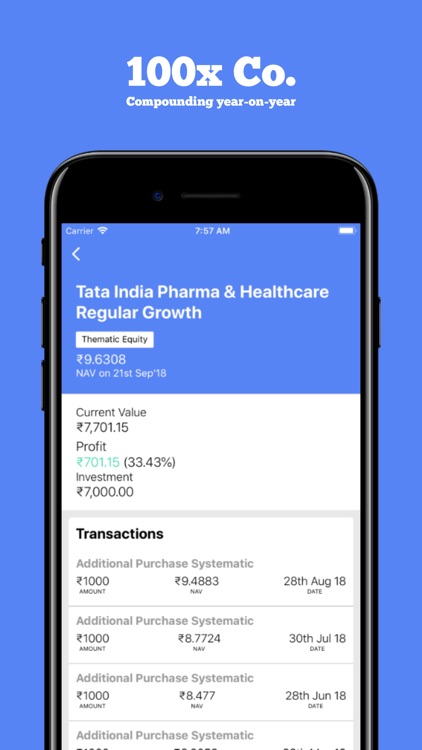

Hundred Times Company is an online investment platform allowing you to invest in Mutual Fund with ease.

App Store Description

Hundred Times Company is an online investment platform allowing you to invest in Mutual Fund with ease.

We offer:

Zero Charges – No advisory or transaction fee, no maintenance fee, no hidden charges for the lifetime.

Unbiased Investing - Funds are listed basis the performance.

Convenience – Buy Lumpsum or Systematic Investment Plan (SIP)/ Redeem at a click.

Flexible – The sooner you invest, the longer it has time to compound. Start with us with as low as Rs 500 pm.

Tax Efficient – We offer tax saving mutual funds to take tax advantage of upto Rs. 45000 under section 80C.

Security - Accredited to SSL certificate with 256 bit encryption.

How it works:

1. Create your free Investing account – Fill one time KYC details, we will drop and pick the forms if required.

2. Risk Profiling and Goal Analysis – Answer few simple questions to help us design a portfolio based on your goals, horizons and risk appetite*.

3. Track your Portfolio anywhere anytime realtime.

*You can skip this and choose your own funds

Why us?

Every investor is different and every investment is made with a different goal. We understand your goal, your risk appetite and thereafter select a fund from the best in the industry.

Our choice of funds is basis:

1. Fund House – We have selected fund houses which have a strong presence in the financial market and provides fund that have a reasonably long and consistent track record.

2. Fund Manager – A fund manager is the ultimate decision maker. Therefore understanding who is the fund manager and his past track record is important.

3. Asset Under Management – We select funds which has a decent size. Less AUM is risky as a big redemption can create sell panic. A less AUM scheme will comparatively have a higher expense ratio.

4. Performance Ranking – We select a fund only after rigorous review fundamentally as well as technically. We use ratings from CRISIL, value research and money control.

Privacy Policy : https://hundredtimes.co/privacy

Terms : https://hundredtimes.co/terms

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.