There are two things only money can buy—

I Want to be a Millionaire

What is it about?

There are two things only money can buy—

App Screenshots

App Store Description

There are two things only money can buy—

Freedom and Options.

Becoming a Millionaire is easier than most people think—

and can be accomplished by following elementary math calculations.

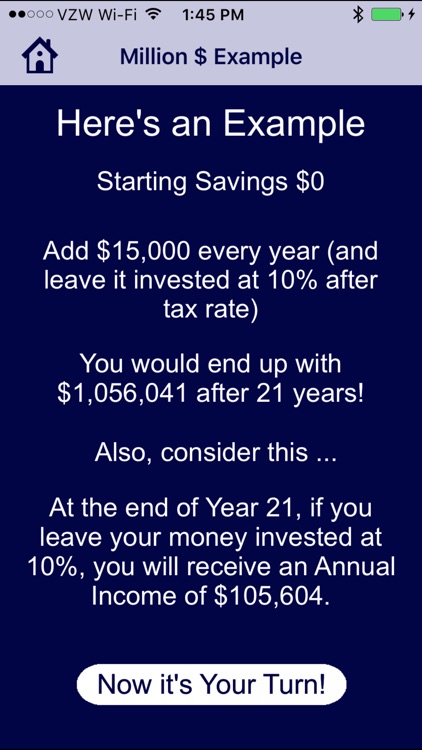

1. If you invest $15,000 to start (you can split this cost with your significant other)

2. Earn 10% (after-tax) on your investment

3. Leave it invested at 10%

4. Add another $15,000 every year at 10%

5. You will have $1,056,041 after 21 years.

And—

• If you never invest another dime, you can withdraw $105,604 in income each year, without touching your Money Tree.

• You will have invested a total of $315,000 over the years but will have achieved over $1 Million in assets.

• Or, if you decide to leave that $1,056,041 invested at 10%, and not add another cent, you will have over $2 Million at the end of an additional 7 years. $3 Million, 4 years after that.

If you are young, you have the most valuable investment tool of all on your side—TIME. Add the miracle of Compounding Interest, and you can be well on your way to a great financial future.

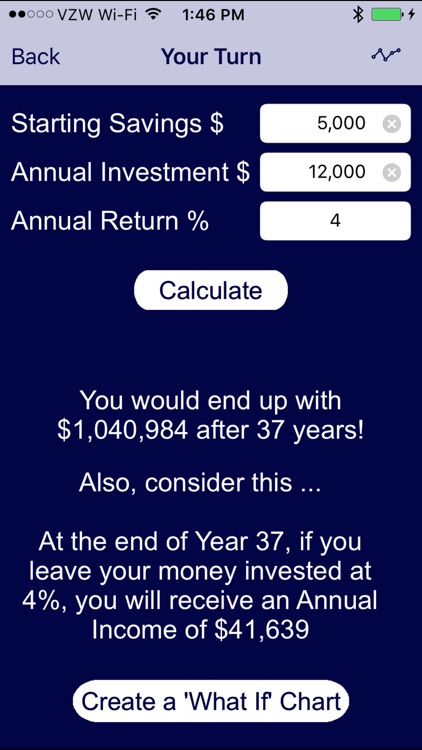

Don’t like the numbers used above?

This calculator lets you input your own savings/investment/% goals and then it shows you how many years until you can become a Millionaire—on your own terms.

It also offers a “What-If” section.

You can input your own assumptions “year by year” and get results “year by year” for up to 40 years—and then email your results.

Want to achieve your financial and lifestyle goals? Start with the calculator. Then, educate yourself about investing or seek out an experienced, licensed, and ethical financial planner.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.