Use the iDrive Mileage app and find out How much mileage expense can you deduct at tax time

iDrive Mileage

What is it about?

Use the iDrive Mileage app and find out How much mileage expense can you deduct at tax time.

App Screenshots

App Store Description

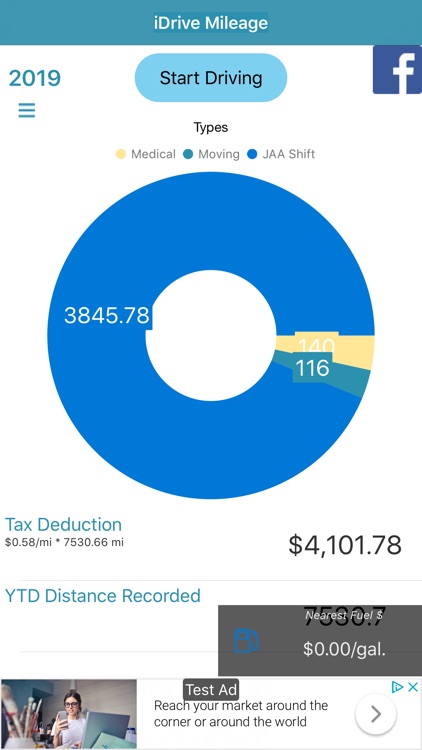

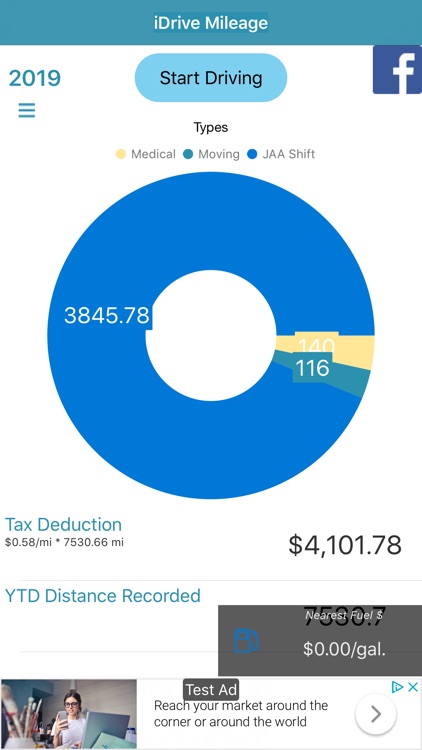

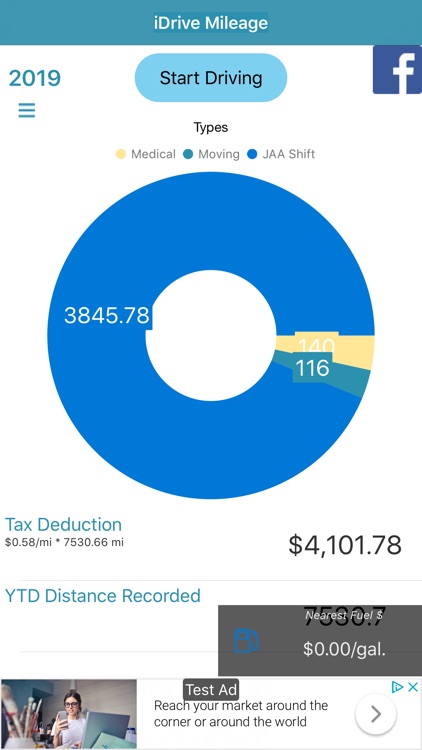

Use the iDrive Mileage app and find out How much mileage expense can you deduct at tax time.

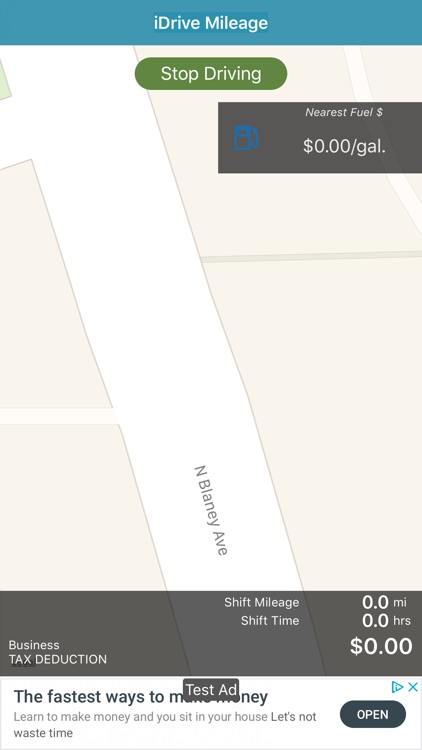

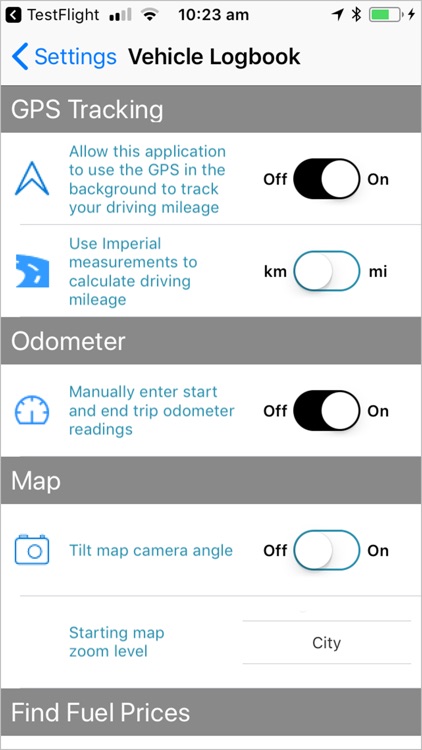

The app tracks mileage automatically using your phone’s GPS. Or if you prefer manual tracking, just update your odometer readings for each trip.

It’s so easy to use!

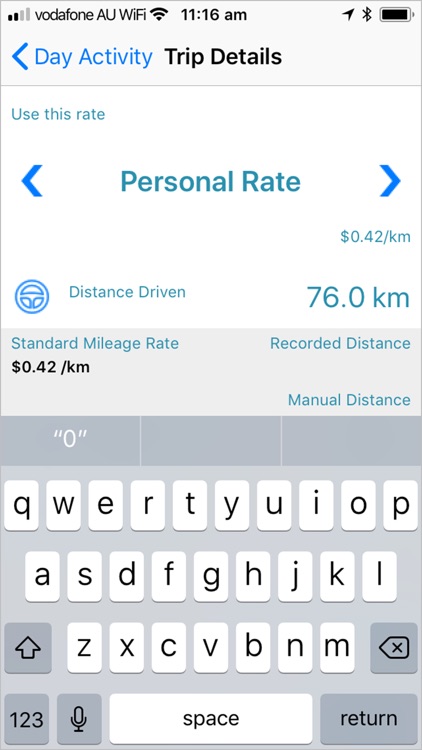

1. Simply select the Business, Charity, Moving, or a personally set standard tax rate as you start your trip and tap GO!

2. End your trip and iDrive Mileage creates a trip log for your tax records.

See the cost of each trip as you drive—helpful for routine business recordkeeping whether you’re self-employed or tracking mileage as an employee. Export the CSV log with each trip’s details for your records.

Oops. Need to correct a trip’s details? No problem. Add or edit individual trip records.

BONUS: Need fuel? Check the app’s Best Fuel Price list—recent local fuel prices posted by app users in your area. See a great price? Share it and let your community know where to find the deal.

Download it now and give it a go!

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.