iLoan Calc is a loan simulator application where you can setup your own details

iLoan Calc (Loan calculator)

What is it about?

iLoan Calc is a loan simulator application where you can setup your own details.

App Screenshots

App Store Description

iLoan Calc is a loan simulator application where you can setup your own details.

You can calculate not only your mortgage but also your car loan or other loans.

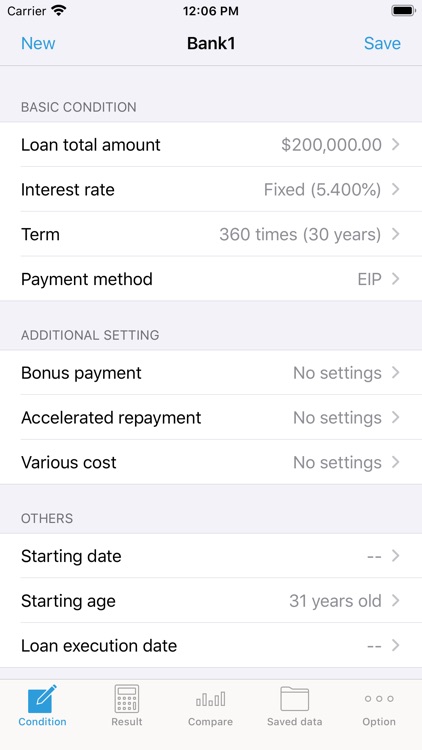

[Simple user interface]

It's very simple to use. You can see your loan to be setting up 4 basic entries: Total loan amount, Interest rate, Term and Payment method.

[Detail settings]

Detail can be added as needed. For example, bonus payment, accelerated repayment and so on.

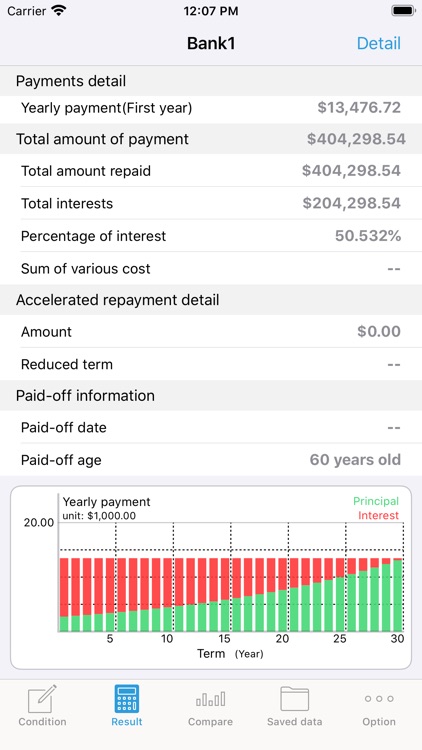

[Loan simulation]

iLoan Calc calculate your loan exactly. If both the repayment start date and the borrowing date are set, daily interest is calculated.

[Comparison]

You can compare between loans with different settings. Moreover, the comparison with/without accelerated repayment is also available. This allows you to check the effect of accelerated repayment easily.

[Main features]

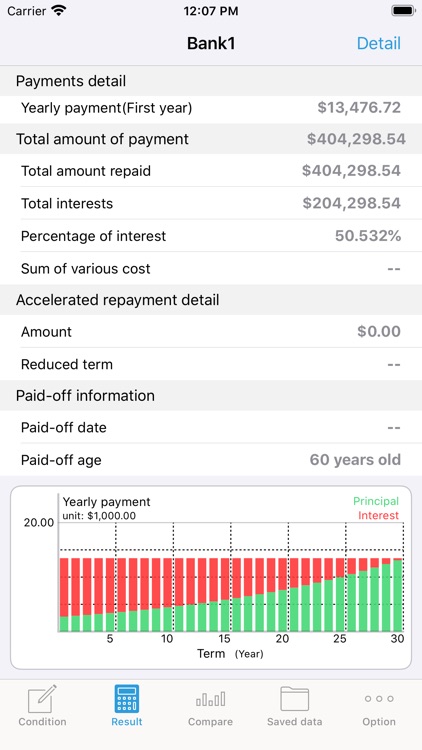

- Calculation of each amount:

- monthly payment

- bonus payment

- yearly payment

- total payment

- total interest

- percentage of interest allocation, etc.

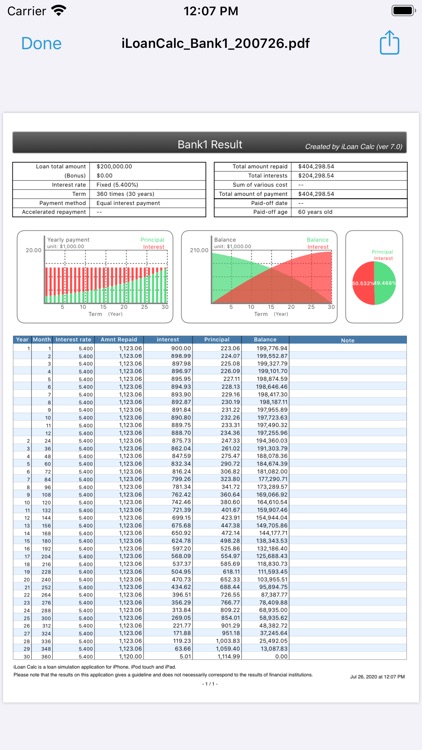

- Show the amortization schedule, export as a CSV file.

- Show graphs (historical graph, comparison graph)

- Comparison:

- compare with/without accelerated repayment

- comparison between data

- Save data

- Calculate the loan amount using a subsidiary calculation function:

- from desired repayment amount

- annual income

[Settable entries]

- Loan amount

- Interest rate and type (Fixed, Fixed multi-step, Variable)

- Loan term

- Payment method (Principal equal, Interest equal)

- Bonus payment

- Accelerated repayment (Reduce the total term, Reduce the monthly payment)

- Various cost (Fees, Taxes, Insurance etc)

- Starting date

- Starting age

- Borrowing date

[Notes about calculation]

- 5 year rule, 125% rule

Amount of monthly payment is revised once every 5 year when you setup variable interest rate (5 year rule). The maximum amount of payment after the adjustment is 1.25 times more than the original amount (125% rule).

- Accelerated repayment with reducing total term for the bonus payment

If you accelerate repayment by reducing the total term, the reduced term is every 6 months (if you select twice a year bonus payment) or 12 months (if you select once a year bonus payment).

* iLoan Calc is an application that allows you to calculate various amount of a loan.

Please note that the results on this application gives a guideline and does not necessarily correspond to the results of financial institutions.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.