Invest Mad Easy focuses on peer (competitor) analysis and relative valuation, allowing you to easily compare stocks and exchange traded funds (ETFs) against one another

Invest Mad Easy

What is it about?

Invest Mad Easy focuses on peer (competitor) analysis and relative valuation, allowing you to easily compare stocks and exchange traded funds (ETFs) against one another.

App Screenshots

App Store Description

Invest Mad Easy focuses on peer (competitor) analysis and relative valuation, allowing you to easily compare stocks and exchange traded funds (ETFs) against one another.

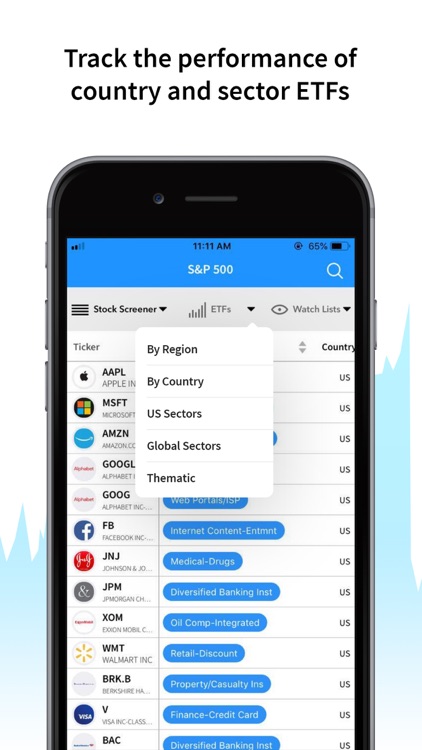

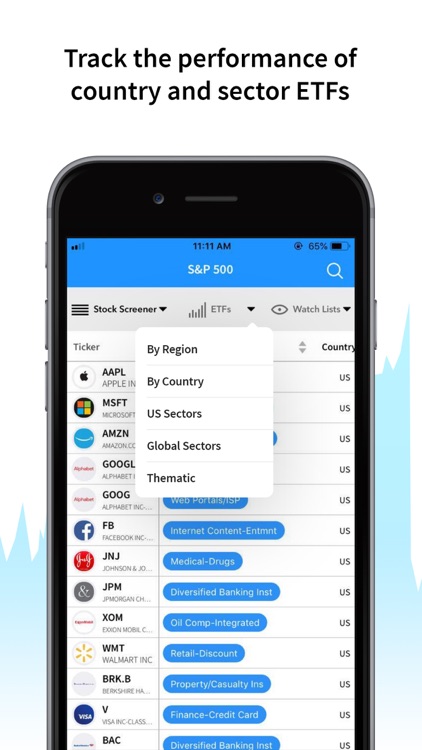

Users can sort stocks by their price-to-earnings ratios (PEs), dividend yields, one day price performance, year-to-date performance, etc. The same can be done for ETFs.

Stocks in each sector are already categorized together so you don’t have to search for a company’s competitors. We have already done that for you.

***Key features***

i. A simple sorting function allows you to select the best and worst performers as you search for the best investment opportunities in the S&P500 or across the ETF universe. Some investors will prefer to identify laggards on a 52-week basis while others will seek momentum plays by identifying the best performers over the past month.

ii. Key valuation metrics such as price-to-earnings (PEs) or price-to-book value can also be sorted from lowest to highest or highest to lowest, allowing for an easy comparison across companies or ETFs. Those investors that prefer to invest in companies or markets with relatively more attractive valuations will choose those stocks or ETFs with lower PE or price-to-book value figures.

iii. Key company metrics were hand-picked and summarized in one place for easy reference. Price-to-earnings (PEs), price-to-book values, dividend yields, return on assets (ROA), return on equity (ROE), and profit margin are provided in one snapshot.

iv. Watch lists can easily be created for those companies or ETFs that users wish to focus on. The key valuation and performance metrics are all there for easy comparison.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.