You are using an outdated browser. Please

upgrade your browser to improve your experience.

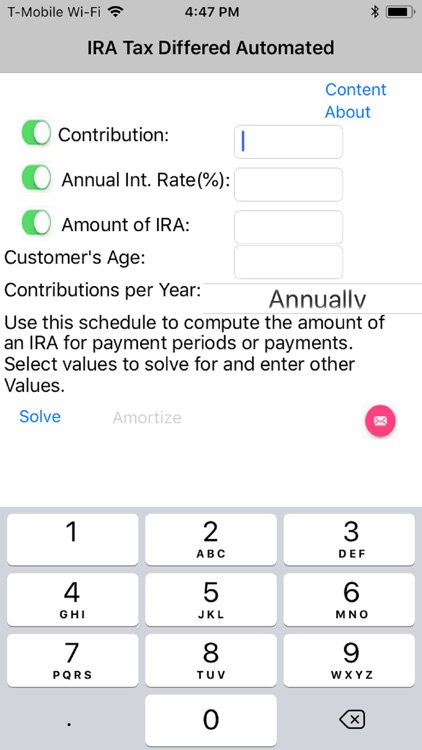

IRA Tax Differed computes the funds saved or invested in an IRA for payment periods or payment intervals for equal periodic payments

IRA Tax Differed Accumulation

by La Salle Software Group Inc.

What is it about?

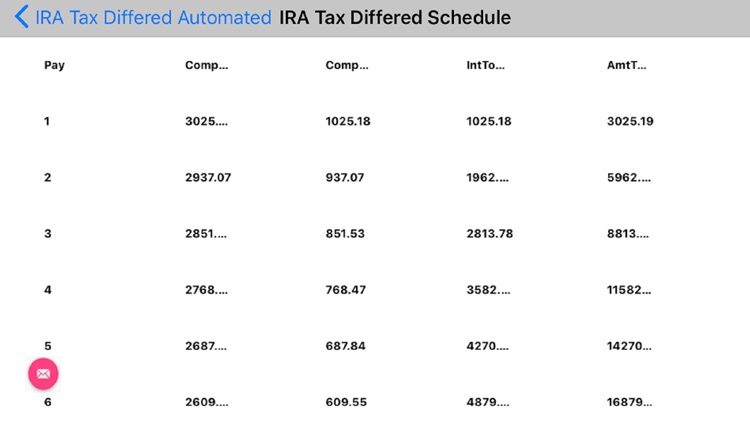

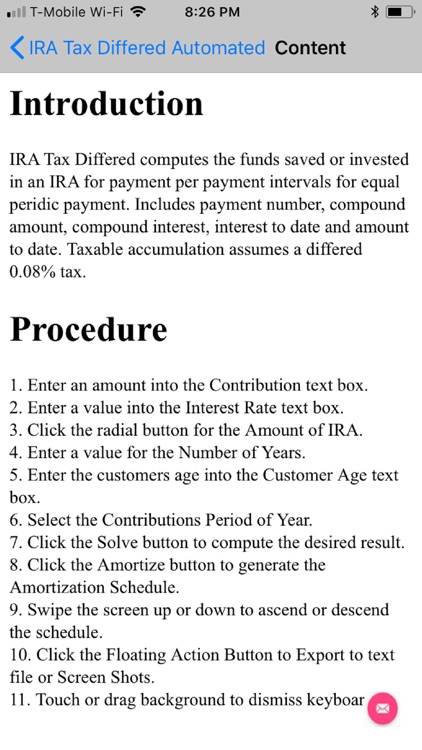

IRA Tax Differed computes the funds saved or invested in an IRA for payment periods or payment intervals for equal periodic payments. IRA Tax Differed includes payment number, compound amount, compound interest, interest to date and amount to date. Tax Differed Accumulations do not

App Store Description

IRA Tax Differed computes the funds saved or invested in an IRA for payment periods or payment intervals for equal periodic payments. IRA Tax Differed includes payment number, compound amount, compound interest, interest to date and amount to date. Tax Differed Accumulations do not

assume a federal tax bracket.

Disclaimer:

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.