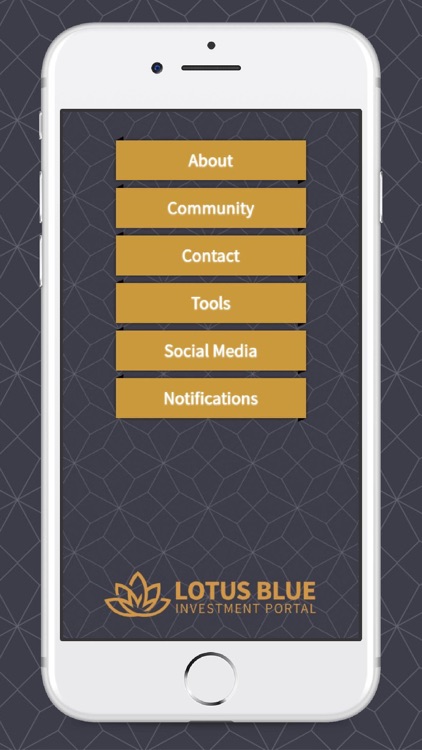

We have created this app for you, our loyal users, to offer you faster and better support, to find out about the latest news, to connect with our community and to use our tools

KOSEC LOTUS BLUE

What is it about?

We have created this app for you, our loyal users, to offer you faster and better support, to find out about the latest news, to connect with our community and to use our tools. We hope you enjoy it. You are welcome to send us your suggestions. Just write to us, we would love to hear your feedback.

App Store Description

We have created this app for you, our loyal users, to offer you faster and better support, to find out about the latest news, to connect with our community and to use our tools. We hope you enjoy it. You are welcome to send us your suggestions. Just write to us, we would love to hear your feedback.

Lotus Blue Investment Portal, powered by KOSEC - Kodari Securities, aims at helping you pick the correct opportunities at the right time, making investing or trading in the stock market simple and easy for both institutional and retail investors. A platform that's interactive, evidence based, easy to use with educational material and information to save you time, money and reduce the stress involved when investing. Lotus Blue provides support and guidance, to help you select the right opportunities, so you can invest with more confidence, maximise your profits and minimise your risk. It's simply revolutionary!

Lotus Blue works on a top down, evidence based investment strategy focused on filtering the best performing businesses that are more liquid, financially stable and better covered by major large institutions. These companies are all from different sectors and could have at least 2-3 years of financials showing:

- An Increase in return on equity or showcasing consistency

- An Increase or consistency in revenue

- An Increase or consistency in earnings

- An Increase or consistency in operating margin

- An Increase or consistency in maintaining cash flow

- A Reduction in debt/equity or generating more revenue from utilising more debt

Once we filter based on macro-economic indicators and fundamentals, we then look at the companies institutional valuations and conduct technical analysis, so that you are buying a quality business, that's undervalued, at the right entry point, saving you the time, stress and money.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.