kraftax is an HMRC recognised application that assists self-employed artists in managing their finances, sending invoices and submitting their tax return

Kraftax

What is it about?

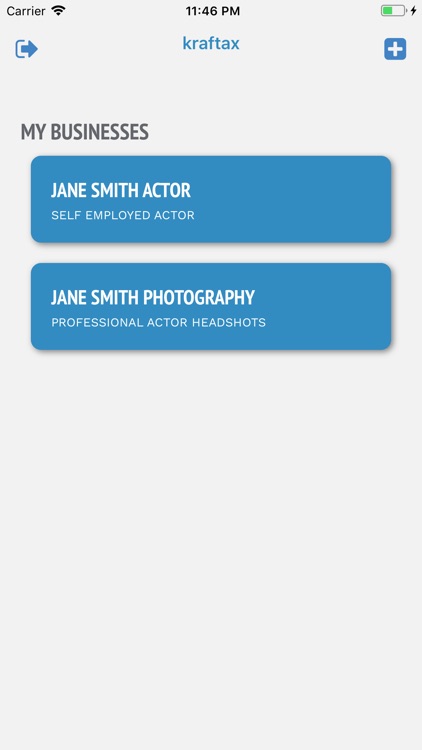

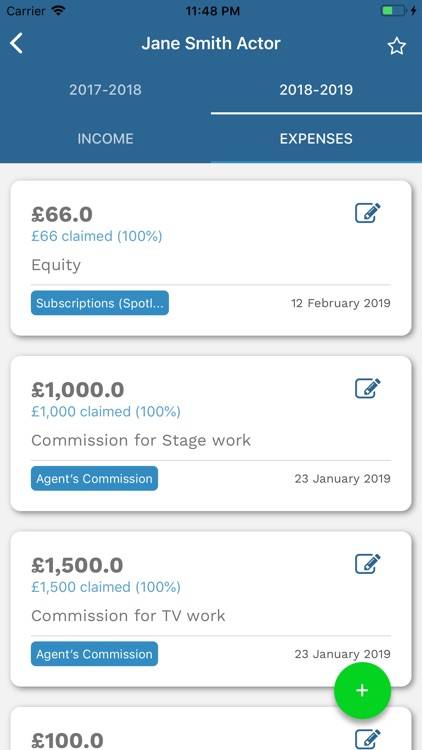

kraftax is an HMRC recognised application that assists self-employed artists in managing their finances, sending invoices and submitting their tax return. The kraftax mobile application is a companion to the full-feature website (https://www.kraftax.com), allowing you to easily monitor and manage your self-employment businesses and log you income and expenses. kraftax mobile will automatically synchronise with the website, which can then be used for more detailed operations, as well as to send and manage invoices and submit your tax return to HMRC at the end of the tax year. HMRC recognition ensures that kraftax meets all requirements for accurate tax calculation and tax return submission.

App Store Description

kraftax is an HMRC recognised application that assists self-employed artists in managing their finances, sending invoices and submitting their tax return. The kraftax mobile application is a companion to the full-feature website (https://www.kraftax.com), allowing you to easily monitor and manage your self-employment businesses and log you income and expenses. kraftax mobile will automatically synchronise with the website, which can then be used for more detailed operations, as well as to send and manage invoices and submit your tax return to HMRC at the end of the tax year. HMRC recognition ensures that kraftax meets all requirements for accurate tax calculation and tax return submission.

kraftax was created by self-employed actor / musician cousins with over 17 years of previous experience in software development and IT security. Our technical backgrounds, combined with our passion and love for the creative industries, led us to create kraftax to make finance and tax easy, so that we can focus on our arts.

kraftax (website) currently supports the following schedules:

- Basic Tax Return (SA100)

- Employment (SA102)

- Self-Employment - Short (SA103S)

- UK Property (SA105)

- Residence, remittance basis etc (SA109)

- Tax Calculation Summary (SA110)

Other schedules are planned to be implemented in future releases.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.