Join the growing number of users who have made MFFAIS Super Simple Budget App the fastest growing (by percentage increase) free budget tracker

MFFAIS track money budget app

What is it about?

Join the growing number of users who have made MFFAIS Super Simple Budget App the fastest growing (by percentage increase) free budget tracker.

App Screenshots

App Store Description

Join the growing number of users who have made MFFAIS Super Simple Budget App the fastest growing (by percentage increase) free budget tracker.

This super simple finance tracker app has a brand new & innovative way to budget – with the single focus of helping users have the money needed when bills are due.

This expense tracker app has a new budgeting method that requires the least amount of effort from users – it automatically budgets your multiple and inconsistent incomes to meet your expenses when they become due. An excellent income tracker app as your expense manager.

Budget App Key Features:

◉ Big picture focus – will you be able pay your bills or not?

◉ Least effort/work compared to ALL other budget or finance apps.

◉ Expects you NOT to enter every transaction and works just as well.

◉ Doesn’t require categories or buckets to be setup.

◉ Completely private – no bank account connections.

◉ Doesn’t require you to determine how much to spend/set aside.

◉ Doesn’t touch your money – all your money stays in your account.

◉ No user account or login setup required.

◉ Designed for variable and fluctuating multiple incomes

◉ Forward looking only – no history, reports or charts just a focus on the next 365 days.

◉ Automatically plans for those once/twice a year bigger expense.

◉ Free & Complete – no cost, no paid version for more features

Budget App Setup:

1) Install the app

2) Enter current bank balance, incomes and required expenses / bills

No need to enter every transaction, just the "must" get paid bills: rent, cable, car, insurance, utilities.

Budget App Usage:

1) There are literally only 2 screens in the app:

a. Home:

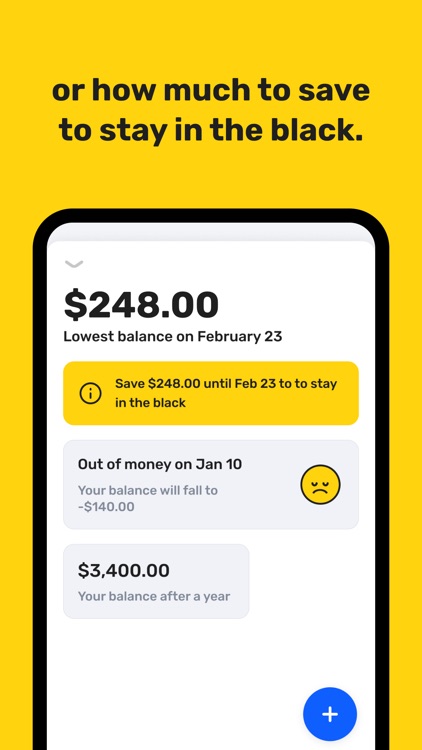

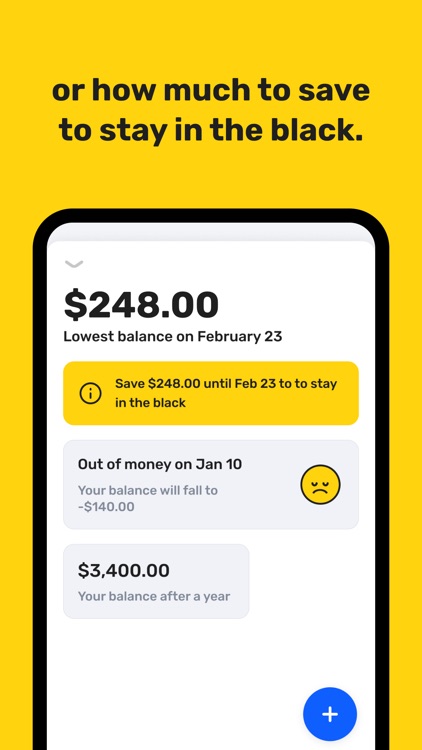

i. Shows how much “free” money (money you can spend today and still pay all your future bills)

ii. Warns you if it doesn’t look like you will have enough money to pay your future bills. The warning will tell you exactly how short and the date you need that amount by.

iii. Ending balance after 365 days

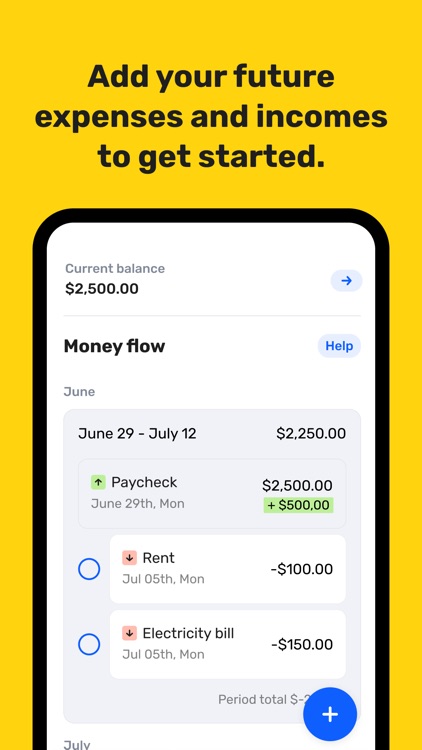

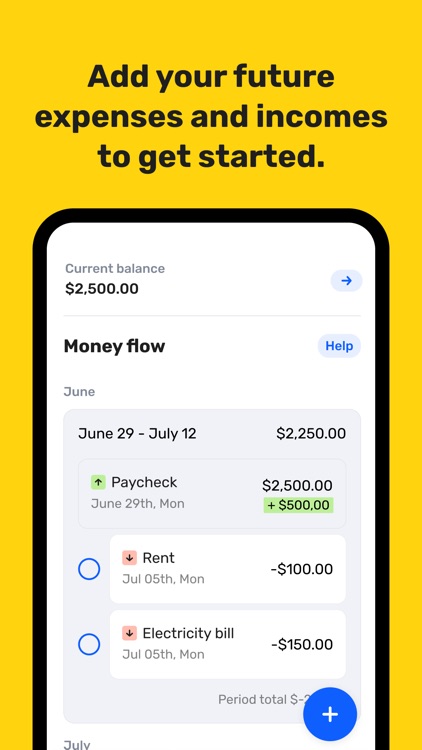

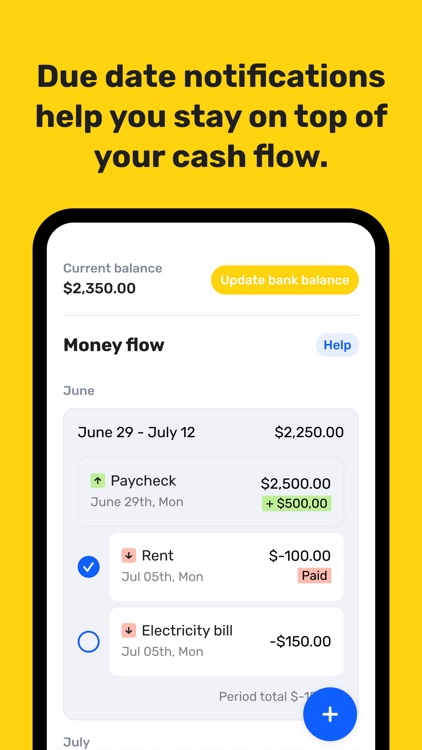

b. Money Flow:

i. Bank Balance (and ability to update the bank balance)

ii. Weekly transactions (pay & expenses)

c. “+” button to add an income/expense on the fly and indicate if they are one-time or recurring.

2) After you put in your expected income & must-pay expenses – all that is required:

a. Check when you received your expected money or pay an must-pay bill

b. Enter your current bank balance and “clear”/mark transactions in the app that cleared the bank.

Budget App Notes:

◉ Don’t bother putting in every transaction (coffee, lunch, gas, metro, etc..) when you update your bank balance all these types of amounts that cleared the bank will automatically be included and considered.

◉ There are no categories – don’t look for them.

◉ No history or past transactions – don’t look for them. The app’s focus/intent is to budget future income to meet your required bills.

◉ No connections to bank accounts– don’t look for them. You will need to manually enter your current bank’s balance and check any cleared transactions. Since you are only recording required bills (rent, phone, care) – most users can easily identify when those cleared the bank.

◉ Money flow screen with payroll groups is only for users that want to see details or need to juggle bills and due dates – 90% of the users only use the home screen except when updating their bank balance.

Make this budget planner a habit. It will be your smart virtual finance manager that helps you to track all your spending and helps you to stop unnecessary expenses. Besides being a money tracking app, this income recorder app will work as a bill reminder too that prevents you from spending extra fines. Let the daily money tracker app be your new normal. Enjoy the services of your new money manager!

Be one of the first to experience this new budgeting method.

Download Mffais now!

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.