Automatically log your tax-deductible mileage with MileCatcher and start your 30 day free trial

MileCatcher Mileage Tracker

What is it about?

Automatically log your tax-deductible mileage with MileCatcher and start your 30 day free trial!

MileCatcher Mileage Tracker is FREE but there are more add-ons

-

$47.99

Annual Subscription

-

$5.99

Monthly Subscription

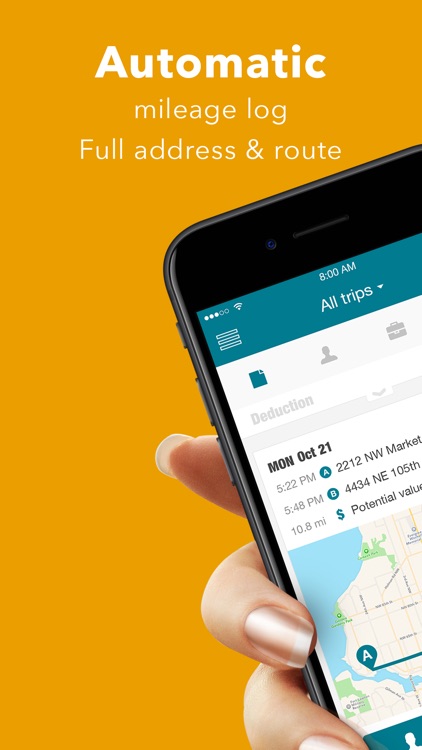

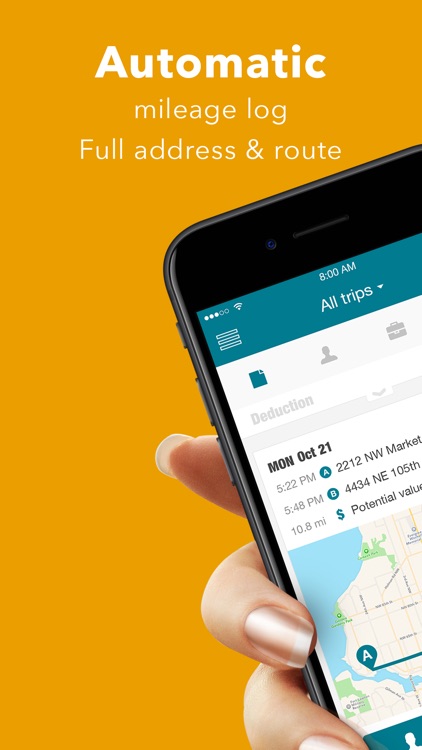

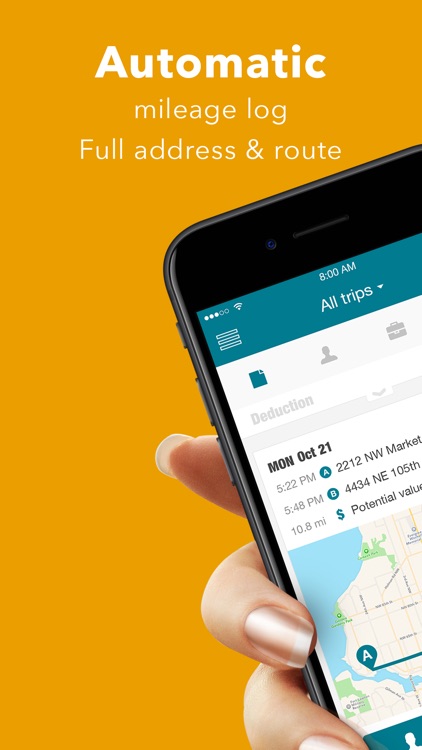

App Screenshots

App Store Description

Automatically log your tax-deductible mileage with MileCatcher and start your 30 day free trial!

If you’re an independent business owner, contractor, realtor, a driver for a delivery or ride share service (Uber, Lyft, DoorDash, Instacart, Postmates), etc - this automatic mileage tracking app was built for you!

Tax authority compliant in 20+ countries (IRS, CRA, HMRC, etc)

Classification Features:

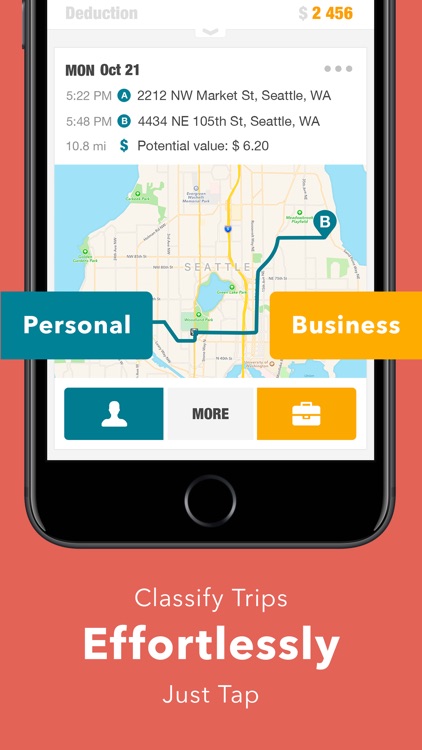

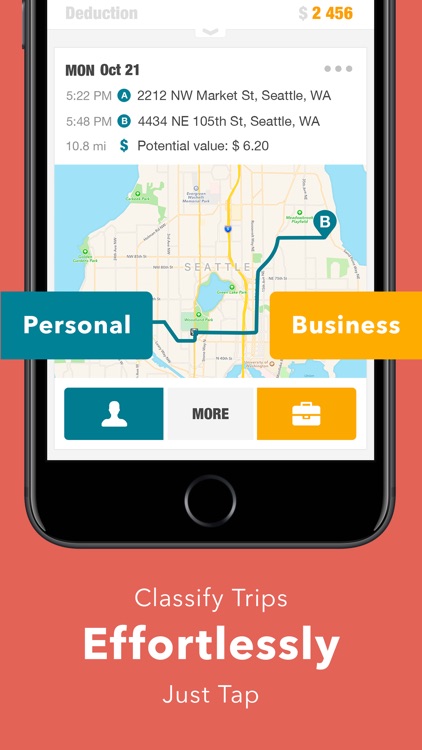

- Classify your trips as Business, Personal, or Custom

- Find Unclassified trips easily for quick Classification

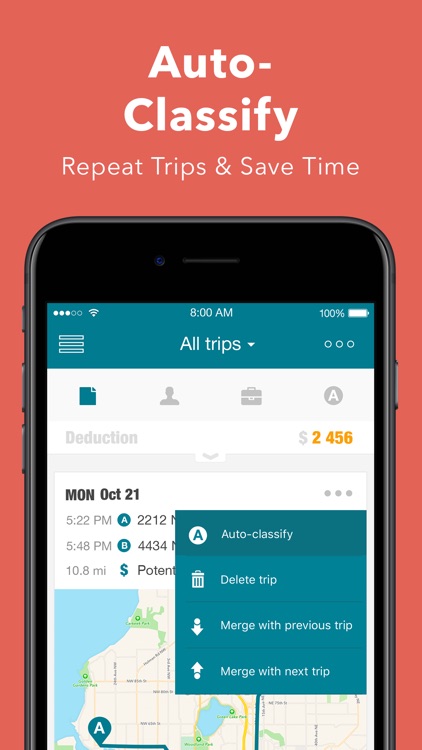

- Auto-Classify your commute and repeat trips to save time

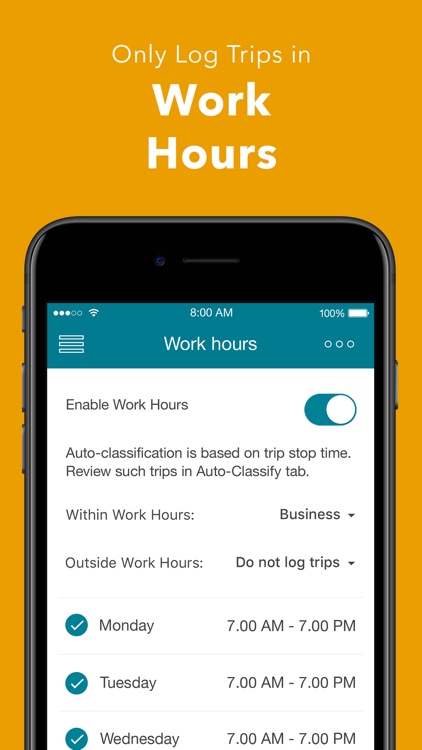

- Only log Business trips when you’re on the clock using MileCatcher’s Work Hours feature

- Classify your trips in-app, from the Web Portal, or by notification

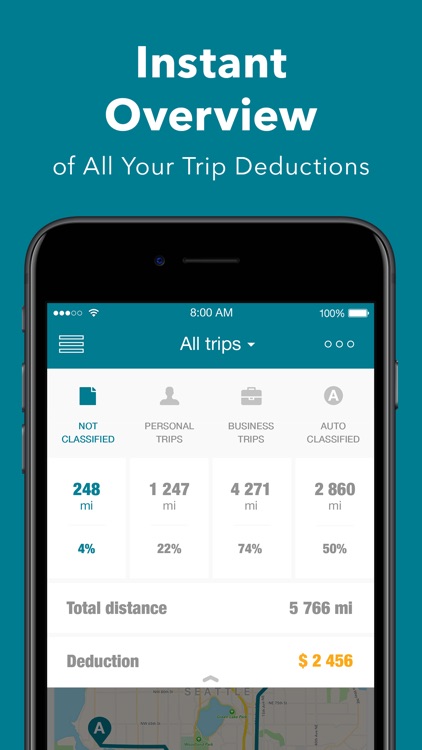

- All trips are sorted automatically by Classification and Date/Time for easy navigation of your trip history

Rate features:

- MileCatcher calculates your deduction using your country's default rate and currency

- Customize your rate to fit your specific requirements

- Rates can be customized by Company, Purpose, etc.

Reporting features:

- Generated reports are easily exportable in PDF, Excel, or CSV format.

- Optional automatic weekly and monthly reports sent to your email

- Generate reports specific to your needs (multi vehicle, multi company, multi rate)

- Report on deductible trips only, or include non-deductible trips

- Have reports sent directly to your employer, accountant, etc.

Web portal access:

- See your complete trip and report history

- Bulk Classify your trips

- Use advanced filter options to find what you need when you need it

- Migrate old paper logs

- Create highly customizable reports

Other features:

- Full address and map route with every trip

- Customizable location names (Work, Home, etc) for an at-glance-friendly experience

- Find out how many trips need classifying, how much you drive for business, total distance traveled, and more with Snap Statistics

- Add Parking, Toll, Odometer reading, and Notes to your trip cards

- Online backups of all trip data

MileCatcher Teams:

Want your Team using MileCatcher? MileCatcher Teams offers consolidated billing, company wide reporting, and more!

Start your 30 day free trial - Let’s get logging!

Terms of Use and Privacy Policy: https://milecatcher.com/legalpro/

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.