Most financial advisors will only manage money for clients with a certain minimum of investable assets or provide a “NextGen” offering using a robo solution

Modearn

What is it about?

Most financial advisors will only manage money for clients with a certain minimum of investable assets or provide a “NextGen” offering using a robo solution. But they’re forgetting about the Gen Xers and Millennials who are already married, in the prime of their careers, buying real estate, building their wealth, enjoying travel/experiences, and growing their families. We know that the next generation of investors won’t necessarily invest the same as prior generations, which means the advice they need should look different.

App Details

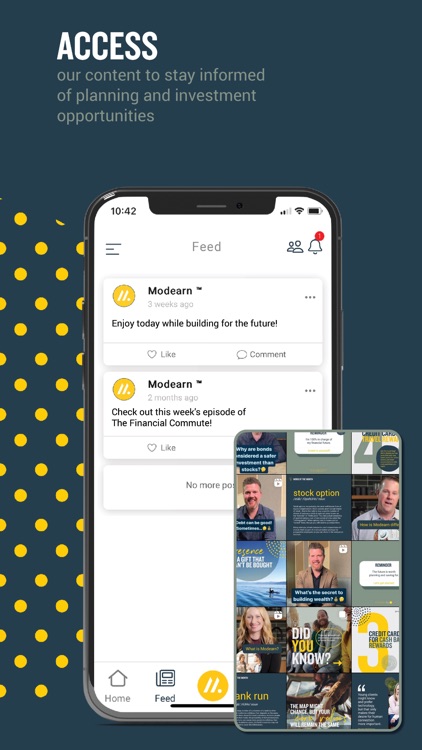

App Screenshots

App Store Description

Most financial advisors will only manage money for clients with a certain minimum of investable assets or provide a “NextGen” offering using a robo solution. But they’re forgetting about the Gen Xers and Millennials who are already married, in the prime of their careers, buying real estate, building their wealth, enjoying travel/experiences, and growing their families. We know that the next generation of investors won’t necessarily invest the same as prior generations, which means the advice they need should look different.

At Morton, we’ve reimagined wealth management to better serve your needs. When you become a Modearn client, we will help you with career opportunities, recommend executive compensation benefits, provide opportunities to increase the enterprise value of your business, implement tax savings strategies, navigate concentrated stock liquidations, manage your investments, use insurance and estate strategies to protect the assets you have now, implement an education savings strategy for your children, and set you up with a spending strategy so that you can enjoy life today while planning for retirement.

We know you’re busy, so we want to save you time while providing financial advice you need in a timely fashion. Think of us like a concierge doctor – we will be there when you need us. Through our app, you’ll be able to direct message us with questions and we’ll reply with updates. If we don’t have an immediate answer or lack in-house expertise on a topic, we’ll leverage our database of preferred professionals to connect you with someone we trust to offer the advice you need.

Through the app, you’ll get to:

Save time and get the financial advice you need all in one place

Track how your investment accounts are performing

Chat with your Modearn advisor before making any financial decision

Access our content to stay informed of planning and investment tips and opportunities

Our goal is to make life easier for our clients through proactive planning, excellent communication, and timely advice.

Please note: Modearn is only available to Morton Wealth clients. Please reach out to your advisor to get access to the app or visit mortonwealth.com if interested in more information.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.