Spend less and save more with Money Dashboard

Money Dashboard Neon

What is it about?

Spend less and save more with Money Dashboard. We take the hard work out of money management and safely connect directly into 90+ financial institutions so you can get a clear view of how, when and where you’re spending. We’ve been doing this for over 10 years, so you know you can trust us.

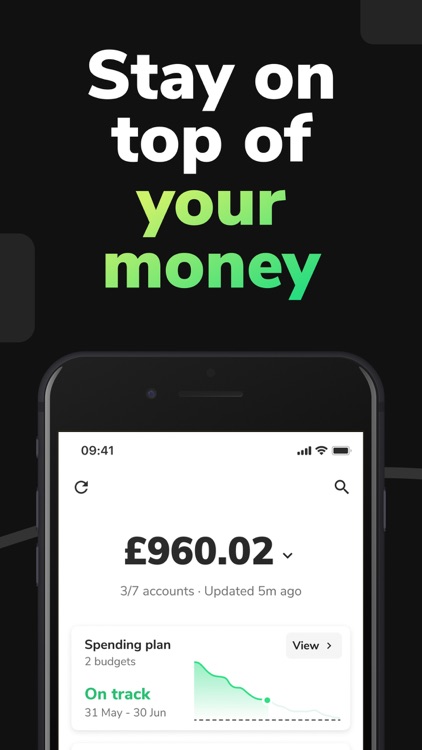

App Screenshots

App Store Description

Spend less and save more with Money Dashboard. We take the hard work out of money management and safely connect directly into 90+ financial institutions so you can get a clear view of how, when and where you’re spending. We’ve been doing this for over 10 years, so you know you can trust us.

In less than 5 minutes, we’ll show you how much you can safely spend until payday by calculating what’s left after all your upcoming bills and subscriptions.

We automatically categorise all of your transactions into helpful groups like Bills, Groceries or Holidays so you can stick to your budgeting plan and reach your financial goals.

EVERYTHING IN ONE APP

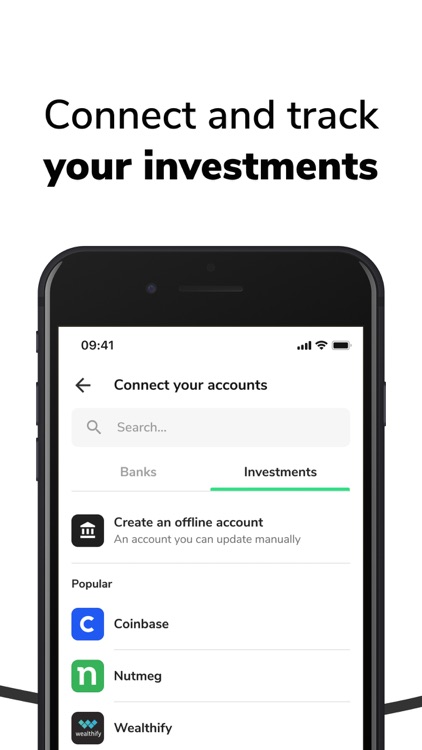

Safe and secure connections with all your banks; we give you a single view for all your financial information. Forget jumping between apps and banking websites. Connect your bank accounts, savings accounts, credit cards, pensions, and investments.

BALANCES AND TRANSACTIONS FROM ALL OF YOUR ACCOUNTS

- Connect your current account, credit cards and savings accounts from major UK banks

- See every transaction that takes place so you know exactly where & what you’re spending

- Gain a clear picture of your financial situation by seeing all of your balances, together

SET A SPENDING PLAN

- We account for all of your upcoming payments and bills so you can see what’s safe to spend

- Set predictions for money coming in and out to forecast your balance into the future

- See your progress over time so you can alter your budget planner

AUTOMATICALLY CATEGORISE AND VIEW YOUR SPENDING

- We identify the purpose of each transaction, so you can implement money saving tricks into your personal budget

- Everything is neatly organised to show you the bigger picture of your personal finances

- Track spending leading up to payday, from household bills to eating out - think of it as your own personal budget calculator or financial assistant

BUDGETS TO HELP YOU STAY ON TRACK

- Set budgets that help you monitor everything from Transport to Holidays

- See the impact of your budget progress on your predicted end of month balance

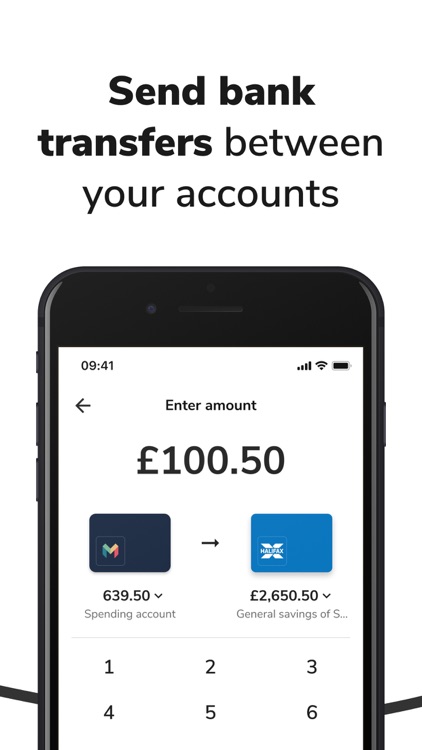

MAKE PAYMENTS BETWEEN YOUR ACCOUNTS

- Securely move money between connected bank accounts.

- Avoid unnecessary bank charges and maximise interest rates by organising your money effectively

- Supported bank accounts only

SECURITY WITH PEACE OF MIND

- We’ve been operating safely for 10 years, securely connecting to over 1.3 million accounts

- Our services are routinely inspected, tested and audited by qualified security and data specialists

- We are authorised and regulated by the Financial Conduct Authority, reg no. 800652

Money Dashboard connects to 90+ institutions including:

AIB (NI), Amazon, American Express (AMEX), Aqua Card, Bank of Scotland, Barclaycard, Barclays, Burton Card, Capital One, Chelsea Building Society, Clydesdale, Cumberland Building Society, Coinbase, Danske Bank, Debenhams Card, Dorothy Perkins Card, Evans Card, First Direct, Fluid Card, Halifax, House of Fraser Card, HSBC, HSBC Business, Laura Ashley Card, Lloyds, M&S, Marbles Card, MBNA, Miss Selfridge Card, Monzo, Nationwide, Natwest, Nutmeg, Opus Card, Outfit Card, Pension Bee, Revolut, Royal Bank of Scotland (RBS), Sainsburys, Santander, Starling, Tesco, Topman Card, Topshop card, TSB, TUI Credit Card, Ulster Bank, Virgin Money, Wallis Card, Wealthify, Wise, WiseAlpha, Yorkshire Bank, Yorkshire Building Society.

AWARDS

Best Personal Finance App, British Bank Awards 2021, 2020, 2018, 2017

FinTech of the Year, The Scottish Financial Technology Awards 2019

Best FinTech Collaboration, The Scotish Financial Technology Awards 2019

Best use of data science for good and Best innovation for savings journey, fDATA Open Banking Awards 2019

Most innovative new features as a force for making lives better, fDATA Open Banking Awards 2019

Authorised and regulated by the Financial Conduct Authority (reg. 800652) & registered provider on openbanking.org.uk

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.