Now more than ever a pro-active approach to managing our financial well being is needed

MoneyMax

What is it about?

Now more than ever a pro-active approach to managing our financial well being is needed. Managing debt and outflow is key, the bank and credit card companies' money is worth 5% - 12% interest, your savings is only worth .25%...

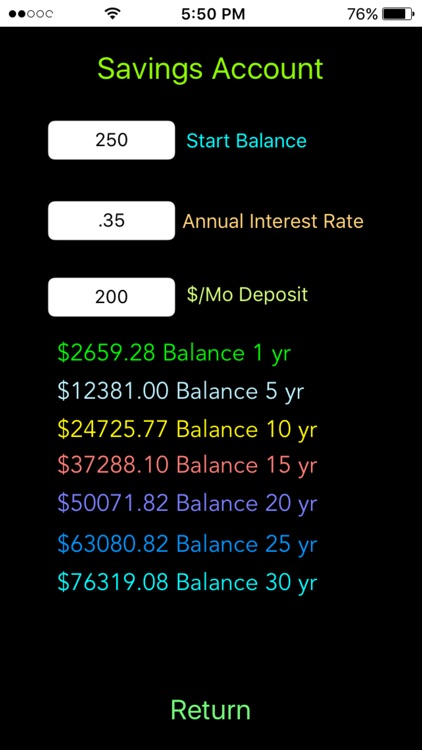

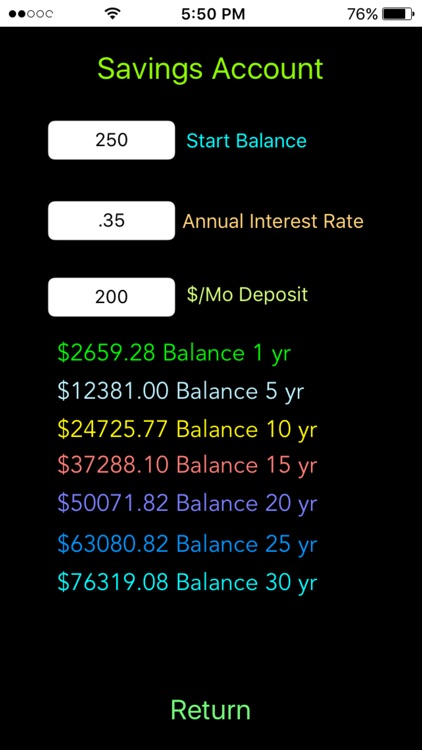

App Screenshots

App Store Description

Now more than ever a pro-active approach to managing our financial well being is needed. Managing debt and outflow is key, the bank and credit card companies' money is worth 5% - 12% interest, your savings is only worth .25%...

The only way to survive this is to use your credit wisely and have some numbers in mind as you build your retirement nest egg.

MoneyMax is the premier tool for budget planing and large investment decisions such as a savings rate, or a mortgage with early payoff, or calculating how long your retirement account will last. You will sleep better knowing the numbers!

If you are thinking about a small business MoneyMax can calculate the breakeven point on a product launch and do supply and demand pricing analysis.

Personal finance:

- Savings Rate (401k growth)

- Mortgage loan with early payoff

- Account draw down (retirement)

Small business:

- Product launch break even analysis

- Sales demand projections

The MoneyMax app uses the same calculus equations that are used throughout business to assure smart choices are being made.

MoneyMax is a great app for all ages, it will show you the HUGE benefit of starting a retirement account early and letting compound interest do the work, or paying a little extra on your mortgage to pay it off early. Imagine working 10 years with no mortgage... that money goes toward a stress free early retirement... :o)

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.