Instant personal loan, free credit-score & more

OneScore: Credit Score Insight

What is it about?

Instant personal loan, free credit-score & more!

App Screenshots

App Store Description

Instant personal loan, free credit-score & more!

OneScore is a one-stop shop for managing credit score and getting an instant personal loan with flexible EMI options. Whether you need money to plan a trip or to take care of medical expenses, you can get an instant loan for any cash emergency with OnePL.

Instant Loan Disbursal

Easy Application

No Collateral requirement

Zero Documentation

Flexible EMI options

How to avail of the best loan offer on OneScore

Build your credit worth by regularly tracking your credit score, and look out for the personalized OnePL loan offer. Depending on your credit score and other factors, you will receive instant approval on your personal loan application.

What’s more!

You can also use the EMI calculator to plan your EMIs and choose from the flexible repayment options.

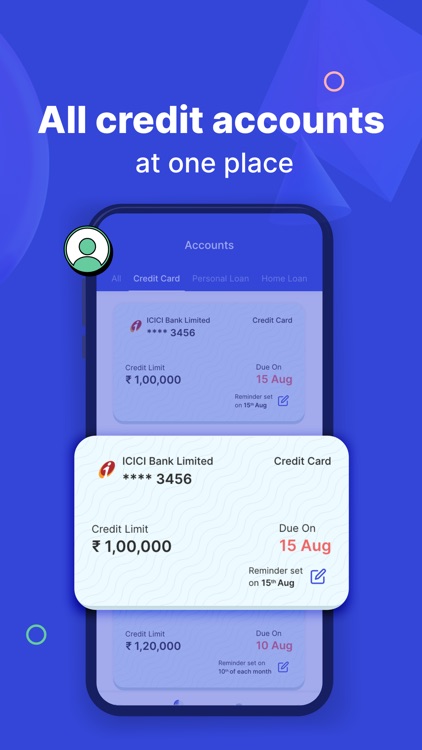

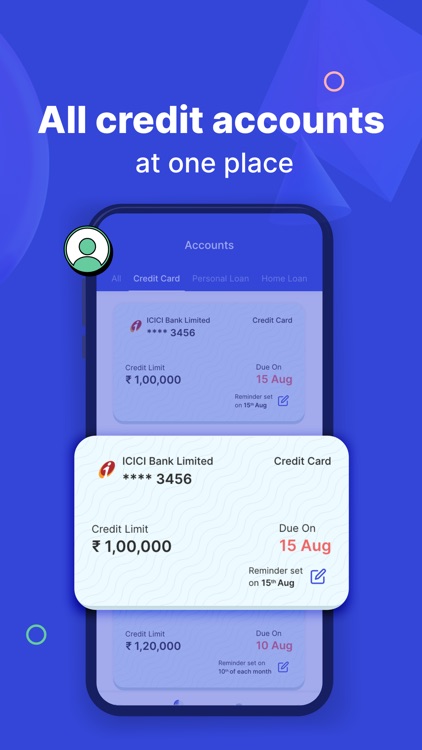

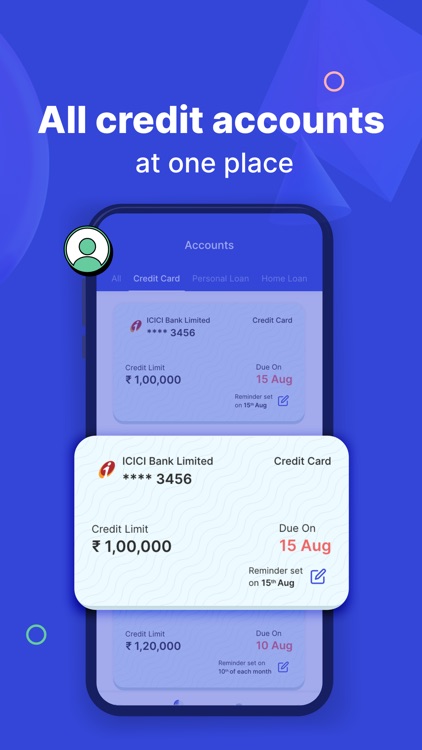

Set up payment reminders so you never miss an EMI.

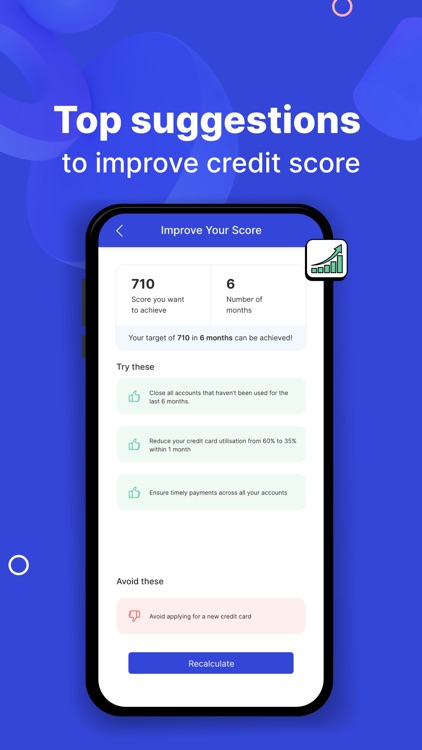

Get customized suggestions on how to improve your credit score and avail of better loan offers.

Eligibility Criteria for OnePL:

A credit score of 730 & above

Stable employment with monthly salary of >₹20,000

Aadhar and PAN card holder

OnePL features:

• Lending partner: Federal Bank Limited, South Indian Bank Limited

• Loan Amount: Up to Rs. 5 Lakh

• Loan tenure: Minimum 6 months, maximum 48 Months

• Interest Rates: 12.5%-18.5% (for Federal bank), 15.9%-16.8% (For SIB)

• Processing fees: 1.5-2.5% (Minimum Rs. 999) for Federal bank and 1% + Rs. 750 Digital document charges + GST for SIB

• APR: 13.32%-27.49% (for Federal bank), 16.54%-20.52% (For SIB)

Let's understand this with an example, assuming a personal loan of Rs. 50,000 with a 13% interest rate and a repayment tenure of 1 year. Here’s how your loan disbursal amount would be calculated:

Loan Amount - ₹50,000

Tenure - 12 months

Interest Rate - 13%

EMI - ₹4,466

Total Interest Payable - ₹4,466 x 12 months - ₹50,000 Principal = ₹ 3592

Processing Fees (incl. GST) - ₹1179

Disbursed Amount - ₹50,000 - ₹1,179 = ₹48,821

Total Amount Payable - Principal + Interest + Processing Fees = ₹54,771

Total Cost of the Loan = Interest Amount + Processing Fees = ₹3592 + ₹1179 = ₹4,771

*In case the loan is disbursed on or after the 6th of the month and your EMIs fall on the 5th of the month, there’s a gap of 29 days between your loan disbursal date and the first EMI. The interest rate charged for this period is called Broken Period Interest.

Why download OneScore?

Get instant loans up to Rs 5 lakh with zero documentation and flexible EMI options.

Check your Experian and CIBIL score in an instant, for free. It’s also completely spam-free & ad-free.

Get notified about changes in your credit score in real-time. Stay in charge of your credit score with a simplified credit report and eliminate errors in real-time.

Use the ‘Find out why feature’ to analyze your data and understand exactly why your credit score has changed.

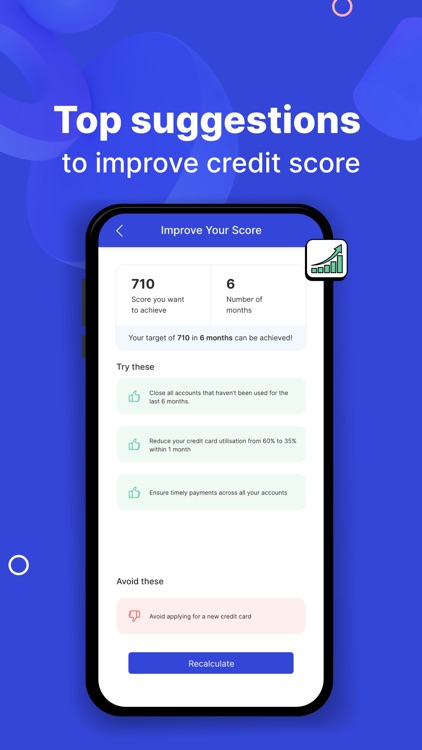

Use the Score Planner to level up your credit score. Set a goal for yourself and achieve your ideal score with personalized insights.

Have a low credit score? Use the simulator to get suggestions on how to improve your credit score with good financial habits.

Get a bird’s eye view of all your loan and credit card accounts.

Report inaccuracies in your credit record with a simple click.

Set financial goals and stay on track with timely reminders.

Why OneScore is different

End-to-End Credit Management Tool

One-stop solution for end-to-end credit management – from building your credit score to availing instant personal loans at low-interest rates, do it all on the OneScore app.

Ad-Free:

Rest assured, you will never get those spam calls and messages with unsolicited offers.

Safe & Secure:

None of your information is shared with any third party or institution. Your data is safe with us.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.