Onoff Insurance - On-Demand Hourly Car Insurance

Onoff Insurance

What is it about?

Onoff Insurance - On-Demand Hourly Car Insurance

App Screenshots

App Store Description

Onoff Insurance - On-Demand Hourly Car Insurance

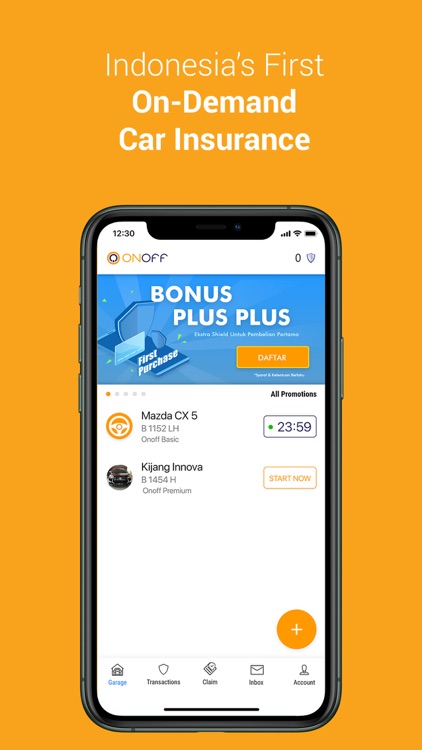

Onoff is the first On-Demand car insurance in Indonesia that provides hourly coverage, giving the user flexibility to pay insurance premium based on their driving time.

The less you drive, the more you save.

Onoff is a reliable choice for car insurance, registered and monitored by the Financial Service Authority (Otoritas Jasa Keuangan/OJK).

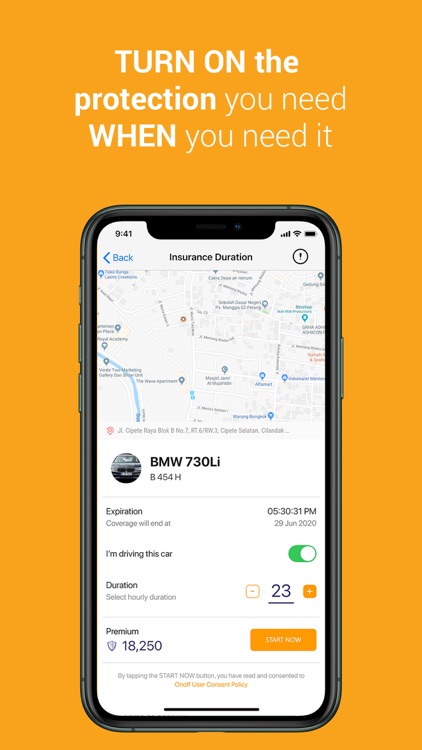

Save up to 55% and enjoy low rate All-Risks coverage, starting from IDR 500/hour by activating On-Demand feature in the app.

With an easy-to-use mobile app, quick and straightforward process from submitting insurance application to filing a claim, Onoff is the smart choice for today's tech-savvy consumer.

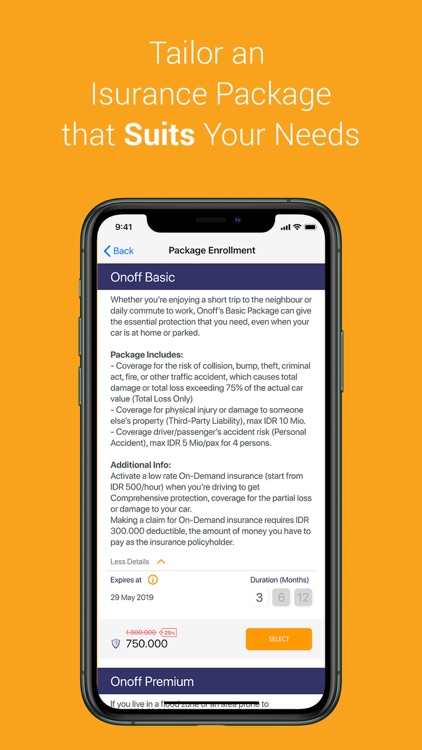

Onoff provides Total Loss Only (TLO) and All-Risks coverage that can be adjusted based on your need. You only need to pay a low base rate to activate TLO insurance package that lasts for 3, 6, or 12 months period. You turn on the hourly On-Demand insurance for All-risks coverage when you drive.

Why On-Demand Car Insurance?

- Far cheaper. You can choose to pay All-risks insurance premium only when you drive.

- The rate is more reasonable for those who rarely use their car.

- You don’t have to spend more money when even/odd policy or Jakarta’s traffic congestion force your car to stay at home.

- Pay a low rate for Total-Loss-Only coverage from Onoff insurance package to protect your car when it’s parked.

- You comprehensively insure your car by the hour when you need it.

Features

- Register one or multiple cars, brand new or used.

- Apply for insurance online by filling in-app form and uploading ID Card along with car ownership document.

- Choose insurance package for TLO coverage for 3, 6, or 12 months period.

- Get All-Risks coverage in the form of On-Demand car insurance that can be activated hourly as long as the insurance package is still apply

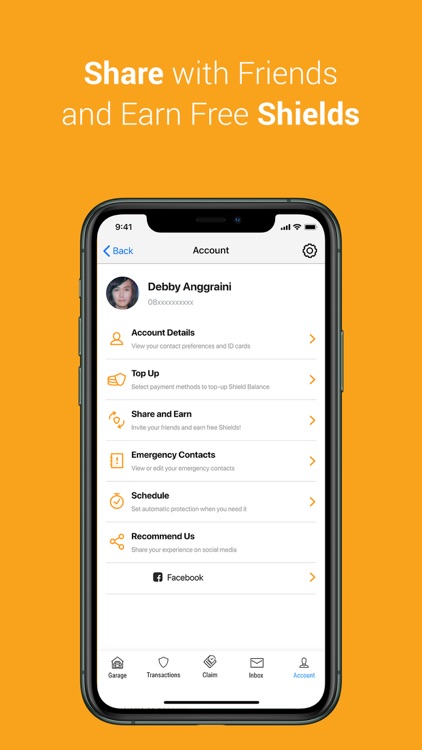

- Enjoy easy payment system by using Shields, Onoff’s currency system that you can top up anytime.

- Shields balance top up can be done through ATM, Online and E-Banking in the following banks: BCA, BRI, Mandiri, BNI, and Permata Bank

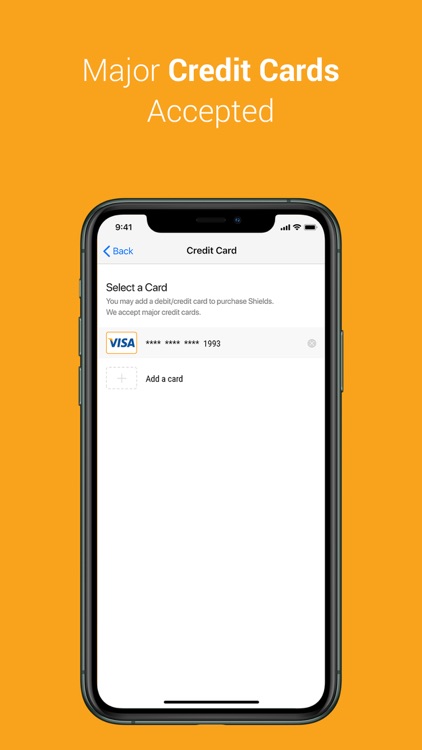

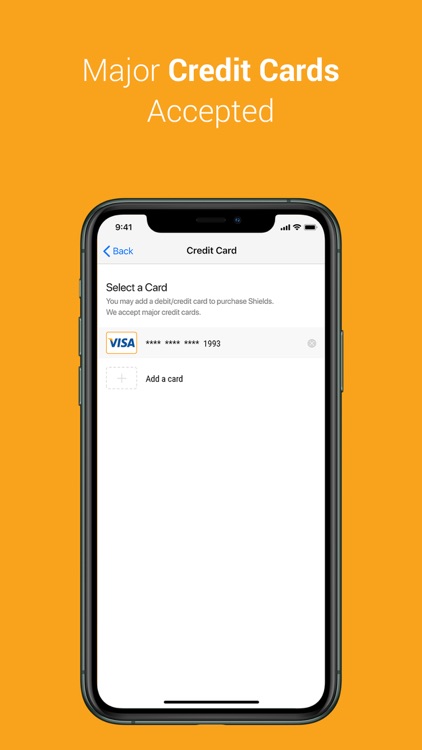

- Pay and top up using Visa, Mastercard, and JCB credit card

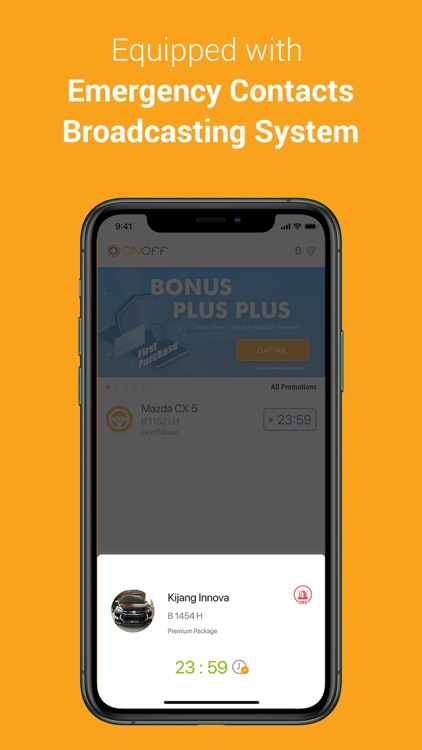

- Mark and report accident only by swiping Onoff app when in driving mode.

- File a claim online by filling a short form inside the app and upload required documents.

- Monitor the insurance status of your car(s) in the main dashboard.

How to use this app

1. Install the app and create an account by using email or mobile phone number

2. Register a car, fill the form, upload required documents and choose basic or premium package to apply for car insurance.

3. Wait for 1x24 hours to get the status update for your insurance application.

4. When your application is approved, top up the Shields (Onoff’s currency system) and proceed to the payment.

5. TLO coverage will be automatically activated as long as the insurance package is valid while the All-Risks On-Demand coverage can be activated as you need.

6. Enjoy all the coverage and get your peace of mind both when you’re driving or when your car is at home or parked.

Packages you can choose:

1. Basic Package

a. Coverage for theft, fire and accidental damage resulting in a total loss or major damage (TLO)

b. Coverage for bodily injury or damage to someone else's property (Third-Party Liability), maximum IDR 10 Million any one accident.

c. Coverage for the driver and/or passengers being injured (Personal Accident), IDR 5 Million per person for a maximum of 4 persons (including the driver).

2. Paket Premium

a. Everything from the Basic Package plus:

b. Damage caused by storm, flood, water damage, earthquake, volcanic eruption, strikes, riots, malicious damage and acts of terrorism which causes major damage or a total loss (TLO).

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.