Buy Now, Pay Tomorrow

Osta

What is it about?

Buy Now, Pay Tomorrow. Safest, Fastest and most secured platform.

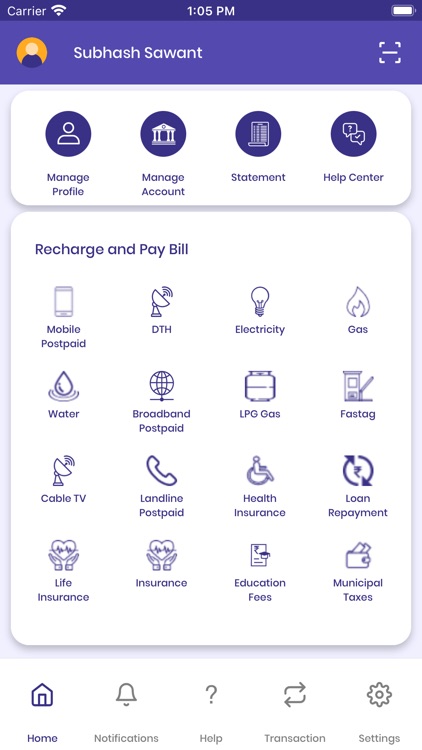

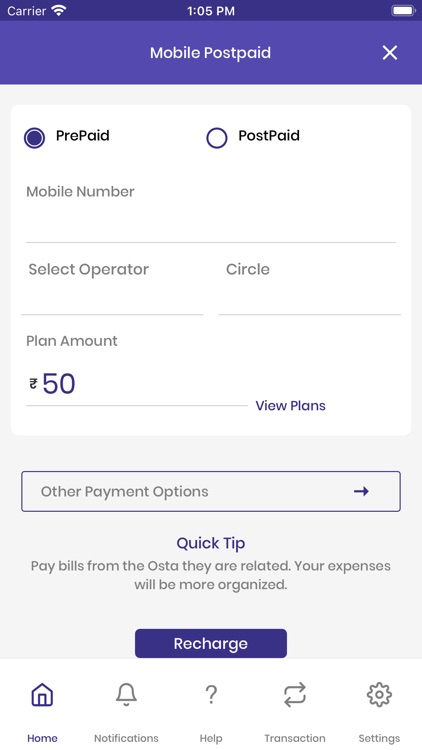

App Screenshots

App Store Description

Buy Now, Pay Tomorrow. Safest, Fastest and most secured platform.

Osta is a Card-less, Wallet-less, POS-less and Swipe-less payment platform. Osta is a single use payment number. Osta platform generates unique digital number on customer request by marking a hold equal to the amount requested. This digital number or QR code can be used by the customer at registered merchants or aggregators or partner ATMs. Buy Now, Pay Tomorrow is for customers whose Banks are listed on the platform. It is not for debit card, credit card, wallet and other payment options.

Osta uses secured payment technology and empowers customers to decide the value and validity of the Osta number. Osta uses lien (hold) marking instead of transfer of funds to wallets or direct debit to account .

Benefits with Osta

Compared to cards - As a user you need not store your bank provided details in third party app or enter it on multiple payment pages and hence zero risk of hacking. Compared to wallets - You need not transfer money in wallets and hence you manage only one financial account and you get interest till the account is debited for the transaction.

We do not debit your bank account unless we are sure the transaction was successful at all ends. Also,We give you an opportunity to raise dispute on a transaction before debit to your account unlike other payment application.

When you buy Jewellery or electronics at small stores - they wont may not ask you 2% extra when you pay by Osta.

You will not lose your IRCTC ticket because you did not get OTP. You will pay less convenience fee.

Your bank details shall be secured with yourself - as we do not store any bank provided credentials.

There will be no double debits to your account. You need not followup for weeks to get your money back.

There is no charge to you to release Osta unlike other products.

Second factor authentication for creation and usage of Osta

How to use?

Register on Osta App or www.ostaapp.com

Select your bank (if your bank is not listed then you shall not be able to use Osta)

Perform one time authorization activity (we do not store any of the banks data in our system)

Create Osta from any of the added payment source

Use Osta at Osta partner location or website or payment gateway or ATM's

You

Features of Osta

You can set expiry of each Osta generated for each account added i.e. In 1 hour, 1 day, 1 week or 1 month

You can set per transaction, per day, per month, per year limits as defined by bank

You can set primary account to be used for creation of Osta

You can decide whether for balance amount should there be auto-generation of Osta or not

Fraud Prevention

Once Osta is used – it cannot be reused (it is a dynamic one-time usage number)

Reattempts post usage would result in failure

There is a second factor authentication while usage of Osta

Recreation of Osta would give new number (reloading is not permitted)

Osta value is decremental and for every usage new number is generated for preventing frauds/misuse

One stop shop: Osta would work with Bank Accounts, Payment Banks, Credit Cards, Wallets and more. Also, you can use Osta for:

Phase - 1:

Online purchase

Offline purchase

Card-less ATM Withdrawal

Phase -2:

Funds Transfer

Gift Osta (Smiler to Gift Vouchers and Gift Cards)

Delivery by Osta

Bill payments

Recharges

B2B payments

Personal Finance Manager

Kids Osta (Similar to Prepaid vouchers or cards)

Food Osta (In lines with Food Card)

Expense Analyser

Budgeting (Plan the way you spend your money)

NCMC

FASTag etc

We shall introduce banks and merchants incrementally and so shall be the features. We are a startup and would like your feedback on what would you like your payment app should do for you.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.