With an ever-increasing amount of workload and responsibilities that people nowadays must shoulder, it is becoming harder for one to devote hours of valuable time to the time-consuming and mostly frustrating task of planning one's taxes

Plan My Taxes

What is it about?

With an ever-increasing amount of workload and responsibilities that people nowadays must shoulder, it is becoming harder for one to devote hours of valuable time to the time-consuming and mostly frustrating task of planning one's taxes. The need for an external expert opinion is always felt. However, the exorbitant prices charged by professional tax planners make it unfeasible for most people to consult one.

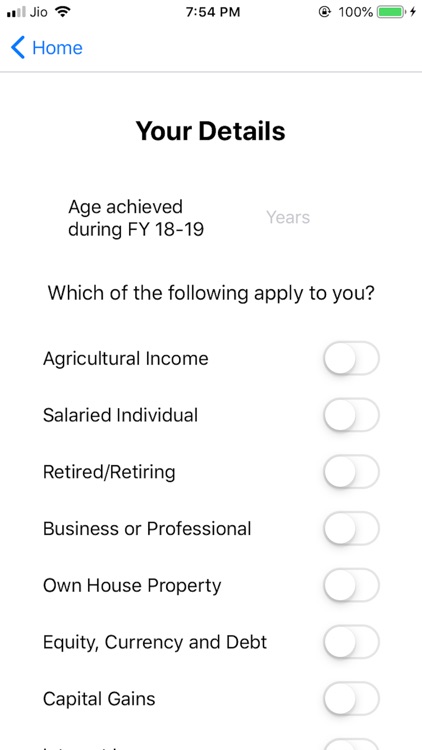

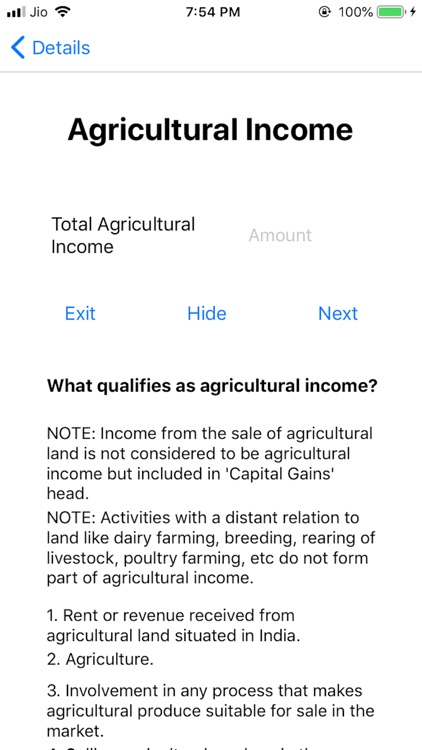

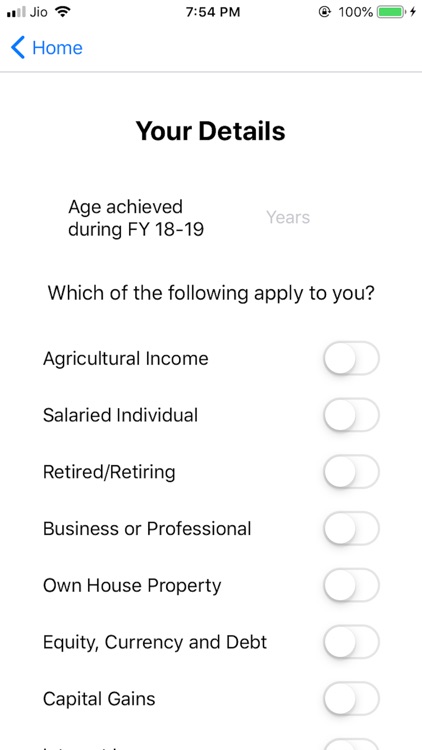

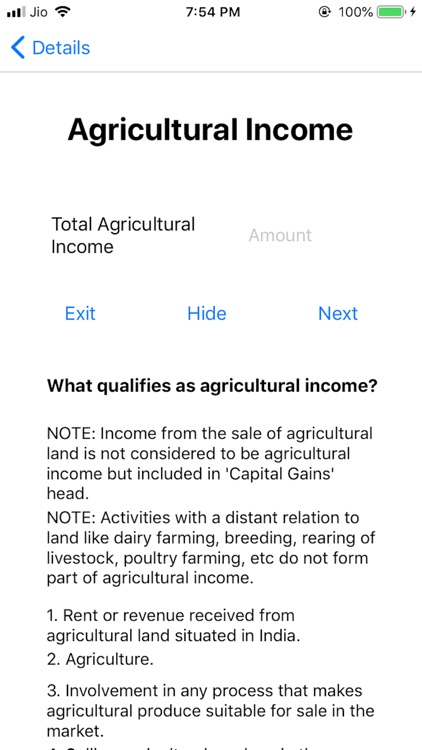

App Screenshots

App Store Description

With an ever-increasing amount of workload and responsibilities that people nowadays must shoulder, it is becoming harder for one to devote hours of valuable time to the time-consuming and mostly frustrating task of planning one's taxes. The need for an external expert opinion is always felt. However, the exorbitant prices charged by professional tax planners make it unfeasible for most people to consult one.

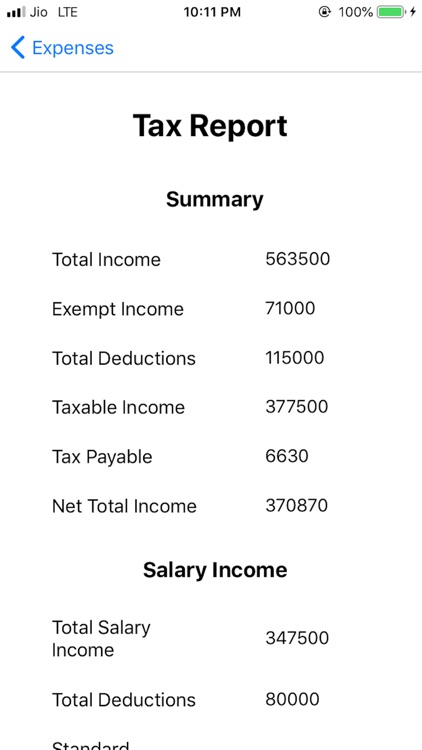

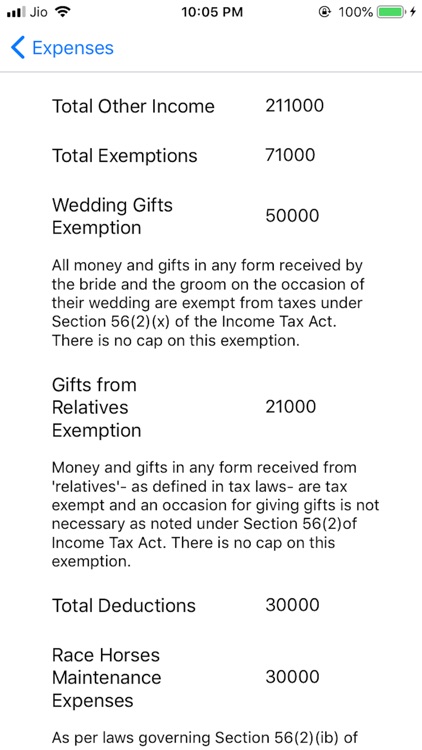

Introducing our solution for you- Plan My Taxes. Plan My Taxes does the work for you and automates the process of computing your tax liability and identifying avenues for tax exemptions and deductions. Based on over 120 inputs about your income and expenditure, it generates a comprehensive and personalized tax report with detailed information about each aspect of your tax return. If greater investments can reduce your tax liability further, it even lists the investments required to be made to avail the benefits. For the apprehensive ones, included with each deduction applied is a short description and the section of the Income Tax Act under which it falls so that you conduct your own research and be absolutely certain of the expected amount of tax payable as you submit your tax returns!

Currently, the app supports tax calculation and planning for financial year 18-19. All heads of incomes- Income from Salary, Business Income, Capital Gains, House Property and Other Sources- are supported by the app and all deductions under Section 80C to 80TTB such as investments, student loans, medical expenses, donations, interest income are accounted for. Furthermore, exempt income is automatically identified and demographic inputs by the user are used to eliminate inapplicable scenarios. And the best part of it? It is completely free to use!!

We hope that you will utilize this free tool and let us navigate you through the intricacies of the Income Tax Act and planning your taxes so that you save both money and time!

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.