*** This version will be shut down soon, please try our integrated app, Alpha Trading Desk, instead ***

Quantitative Portfolio Optimizer (Free)

What is it about?

*** This version will be shut down soon, please try our integrated app, Alpha Trading Desk, instead ***

App Screenshots

App Store Description

*** This version will be shut down soon, please try our integrated app, Alpha Trading Desk, instead ***

Quantitative Portfolio Optimizer (QPO) is an asset allocation tool designed for investment professionals. It simplifies and speeds up the time-consuming portfolio optimization in asset allocation process with our BI technology and our propriety iPad intuitive interface.

With QPO, users can rapidly construct a desired optimized portfolio in minutes, rather than days, based on users’ individual return requirement and risk tolerant. Once the targeted portfolio is set, users will be guarded by the auto-pilot buy/sell order suggestion module to keep their portfolio in control regardless of the market movements.

The QPO (Free) version has the limit of maximum 4 assets in portfolio. Should you need more, please try the full version which can have 14 assets in portfolio. QPO is designed for sophisticated finance investors or investment professionals. If you are a Finance student and would like to explore the Modern Portfolio Theory or the asset allocation process, please try out our Stock Portfolio Optimizer (SPO).

Feature highlights

* Intelligent star asset search engine (Alpha, Return, Risk, Sharpe Ratio, Beta)

* Real-time stock value tracking

* Real-time portfolio expected return and risk calculation

* Two optimization modes to suit investment objectives (Selected and All mode)

* Intuitive interface for investment level adjustment

* Dynamic Roy's Safety First ratio adjuster

* Target Portfolio Daily VaR

* Real-time portfolio dynamic re-balancer with order suggestion

* 10,000+ investment grade US assets

* Choice of 1-year or 3-year data to suit different investment horizon.

* Option to override expected return for calculation

* new pop-up edit function, no more scrolling

* Fast optimization algorithm (guided mutation)

* Probability chart of return distribution.

Product Summary

Quantitative Portfolio Optimizer (QPO) is a complete intuitive system which supports the full life cycle of asset allocation process: portfolio construction, portfolio optimization, portfolio monitoring and portfolio re-balancing.

Asset Selection

The rapid asset search screen, Bull-Eye search, could locate target assets rapidly. It supports wild-card search and also by category (Stock, ETF, Mutual Fund), by capital size (Large-cap, Mid-cap, Small-cap), by sectors (Health Care, Technology etc..) ranked by return, risk, Sharpe ratio, Alpha, Beta.

Portfolio Optimization

The portfolio optimization screen shows the portfolio return-risk chart with relevant KPIs. It supports AI automatic portfolio optimization with options of top performance assets or with all assets. The optimized portfolio includes its return and risk values, and indicates the asset mixes and their weightings for visual inspection.

Portfolio Monitoring

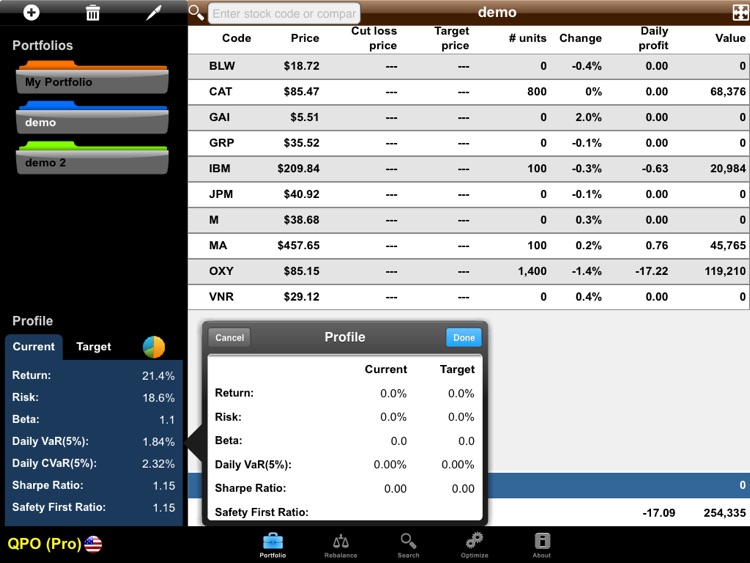

The portfolio monitoring screen keeps track of your asset mixes with up-to-date value, and benchmarks their weighting against the targeted optimized weightings.

Portfolio Dynamic Re-Balancing

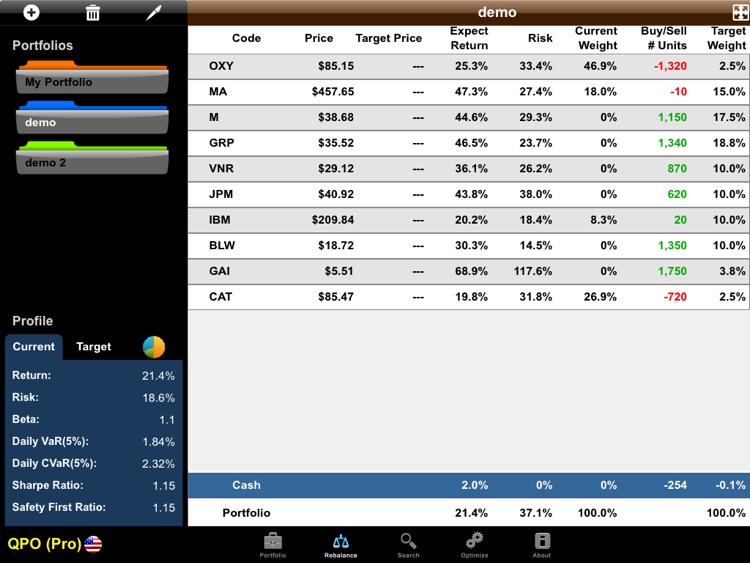

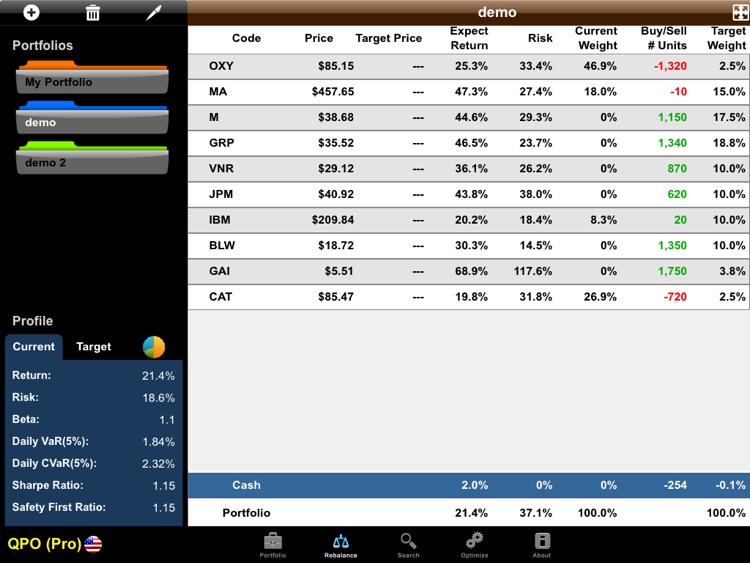

In order to limit the risk volatility due to market fluctuation, portfolio should be re-balanced from time to time. The allocation screen gives buy/sell order suggestions with rel time data so as to maintain the desired targeted return and risk level by dynamic rebalancing.

Market Data

QPO data services include 10,000+ investment grade assets in US stock markets, with a choice of 1-year and 3-year statistics for optimization process. If you can not find mutual funds you need, feel free to contact our customer services.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.