We make it easy to earn a return on your cash, by lending to UK businesses who make monthly repayments

rebuildingsociety.com

What is it about?

We make it easy to earn a return on your cash, by lending to UK businesses who make monthly repayments.

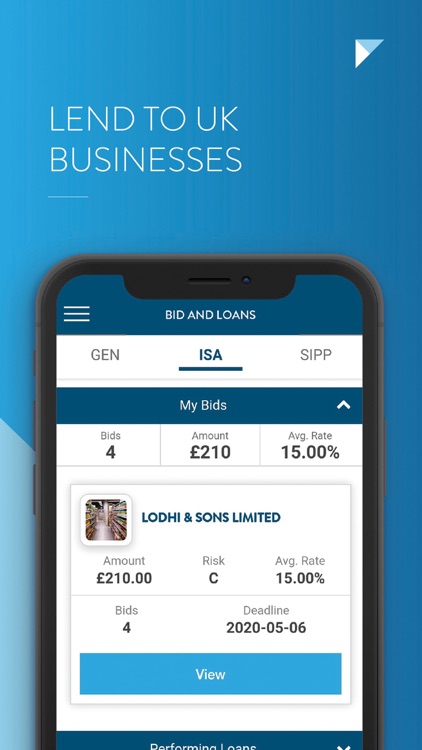

App Screenshots

App Store Description

We make it easy to earn a return on your cash, by lending to UK businesses who make monthly repayments.

rebuildingsociety makes better use of your money, by cutting out banks, advisors and other intermediaries. When you lend to a business, 100% of the interest paid by the business is relayed to the lenders. We take a small arrangement fee from the borrower, but we do not take a margin on the loan. This is the secret to how our lenders get a better financial return.

Using the app you can:

* Track your portfolio and see it grow over time

* Set investment preferences

* Quickly add & withdraw funds

* View a repayments calendar

* Sell out of your investments (subject to demand)

* Read updates on loans

* Chat with the support team

* View businesses looking for funding

Join our community of over 1700 lenders today...

--

Why invest in peer-to-business lending?

Lending to businesses is a productive way to invest money. You reinvest directly into the UK economy, helping SMEs grow and create a sustainable business community. Main benefits include:

1. Target Returns of 6% pa*

Whilst the world’s economic position may have changed, yours hasn’t – you still want value for money and you still want to make investments that generate a decent return.

Lending to businesses through rebuildingsociety.com can result in overall gross annual returns (allowing for tax deduction and non-repayment of loans) that exceed those available through retail savings products. However, lending to businesses is not like a savings account as your capital is at risk.

*Returns may vary depending on the performance of your account. No FSCS protection.

2. BuyBack Guarantee

Risk adverse lenders can begin lending by cooperating with other lenders to share the risk and rewards. Rebuildingsociety.com is the only platform that allows one lender to sell to another lender with a guarantee to buy it back if the loan falls into arrears by more than 60 days. This feature allows new lenders to get comfortable with the returns available from guaranteed loans before considering non-guaranteed loans with a higher yield.

3. Manage the Investment Risk

We credit check EVERY business that applies to borrow, but we also make sure they supply information used to inform lenders. You can manage your investment risk by finding out more about the companies you lend to. This can help you to earn a higher return.

i) Lending to UK businesses is caries risk, so we will ask you to do a short test to inform and check your understanding of p2p lending.

ii) If you pay a premium to buy microloans on the secondary market, you may lose part of the premium paid.

iii) Your lending is not covered by the Financial Services Compensation Scheme (FSCS).

Lending to UK businesses is more fun than saving money in a bank. You will periodically get offers and promotions from businesses keen to win your support.

Your economy needs you, become a rebuilder today, get the app.

--

Regulated and authorised by the FCA.

Read more at https://www.rebuildingsociety.com/risks/

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.