Schoolable empowers parents to set aside a portion of their income and lock it down for the purpose of paying their children's school fees

Schoolable

What is it about?

Schoolable empowers parents to set aside a portion of their income and lock it down for the purpose of paying their children's school fees. When you save with Schoolable, Enjoy access to tuition loans at very affordable interest rates to augment any shortfalls you may have in your savings. When school fees are due, Schoolable enables you to pay fees directly to your children's school and get receipts instantly.

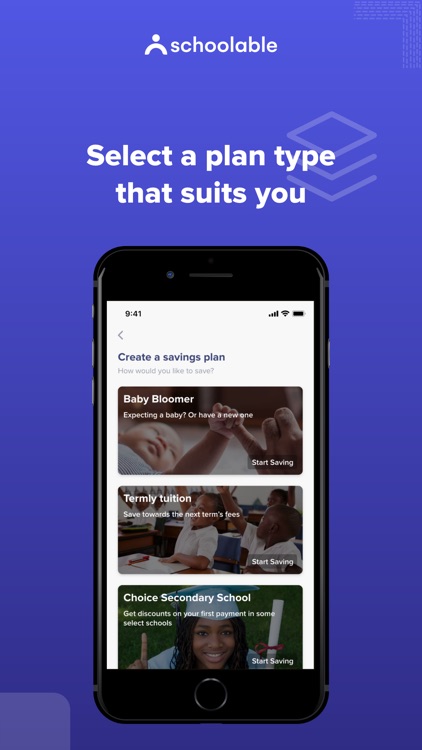

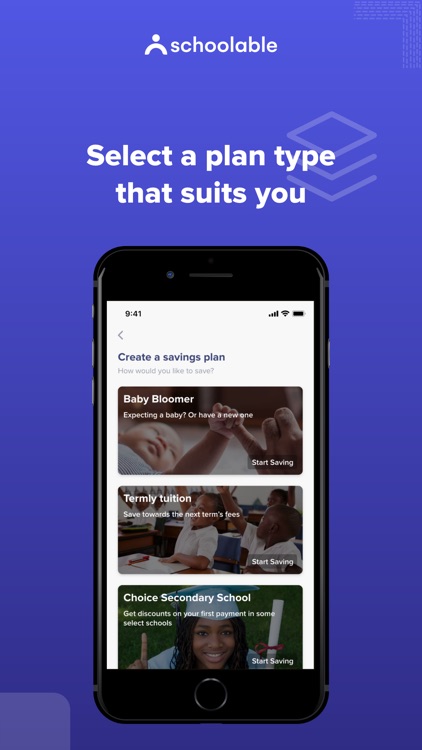

App Screenshots

App Store Description

Schoolable empowers parents to set aside a portion of their income and lock it down for the purpose of paying their children's school fees. When you save with Schoolable, Enjoy access to tuition loans at very affordable interest rates to augment any shortfalls you may have in your savings. When school fees are due, Schoolable enables you to pay fees directly to your children's school and get receipts instantly.

Saving With Schoolable:

- Save as low as NGN 100

- Save for your newborn or unborn child and get a discount on your first payment in your school of choice

- Save towards the coming term's school fees.

- Set aside a lump sum to secure your child's long term education plan.

- Earn big while securing your child's future.

Tuition Loan on Schoolable:

- When you have a savings history with us, tuition loans will be made available to you at a very affordable interest rate anytime you need help.

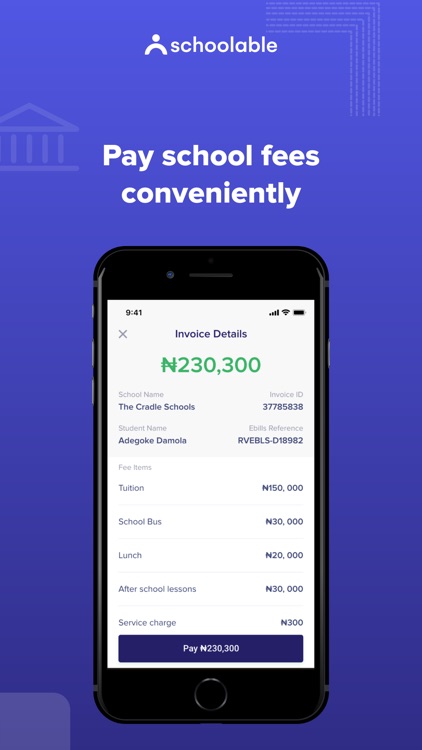

Paying Tuition with Schoolable:

- When your savings mature, you can pay your children's school fees directly from Schoolable and the receipt will be available to you instantly.

- If you do not have any savings on Schoolable, you can also pay a school directly using your card or by initiating a bank transfer directly to the school through Schoolable.

Discounts on Schoolable:

- Discounts are the best! we get you discounts from thousands of schools when you save and pay with Schoolable right before school resumption.

- We can also get you a discount on your first payment when enrolling your child into a new school.

Your Money is Secure with Schoolable:

- Savings made by parents via Schoolable are held and managed by capital market operators licensed by the Securities and Exchange Commission (SEC) on behalf of savers. All monies provided as loans through Schoolable are bankrolled by legal entities duly licensed by the Central Bank of Nigeria.

- You need not worry about the safety of your information as your card details are stored with a PCIDSS compliant payment processor.

Withdrawing your Money:

- All savings have a minimum lock-in period of 3 months. At maturity, you can decide to pay tuition directly or withdraw it directly to your bank account.

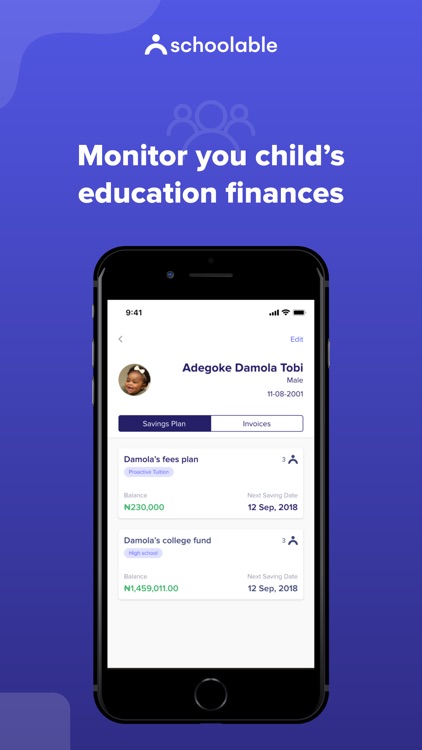

Monitoring your Savings:

- From the Schoolable app, you can monitor your children's education savings right to the smallest detail.

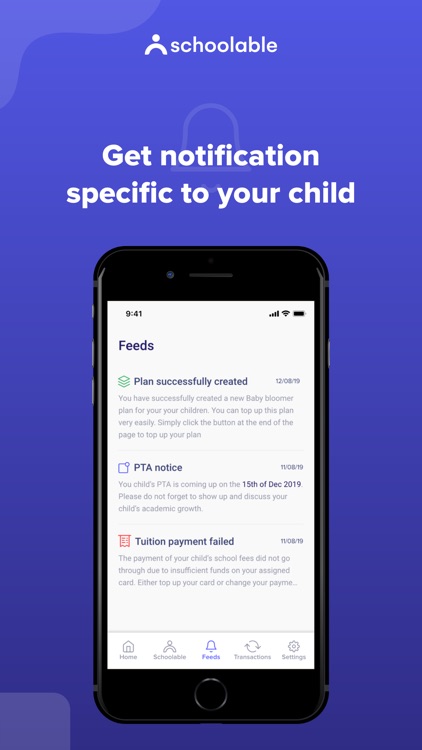

24x7 Customer Support:

- Within the Schoolable app, you can talk to our customer happiness agents or you can email us directly on help@schoolable.co

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.