To all Option Wheel strategy traders: This app makes it super easy to calculate your annualized yield in just a few seconds - which is the key to properly execute income strategies in option trading

Short Option Calculator

What is it about?

To all Option Wheel strategy traders: This app makes it super easy to calculate your annualized yield in just a few seconds - which is the key to properly execute income strategies in option trading.

App Screenshots

App Store Description

To all Option Wheel strategy traders: This app makes it super easy to calculate your annualized yield in just a few seconds - which is the key to properly execute income strategies in option trading.

Especially when trading mobile, this App will enable you to improve and speed up your decision making significantly - by providing you with annualized yield figures in a snap.

You can set relevant parameters and see how adjusting these parameters will impact your yield. You no longer need to rely on your gut feeling, since you will get reliable yield indications super fast:

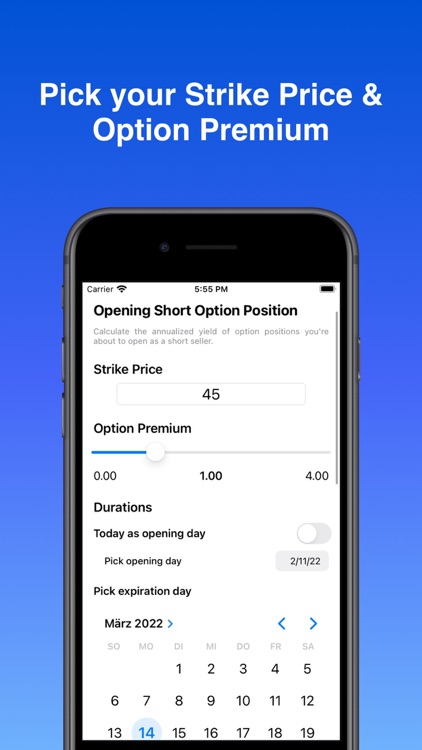

* Pick your strike price and optionally margin requirement

* Slide your option premium up and down

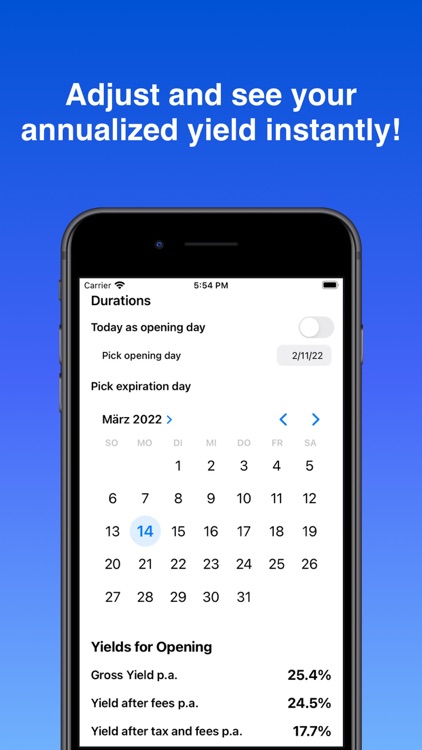

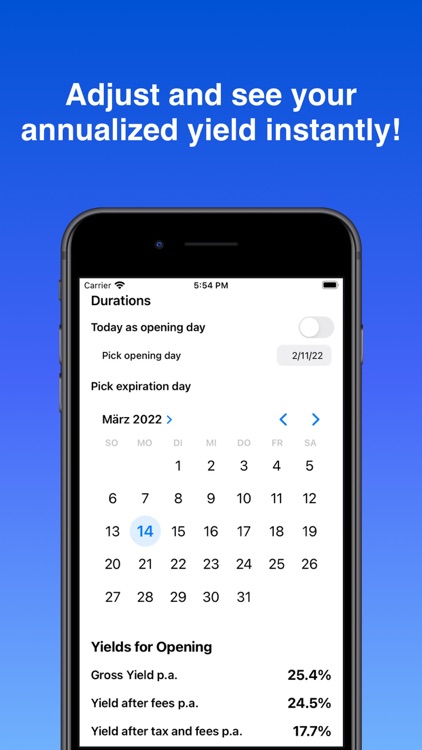

* Play with different expiration dates

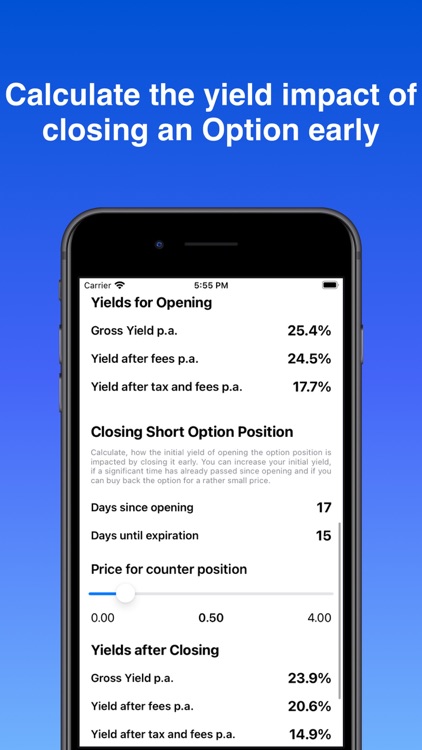

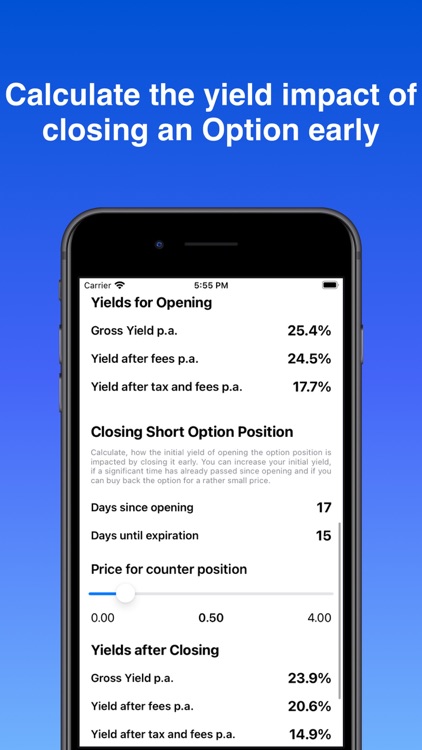

* Simulate yield impact of closing an option position early

* Set your individual brokerage fees and tax rate

-> You will see your calculated annualized gross yield, yield after fees and yield after fees & taxes (cash secured and on margin)

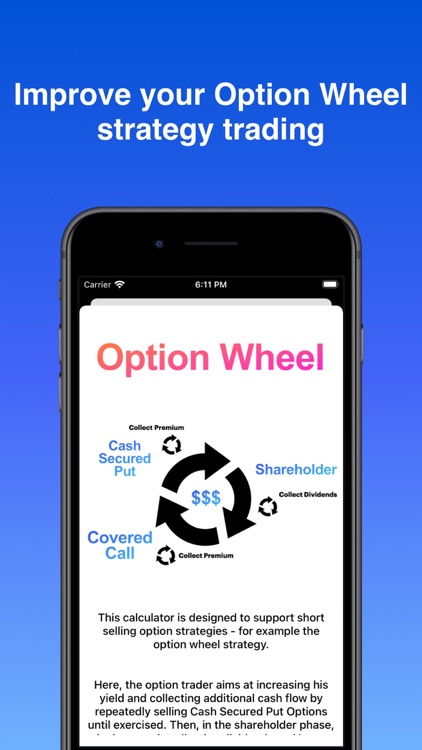

About the Option Wheel strategy:

In this strategy, the option trader aims at increasing his yield and collecting additional cash flow by repeatedly selling Cash Secured Put Options until assigned. Then, in the shareholder phase, the investor is collecting dividends and keeps selling Covered Call Options until assigned again - which brings the investor back to the Cash Secured Put phase. The strategy can be optimised, when the investor avoids assignment by rolling the position. The investor would aim at yields that are above the long term market average - to compensate the additional work he needs to invest.

This calculator was developed to support on this endeavor.

**DISCLAIMER**

The information shown in the app does not represent any investment or investment strategy recommendations for trading in securities, but serves solely for personal information or entertainment and is in no way to be understood as an invitation to trade in securities. The information shown does not constitute business, legal or tax advice and is no substitute for individual advice from an expert. If you make use of the information provided, you always act entirely at your own risk.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.