Simple GST Calculator India

Simple GST Calculator India

What is it about?

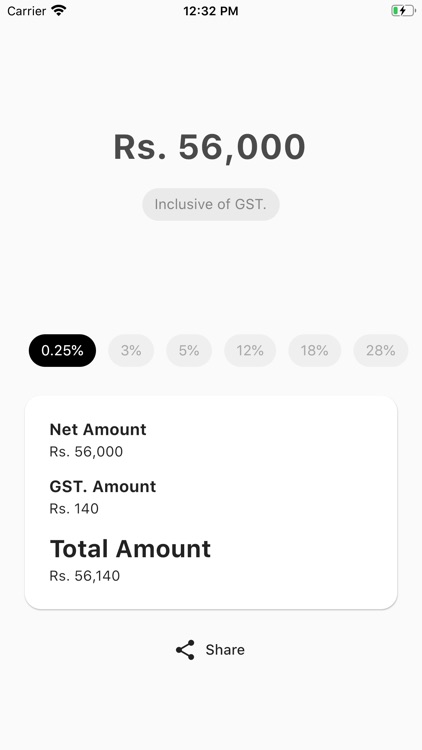

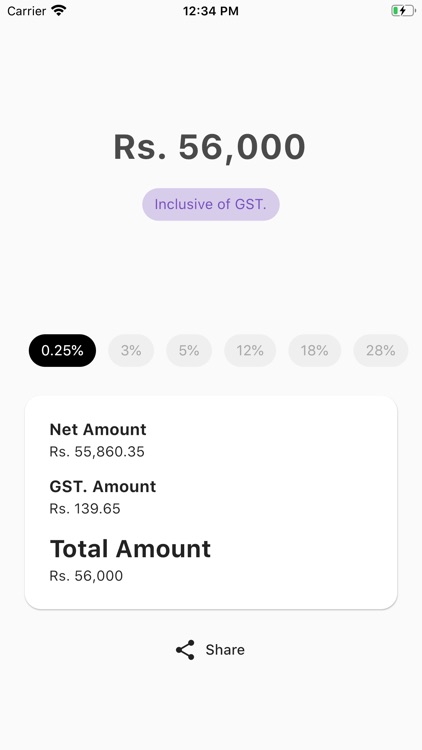

Simple GST Calculator India. Calculate the GST tax on any item with all tax rate slabs - 0.25%, 3%, 5%, 12%, 18% and 28%. Simple GST Calculator lets you calculate GST using a GST inclusive tax rate and GST exclusive tax rate.

App Store Description

Simple GST Calculator India. Calculate the GST tax on any item with all tax rate slabs - 0.25%, 3%, 5%, 12%, 18% and 28%. Simple GST Calculator lets you calculate GST using a GST inclusive tax rate and GST exclusive tax rate.

You can also share the result of your calculation via WhatsApp, Facebook, SMS and other platforms as an image to your customers/clients.

The result is presented in the following manner:

=> Net Amount

=> GST Amount

=> Total Amount

What is GST?

GST is an Indirect Tax which has replaced many Indirect Taxes in India. The Goods and Service Tax Act was passed in the Parliament on 29th March 2017. The Act came into effect on 1st July 2017; Goods & Services Tax Law in India is a comprehensive, multi-stage, destination-based tax that is levied on every value addition. In simple words, Goods and Service Tax (GST) is an indirect tax levied on the supply of goods and services. This law has replaced many indirect tax laws that previously existed in India. GST is one indirect tax for the entire country.

The GST Regime, what is to be implemented?

It would be a dual GST with the Centre and States simultaneously levying it on a common tax base. The GST to be levied by the Centre on intra-State supply of goods and/or services would be called the Central GST (CGST) and that to be levied by the States would be called the State GST (SGST). Similarly Integrated GST (IGST) will be levied and administered by Centre on every inter-state supply of goods and services.

Why is Dual GST required?

India is a federal country where both the Centre and the States have been assigned the powers to levy and collect taxes through appropriate legislation. Both the levels of Government have distinct responsibilities to perform according to the division of powers prescribed in the Constitution for which they need to raise resources. A dual GST will, therefore, be in keeping with the Constitutional requirement of fiscal federalism.

AppAdvice does not own this application and only provides images and links contained in the iTunes Search API, to help our users find the best apps to download. If you are the developer of this app and would like your information removed, please send a request to takedown@appadvice.com and your information will be removed.